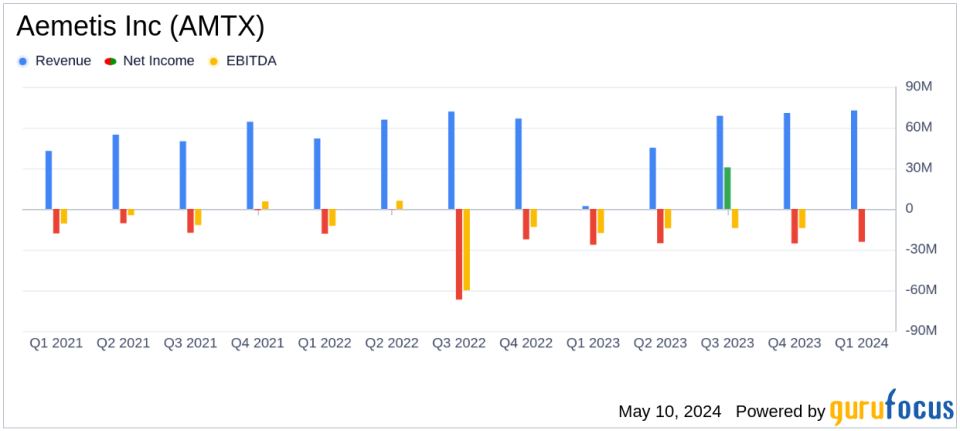

Aemetis Inc (AMTX) Q1 2024 Earnings: Revenue Surges, Yet Net Loss Widens

Revenue: Reported at $72.6 million for Q1 2024, a significant increase from $2.2 million in Q1 2023, but fell short of the estimated $77.21 million.

Net Loss: Recorded at $24.2 million in Q1 2024, improved from a net loss of $26.4 million in Q1 2023, yet was higher than the estimated loss of $19.13 million.

Operating Loss: Decreased to $9.5 million in Q1 2024 from $12.1 million in the same period last year.

Interest Expense: Increased to $10.5 million excluding accretion, up from $9.0 million in Q1 2023.

Gross Loss: Narrowed to $0.6 million in Q1 2024 from a loss of $1.3 million in Q1 2023.

Selling, General and Administrative Expenses: Decreased to $8.9 million in Q1 2024 from $10.8 million in the same quarter the previous year.

Cash Position: Ended Q1 2024 with $1.6 million in cash, down from $2.7 million at the end of Q4 2023.

Aemetis Inc (NASDAQ:AMTX) disclosed its financial results for the first quarter of 2024 on May 9, 2024, through its 8-K filing. The company, a leader in renewable natural gas and renewable fuels, reported significant revenue growth but also an increase in net loss compared to the previous year.

Company Overview

Founded in 2006 and headquartered in Cupertino, California, Aemetis is at the forefront of producing renewable natural gas and renewable fuels. The company operates a 65 million gallon per year ethanol production facility in California and a 60 million gallon per year biodiesel production facility in India. Aemetis is also expanding into sustainable aviation fuel (SAF) and renewable diesel fuel biorefineries, leveraging renewable resources to produce low carbon intensity fuels.

Financial Performance Highlights

For Q1 2024, Aemetis reported revenues of $72.6 million, a substantial increase from $2.2 million in Q1 2023. This surge was primarily due to the full resumption of operations at its Keyes plant and the first sale of Low Carbon Fuel Standard (LCFS) credits by its Dairy Renewable Natural Gas segment. Despite the impressive revenue growth, the company incurred a net loss of $24.2 million, slightly reduced from a net loss of $26.4 million in the same quarter the previous year.

Operational and Strategic Developments

During the quarter, Aemetis made significant strides in its operational segments. The California Ethanol segment, India Biodiesel, and Dairy Renewable Natural Gas segments all contributed positively to the EBITDA. Notably, the Dairy RNG business achieved a milestone by selling its first LCFS credits, enhancing its cash flow. Additionally, the company's Riverbank SAF project received final construction permits, paving the way for a 78 million gallon per year SAF production facility.

Financial Health and Future Outlook

Aemetis's balance sheet shows a cash position of $1.6 million as of March 31, 2024, down from $2.7 million at the end of 2023. The decrease in cash is attributed to investments in capital projects aimed at reducing carbon intensity and constructing dairy digesters. Looking ahead, Aemetis anticipates additional revenue streams from LCFS provisional pathway approvals and federal Inflation Reduction Act tax credits starting in January 2025.

Challenges and Industry Context

While Aemetis is progressing in its strategic initiatives, the company faces challenges such as higher interest expenses and the ongoing need for substantial capital to fund its expansion projects. The renewable energy sector is highly competitive and sensitive to regulatory changes, which could impact Aemetis's operations and financial performance.

Conclusion

Aemetis's first quarter of 2024 illustrates a company in transition, capitalizing on operational efficiencies and strategic initiatives to position itself for future profitability. Despite current financial losses, the steps being taken to expand into new markets and enhance product offerings are pivotal for long-term success. Investors and stakeholders may look forward to the potential uplift from upcoming projects and regulatory incentives.

For further details and updates, investors are encouraged to review the Aemetis Corporate Presentation and join the earnings review call hosted by the company.

Explore the complete 8-K earnings release (here) from Aemetis Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance