Aflac Inc (AFL) Surpasses Analyst Revenue Forecasts with Strong Q1 Earnings

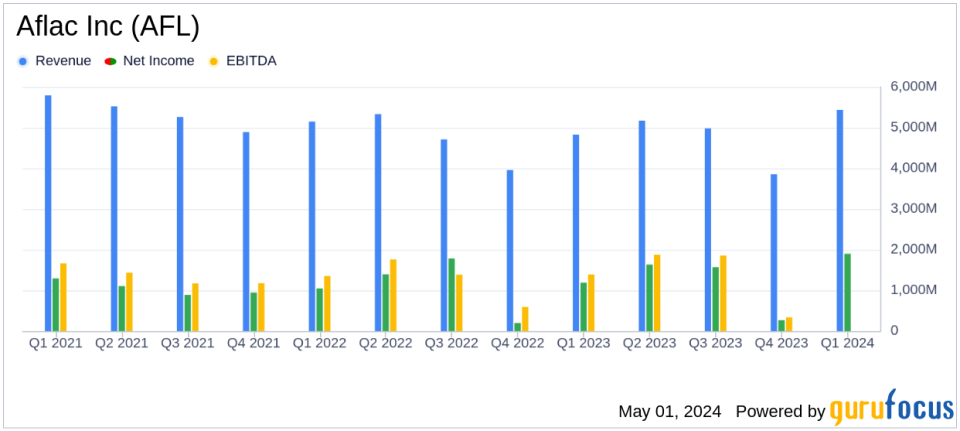

Revenue: Reported $5.4 billion, up 12.5% from $4.8 billion in the previous year, surpassing the estimated $5.296 billion.

Net Earnings: Reached $1.9 billion, a significant 58.2% increase from $1.2 billion a year ago, exceeding the estimated $909.49 million.

Earnings Per Share (EPS): $3.25 per diluted share, a substantial rise from $1.94 per diluted share in the previous year, surpassing the estimated $1.58.

Adjusted Earnings: Slightly increased to $961 million from $953 million, reflecting a modest growth of 0.8% year-over-year.

Shareholders Equity: Grew to $23.5 billion from $19.8 billion, marking an increase of 18.7% year-over-year.

Dividend: Declared a second quarter cash dividend of $0.50 per share, payable on June 3, 2024.

Share Repurchases: $750 million spent to repurchase 9.3 million shares during the quarter.

Aflac Incorporated (NYSE:AFL) unveiled its first quarter results on May 1, 2024, reporting a significant surge in revenues and earnings, largely exceeding analyst expectations. The company announced these results in its recent 8-K filing. Aflac, a leader in supplemental insurance sales in the U.S. and Japan, disclosed a total revenue of $5.4 billion for the quarter, up from $4.8 billion in the same period last year, reflecting a robust 13.3% increase. This performance notably surpassed the estimated revenue of $4296.40 million projected by analysts.

Net earnings for the quarter stood at an impressive $1.9 billion, or $3.25 per diluted share, compared to $1.2 billion, or $1.94 per diluted share in the first quarter of 2023. These figures significantly exceeded the earnings per share estimate of $1.58. The substantial rise in net earnings included $951 million from net investment gains, highlighting the company's effective investment strategies and market conditions.

Company Overview

Aflac Inc specializes in supplemental health and life insurance products, primarily in the United States and Japan. The company's diverse portfolio includes cancer, accident, dental, vision, and disability insurance products. Aflac markets these products through independent distributors and has a significant presence in workplaces across the U.S., supplemented by digital sales platforms. The company operates through two main segments: Aflac Japan, which is the major revenue contributor, and Aflac U.S.

Financial Highlights and Strategic Achievements

The financial results reflect Aflac's strategic initiatives and operational efficiency. The company's shareholders equity increased to $23.5 billion, or $41.27 per share, as of March 31, 2024, up from $19.8 billion, or $32.65 per share, a year earlier. This growth in equity underscores Aflac's strong financial position and its ability to create value for its shareholders.

Aflac's commitment to shareholder returns was evident as the board declared a quarterly dividend of $0.50 per share, payable in June 2024. Additionally, the company repurchased $750 million worth of its shares in the first quarter, demonstrating confidence in its financial health and future prospects.

Operational Insights

In Japan, Aflac's largest market, the company saw a mix of challenges and achievements. Net earned premiums in yen terms decreased by 6.0%, mainly due to prior year reinsurance transactions. However, adjusted net investment income in Japan increased by 19.3%, benefiting from lower hedge costs and favorable currency impacts. The U.S. segment also showed positive trends with a 3.3% increase in net earned premiums, driven by improved sales and persistency rates.

Management's Outlook

Chairman and CEO Daniel P. Amos commented on the results, noting the company's solid earnings and ongoing focus on profitable growth. He highlighted the strategic measures in both the U.S. and Japan aimed at enhancing product offerings and distribution strategies. The management remains optimistic about maintaining strong profit margins and driving sales, particularly with upcoming campaigns in Japan and sustained underwriting discipline in the U.S.

Conclusion

Aflac's Q1 performance not only demonstrates its resilience but also its capability to significantly outperform market expectations. With strategic initiatives in place and a strong focus on core operational efficiencies, Aflac continues to stand out as a robust player in the supplemental insurance industry.

For detailed financial figures and further information, investors and interested parties are encouraged to refer to Aflac's full earnings release and supplementary materials available on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Aflac Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance