Amarin Corp PLC (AMRN) Q1 2024 Earnings: Navigating Challenges with Strategic Focus

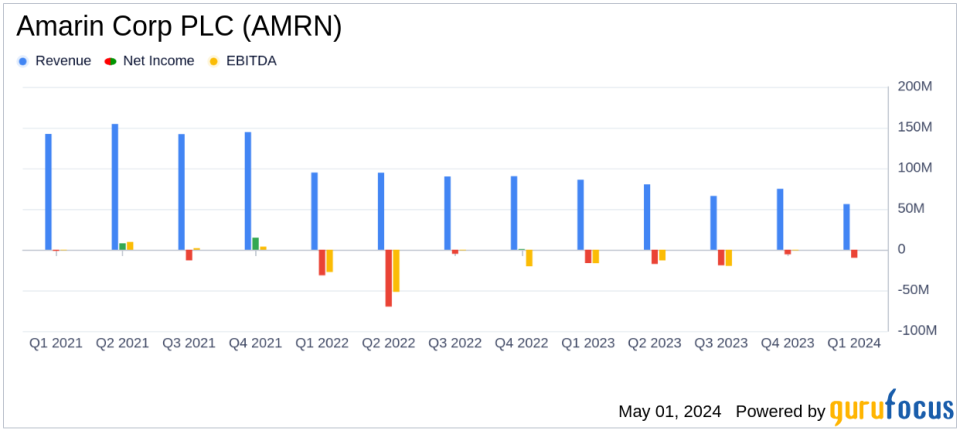

Revenue: Reported $56.5 million, a decrease of 34% year-over-year, falling short of estimates of $57.05 million.

Net Loss: Reported $10.0 million, an improvement from a net loss of $16.5 million year-over-year, exceeding estimates of a $12.11 million loss.

Earnings Per Share (EPS): Reported a loss of $0.02 per share, better than the estimated loss of $0.03 per share.

U.S. Market: U.S. net product revenue declined by 41% to $48.1 million, primarily due to reduced net selling price from generic competition.

European Growth: In-market sales in Europe grew approximately 65% in Q1 2024 compared to Q4 2023, driven by strong patient growth in Spain and the U.K.

Gross Margin: Maintained at 55%, consistent with the prior year, excluding a one-time inventory restructuring charge which had previously reduced it to 70%.

Cash Position: Ended the quarter with $308 million in cash and investments, maintaining a stable financial position.

Amarin Corp PLC (NASDAQ:AMRN) disclosed its financial outcomes for the first quarter of 2024 on May 1, 2024, revealing a challenging yet strategically adaptive quarter. The biopharmaceutical company, known for its cardiovascular health product Vascepa, reported a total net revenue of $56.5 million for Q1 2024, a 34% decrease from $86.0 million in Q1 2023. This performance aligns closely with analyst estimates which projected a revenue of $57.05 million. The earnings per share (EPS) stood at -$0.02, slightly better than the estimated -$0.03. For more details, view the company's 8-K filing.

Company Overview

Amarin Corp PLC is a dynamic entity in the biopharmaceutical industry, focusing on developing and commercializing therapeutics to enhance cardiovascular health and mitigate associated risks. Its flagship product, Vascepa, has been a cornerstone in its portfolio, addressing critical needs within cardiovascular care.

Quarterly Performance Insights

The reduction in revenue primarily stemmed from a significant drop in U.S. sales, which fell to $48.1 million from $82.3 million in the previous year, largely due to intensified generic competition impacting net selling prices. Despite these challenges, Amarin's strategic maneuvers in Europe painted a brighter picture, with approximately 65% in-market sales growth driven by robust performance in Spain and the UK.

On the operational front, Amarin has been proactive in securing a new patent for VAZKEPA in Europe, extending its exclusivity until 2039, which is crucial for its long-term revenue stream. The company also reported a stable cash position of $308 million, reflecting effective financial stewardship and operational efficiency.

Strategic Developments and Financial Health

Amarin's strategic initiatives, including the recent approval of a $50 million share repurchase program, underscore its commitment to shareholder value. This program is poised to commence following UK High Court approval in Q2 2024. Additionally, the company's focus on reducing operating expenses is on track to achieve $40 million in annual savings, further stabilizing its financial base amidst market challenges.

The company's cost of goods sold showed a favorable decrease to $24.6 million from $38.0 million in Q1 2023, contributing to a gross margin of 55%. This was supported by lower selling, general, and administrative expenses, which dropped to $39.9 million from $59.6 million, reflecting the benefits of a restructuring plan initiated in mid-2023.

Looking Ahead

While Amarin faces ongoing challenges in the U.S. due to generic competition, its strategic expansions in Europe and other global markets, alongside robust cost management and innovation in its product offerings, provide a balanced pathway for future growth and stability. The company remains focused on leveraging its strengths to enhance shareholder value and sustain its leadership in cardiovascular therapeutics.

In conclusion, Amarin Corp PLC's first quarter of 2024 encapsulates a period of strategic recalibration and operational adjustments aimed at navigating market adversities and laying a stronger foundation for future growth.

Explore the complete 8-K earnings release (here) from Amarin Corp PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance