Amgen Inc's Dividend Analysis

Exploring the Sustainability and Growth of Amgen Inc's Dividends

Amgen Inc (NASDAQ:AMGN) has recently announced a dividend of $2.25 per share, set to be payable on June 7, 2024, with the ex-dividend date on May 16, 2024. As investors anticipate this upcoming payment, it's crucial to delve into the company's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this analysis will explore Amgen Inc's dividend performance and evaluate its sustainability.

What Does Amgen Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

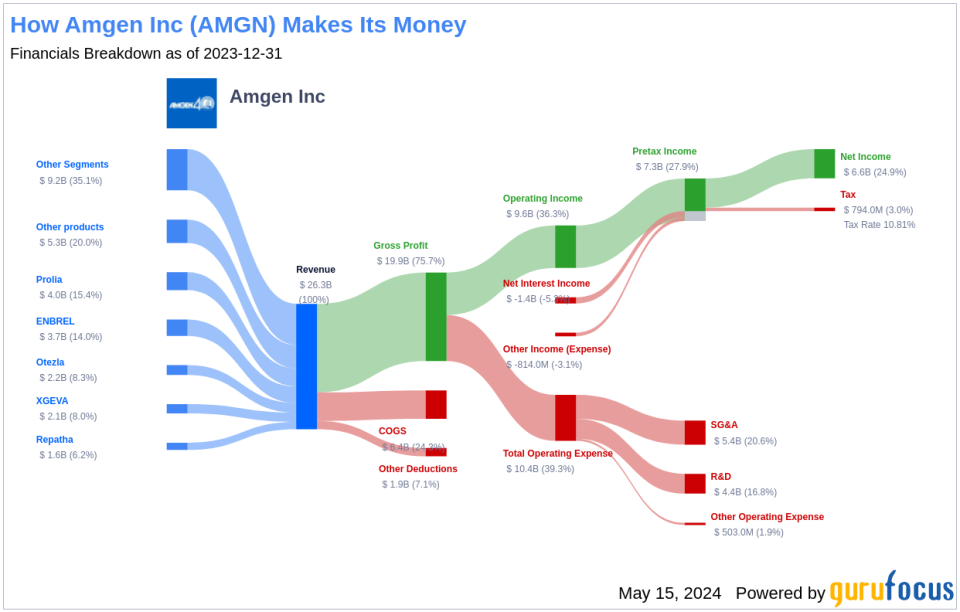

Amgen is a pioneer in biotechnology-based human therapeutics. Its flagship products include red blood cell boosters like Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and treatments for inflammatory diseases such as Enbrel and Otezla. The company entered the cancer therapy market with Vectibix in 2006 and has since expanded its portfolio with drugs like Kyprolis from its Onyx acquisition. Recent additions include Repatha for cholesterol, Aimovig for migraines, Lumakras for lung cancer, and Tezspire for asthma. The acquisition of Horizon in 2023 added rare-disease drugs, including Tepezza for thyroid eye disease, to Amgen's broadening biosimilar portfolio.

A Glimpse at Amgen Inc's Dividend History

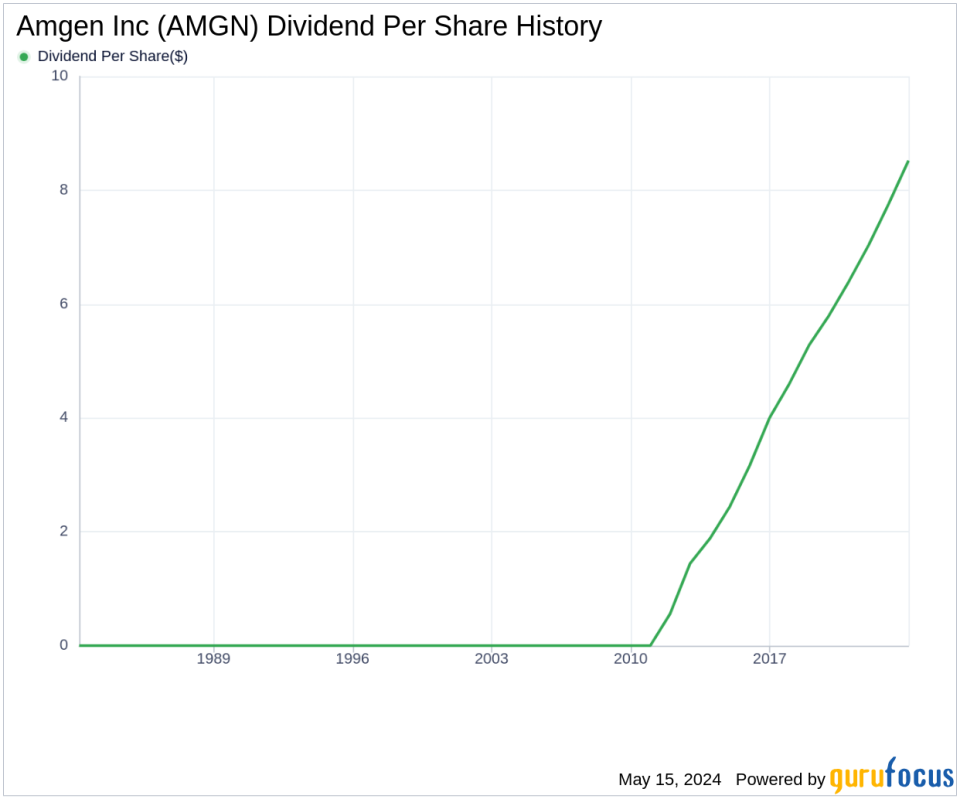

Since 2011, Amgen Inc has maintained a consistent dividend payment record, with distributions occurring quarterly. The company has also increased its dividend annually since 2011, earning it the status of a dividend achievera title awarded to companies that have consistently raised their dividends for at least 13 consecutive years.

Breaking Down Amgen Inc's Dividend Yield and Growth

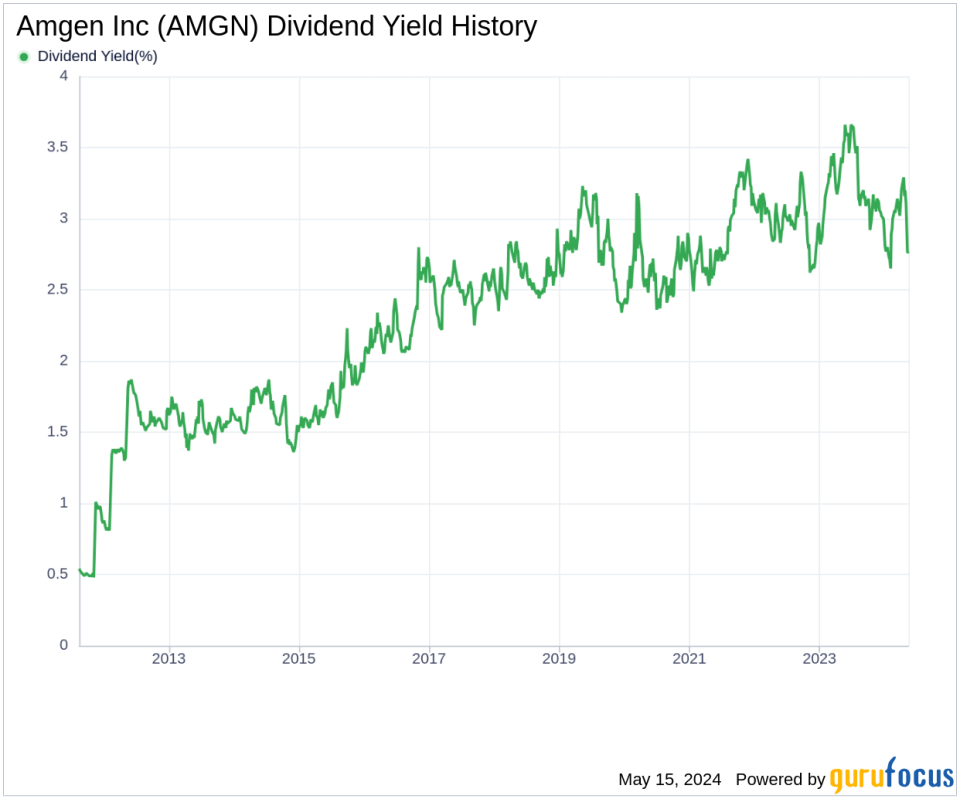

Currently, Amgen Inc boasts a trailing dividend yield of 2.75% and a forward dividend yield of 2.88%, indicating anticipated increases in dividend payments over the next year. Over the last three years, the annual dividend growth rate was 10.00%, which slightly rose to 10.10% over five years. Impressively, the decade-long annual growth rate of dividends per share stands at 15.40%. As of today, the 5-year yield on cost for Amgen Inc stock is approximately 4.45%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio, which currently stands at 0.68, offers insights into the portion of earnings Amgen Inc distributes as dividends. This lower ratio suggests that the company retains a significant part of its earnings, which supports future growth and buffers against downturns. Amgen Inc's profitability rank of 9 out of 10, as of March 31, 2024, underscores its robust earnings capability relative to peers. The company's consistent positive net income over the past decade further solidifies its financial health.

Growth Metrics: The Future Outlook

Amgen Inc's growth rank of 9 out of 10 indicates a strong growth trajectory relative to its competitors. The company's revenue per share and 3-year revenue growth rate of 6.70% annually outperform approximately 51.47% of global competitors. Additionally, its 3-year EPS growth rate of 14.90% annually and a 5-year EBITDA growth rate of 5.30% further highlight its capability to sustain dividends in the long run.

Conclusion: A Robust Dividend Profile

Amgen Inc's consistent dividend increases, coupled with a solid payout ratio and strong profitability, paint a promising picture for dividend sustainability. The company's impressive growth metrics indicate a robust foundation that supports ongoing dividend payments. For investors seeking dividend growth stocks, Amgen Inc represents a compelling option. Interested in exploring more high-dividend yield opportunities? GuruFocus Premium users can leverage the High Dividend Yield Screener for more insights.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance