AMN Healthcare Services Inc. Reports Subdued Q1 2024 Earnings Amid Challenging Market Conditions

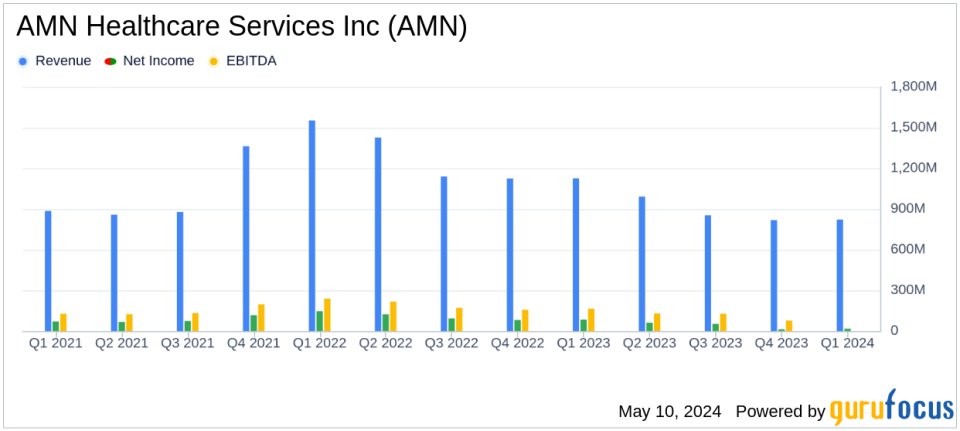

Quarterly Revenue: Reported at $821 million, showing a significant 27% decrease from the previous year, aligning closely with estimates of $816.54 million.

Adjusted EPS: Achieved $0.97, slightly above the estimated $0.96, despite a 61% decline from the same quarter last year.

Net Income: Recorded at $17.3 million, significantly below the estimated $33.87 million, marking a steep 79% decrease year-over-year.

Gross Margin: Fell to 31.4%, down from 32.8% a year ago and 31.9% in the previous quarter, reflecting a shift towards lower-margin business lines.

SG&A Expenses: Totaled $175 million or 21.3% of revenue, showing effective cost management compared to $206 million or 25.4% of revenue in the prior year.

Operating Margin: Dropped to 4.9%, a significant decline from 11.2% in the same quarter last year, indicating increased operational challenges.

Adjusted EBITDA: Decreased by 46% to $97.7 million, with the margin contracting by 400 basis points to 11.9% from the previous year.

On May 9, 2024, AMN Healthcare Services Inc (NYSE:AMN), a leading provider of healthcare staffing solutions, disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company reported a significant year-over-year decline in both revenue and earnings, attributing the downturn to persistent challenges in the nurse staffing sector, its largest business division.

AMN Healthcare, recognized for its comprehensive network of quality healthcare professionals and innovative recruitment strategies, faced a tough quarter with revenues plummeting by 27% to $821 million from the previous year, a figure that aligns closely with analyst expectations of $816.54 million. The adjusted earnings per share (EPS) stood at $0.97, marginally surpassing the forecasted $0.96, reflecting the company's efforts to maintain profitability amidst adverse conditions.

Financial and Operational Highlights

The detailed earnings report highlighted a stark decrease in net income, which dropped by 79% to $17.3 million. This decline was mirrored in the GAAP EPS, which fell drastically by 78% to $0.45. The gross profit also saw a substantial reduction, coming in at $257.5 million, a 30% decrease from the previous year.

The Nurse and Allied Solutions segment, usually a significant revenue driver, experienced a 37% decline year-over-year, with travel nurse staffing revenue decreasing by 44%. Conversely, the Physician and Leadership Solutions segment reported a revenue increase of 14%, boosted by acquisitions and growth in locum tenens revenue, which surged by 36%.

Despite these challenges, AMN Healthcare's management is actively implementing strategic measures to adapt to the evolving market dynamics. President and CEO Cary Grace emphasized the company's commitment to innovation and adaptation to support health systems through transformational changes, including new labor models aimed at enhancing cost-effectiveness and quality in healthcare staffing.

Looking Ahead

For the second quarter of 2024, AMN anticipates consolidated revenue to be between $730 million and $750 million, projecting a continued decline compared to the previous year. The company expects the Nurse and Allied Solutions segment to remain under pressure, with anticipated revenue decreases of 36-38% year-over-year. However, modest growth is forecasted in the Physician and Leadership Solutions segment.

The company's financial stability is supported by a cash and cash equivalents balance of $51 million as of March 31, 2024, and a robust cash flow from operations which stood at $81 million for the quarter. These factors, combined with strategic expense management and capital spending adjustments, are pivotal as AMN navigates through the current market challenges.

In conclusion, while AMN Healthcare Services Inc faces significant headwinds, particularly in its largest segment, its diversified service offerings and strategic adjustments provide a pathway to navigate the current industry challenges. The company's ability to slightly exceed EPS estimates despite revenue declines illustrates resilience and a potentially steady path to recovery as market conditions evolve.

Explore the complete 8-K earnings release (here) from AMN Healthcare Services Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance