ASX Growth Companies With High Insider Ownership To Watch

Amidst a backdrop of modest gains in the ASX200, driven by a surge in materials and bolstered by rising iron ore prices, Australia's economic indicators like retail trade and inflation are painting a complex picture of consumer behavior and price movements. In this environment, growth companies with high insider ownership on the ASX stand out as particularly noteworthy, as such ownership can signal confidence from those who know the company best. In light of current market conditions where specific sectors are experiencing growth due to external economic stimuli, stocks with substantial insider stakes might be well-positioned to navigate through these evolving economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 51.2% |

SiteMinder (ASX:SDR) | 11.3% | 75.1% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cettire

Simply Wall St Growth Rating: ★★★★★★

Overview: Cettire Limited operates as an online retailer of luxury goods, serving customers in Australia, the United States, and other international markets, with a market capitalization of approximately A$496.62 million.

Operations: The company generates its revenue primarily through online retail sales, amounting to A$582.79 million.

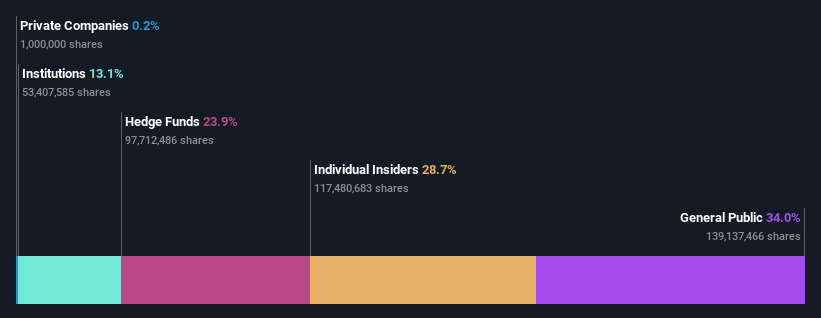

Insider Ownership: 28.7%

Cettire, an Australian e-commerce platform, is positioned for substantial growth with earnings and revenue forecast to outpace the market significantly at 26.7% and 23.6% per year respectively. Despite a highly volatile share price and recent shareholder dilution, the company's Return on Equity is expected to reach a high of 39% in three years. However, it's trading at a considerable discount to its estimated fair value and lacks recent insider trading activity to affirm confidence from internal stakeholders.

Navigate through the intricacies of Cettire with our comprehensive analyst estimates report here.

Our valuation report unveils the possibility Cettire's shares may be trading at a discount.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$578.80 million.

Operations: The company is engaged in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.8%

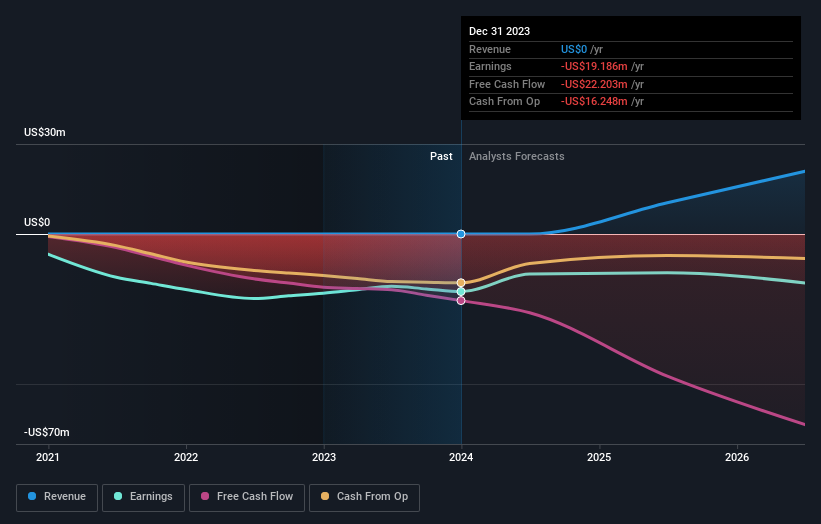

IperionX is poised for notable growth, with forecasts predicting it will turn profitable within three years amidst a revenue increase of 76.2% annually, outpacing the Australian market significantly. Despite earning less than US$1m currently and experiencing shareholder dilution over the past year, its innovative partnerships, like those with Aperam and Vegas Fastener Manufacturing for advanced titanium products, underscore its potential in high-performance industries. However, a low forecasted Return on Equity of 11.7% tempers expectations slightly.

Get an in-depth perspective on IperionX's performance by reading our analyst estimates report here.

Our valuation report here indicates IperionX may be overvalued.

Lotus Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotus Resources Limited is a company focused on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market capitalization of approximately A$595.15 million.

Operations: The firm primarily generates revenue from the exploration, evaluation, and development of uranium properties across Australia and Africa.

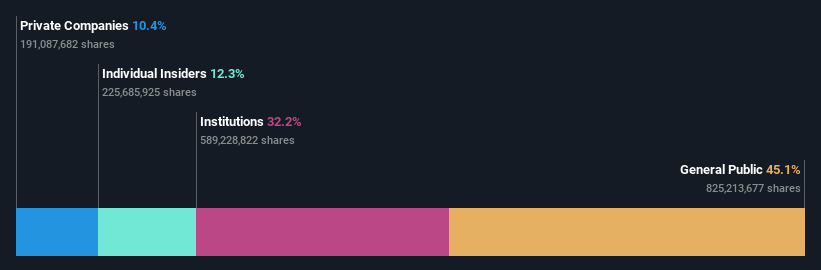

Insider Ownership: 12.3%

Lotus Resources is positioned for substantial growth, with expectations of becoming profitable within the next three years, a forecast significantly above average market growth. Currently trading at 41.3% below its estimated fair value, analysts predict a potential stock price increase of 100.9%. Despite having minimal revenue (A$102K), the company's earnings are expected to grow by 58.95% annually. However, shareholders have experienced dilution over the past year, and there's no recent insider trading activity to report.

Where To Now?

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 86 more companies for you to explore.Click here to unveil our expertly curated list of 89 Fast Growing ASX Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:CTTASX:IPX and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance