Applied Therapeutics Inc (APLT) Reports Q1 2024 Earnings: A Deep Dive into Financials and ...

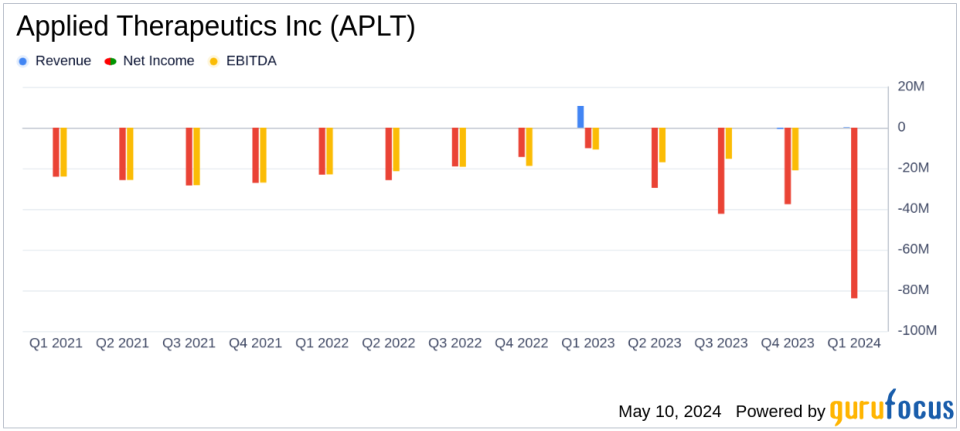

Revenue: Reported at $190K for Q1 2024, significantly below estimates of $3.33M.

Net Loss: Increased to $83.94M in Q1 2024, far exceeding the estimated net loss of $16.72M.

Earnings Per Share (EPS): Recorded a loss of $0.67 per share, deeper than the estimated loss of $0.16 per share.

Cash and Cash Equivalents: Increased to $146.48M as of March 31, 2024, up from $49.90M as of December 31, 2023.

Research and Development Expenses: Amounted to $12.22M, showing a decrease from the previous year's $15.94M.

General and Administrative Expenses: Rose to $9.07M from $5.58M in the corresponding period last year.

Total Assets: Grew to $151.23M, up from $54.83M at the end of the previous year.

On May 9, 2024, Applied Therapeutics Inc (NASDAQ:APLT) released its 8-K filing, detailing the financial results for the first quarter ended March 31, 2024. The clinical-stage biopharmaceutical company, known for its innovative approach to targeting molecular mechanisms in rare diseases, has reported significant regulatory progress alongside its financial outcomes for the period.

Applied Therapeutics is actively preparing for the potential approval and commercial launch of its lead drug candidate, govorestat, for the treatment of Classic Galactosemia in the US and EU. This follows the drug's acceptance under Priority Review with a PDUFA target action date set for November 28, 2024, and its ongoing review by the EMA, expected to conclude in early Q1 2025.

Financial Performance Overview

The first quarter of 2024 saw Applied Therapeutics report a revenue of $190,000, a stark contrast to the $10.66 million reported in the same period last year, primarily attributed to the high license revenue recorded in Q1 2023. The company's net loss for the quarter significantly widened to $83.94 million, compared to a net loss of $10.14 million in Q1 2023. This increase in net loss was largely due to a substantial $63.41 million change in the fair value of warrant liabilities and elevated research and development expenses aimed at advancing the company's clinical programs.

The company's total operating expenses for Q1 2024 amounted to $21.28 million, with research and development expenses accounting for $12.22 million as Applied Therapeutics continues to invest in its innovative drug pipeline. General and administrative expenses also rose to $9.07 million, up from $5.58 million in the prior year, reflecting increased operational activities as the company scales its efforts towards commercial readiness.

Strategic Highlights and Future Directions

Amidst these financial figures, Applied Therapeutics is not only navigating its path through complex regulatory landscapes but also discussing potential NDA submissions under Accelerated Approval for govorestat for the treatment of SORD Deficiency with the Neurology I Division of the FDA. These strategic regulatory engagements are pivotal as they could potentially expedite the drug's market entry, providing critical treatments to patients with rare metabolic diseases.

The company's robust pipeline also includes AT-001 for Diabetic Cardiomyopathy and AT-003 for Diabetic Retinopathy, both of which are designed to address significant unmet medical needs in their respective areas. With a cash and cash equivalents balance of $146.48 million as of March 31, 2024, Applied Therapeutics is well-positioned to fund its operations into 2026, ensuring sustained progress in its clinical and operational endeavors.

Assessment and Outlook

While the widened net loss and the substantial increase in operating expenses highlight the company's aggressive investment in its future, the strategic advancements in regulatory discussions and potential market entries for its lead candidates paint a promising picture for Applied Therapeutics. The company's focus on rare diseases, coupled with its innovative therapeutic approaches, sets a solid foundation for potential long-term growth, making it a noteworthy entity in the biopharmaceutical landscape.

For more detailed information and updates, investors and interested parties are encouraged to visit Applied Therapeutics' official website.

As Applied Therapeutics continues to navigate through these pivotal phases of clinical development and regulatory approvals, the financial trajectory and strategic milestones achieved in the coming quarters will be critical in shaping the company's path forward in the biotechnology sector.

Explore the complete 8-K earnings release (here) from Applied Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance