ATI's (ATI) Earnings and Revenues Surpass Estimates in Q1

ATI Inc. ATI recorded a profit of $66.1 million or 46 cents per share in first-quarter 2024 compared with the year-ago quarter's $84.5 million or 58 cents.

ATI posted adjusted earnings of 48 cents per share, down 19% from the year-ago quarter’s figure of 59 cents. Adjusted earnings exceeded the Zacks Consensus Estimate of 41 cents.

The company’s net sales in the first quarter were $1,042.9 million, exceeding the Zacks Consensus Estimate of $1,011.7 million. Net sales remained flat year over year. ATI saw strong year-over-year sales growth in aerospace and defense.

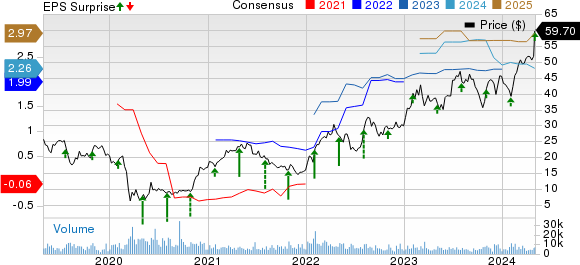

ATI Inc. Price, Consensus and EPS Surprise

ATI Inc. price-consensus-eps-surprise-chart | ATI Inc. Quote

Segment Highlights

High Performance Materials & Components (HPMC) recorded sales of $529.9 million in the fourth quarter, up 9% from sales recorded in the year-ago quarter. The figure missed the Zacks Consensus Estimate of $531 million. In the reported quarter, HPMC's segment EBITDA increased 18.9% year over year to $97.6 million. Reduced volumes on higher-margin latest-generation commercial aerospace platforms contributed to lower margins on a sequential-comparison basis.

Advanced Alloys & Solutions (AA&S) recorded sales of $513 million, down approximately 9.5% from the previous year's figure of $567 million. The figure topped the Zacks Consensus Estimate of $474.8 million. While sales in aerospace and defense were strong, there was a softness in general industrial markets, contributing to the overall reduction. In terms of EBITDA, the AA&S segment registered $71.8 million in the quarter, down 14.2% year over year. Higher deliveries of nickel-based alloys and exotic alloys drove sequential margin improvement.

Financials

In the first quarter of 2024, cash used by operating activities amounted to $99 million compared with the previous year's figure of $285.2 million. The company's long-term debt was $2,146.4 million, up 26% from the prior year’s levels.

Outlook

ATI noted that its outlook is bright, backed by a healthy backlog of commercial aircraft orders. The company is set to maintain its growth and improve margins thanks to steady demand in key markets and expanding production capacity. This positions ATI well to meet its strong financial goals for 2024 and 2025 and to surpass $5 billion in revenues and $1 billion in adjusted EBITDA by 2027. With top-notch capabilities, advanced materials science expertise and a remarkable team, ATI is committed to serving customers and meeting their growing needs.

Zacks Rank & Key Picks

ATI currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy) and L.B. Foster Company FSTR and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The Zacks Consensus Estimate for GFI’s first-quarter earnings has been stable in the past 60 days.

L.B. Foster is slated to report first-quarter results on May 7. The consensus estimate for FSTR’s first-quarter earnings is pegged at a loss of 16 cents per share. The company’s shares have surged 114.7% in the past year.

AVD is expected to report first-quarter results on May 14. The consensus estimate for AVD’s first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance