Should You Be Adding Hemisphere Energy (CVE:HME) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hemisphere Energy (CVE:HME). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Hemisphere Energy

How Fast Is Hemisphere Energy Growing Its Earnings Per Share?

In the last three years Hemisphere Energy's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. It's good to see that Hemisphere Energy's EPS has grown from CA$0.21 to CA$0.25 over twelve months. That's a 15% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, revenue is down and so are margins. This is less than stellar for the company.

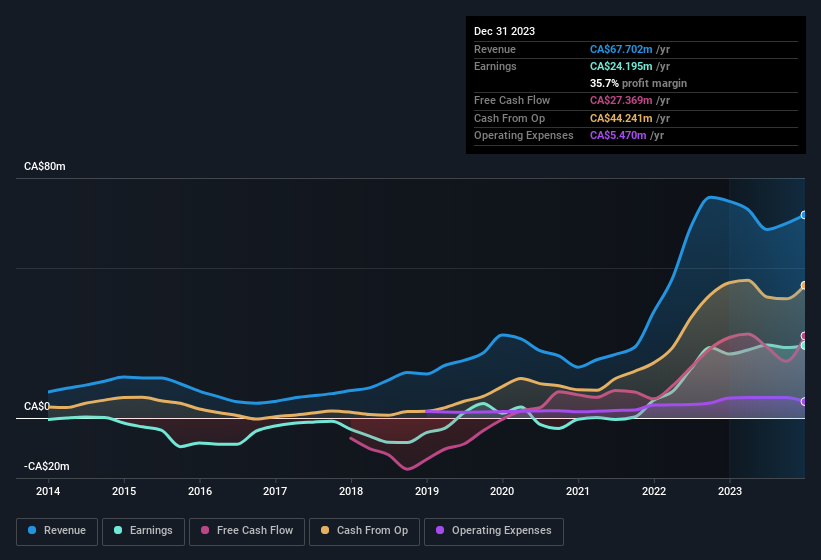

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Hemisphere Energy's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Hemisphere Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in Hemisphere Energy both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the Vice President of Exploration, Andrew Arthur, who made the biggest single acquisition, paying CA$38k for shares at about CA$1.25 each.

On top of the insider buying, it's good to see that Hemisphere Energy insiders have a valuable investment in the business. To be specific, they have CA$24m worth of shares. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 15% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Hemisphere Energy Deserve A Spot On Your Watchlist?

One important encouraging feature of Hemisphere Energy is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. You still need to take note of risks, for example - Hemisphere Energy has 2 warning signs (and 1 which is concerning) we think you should know about.

Keen growth investors love to see insider buying. Thankfully, Hemisphere Energy isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance