Accent Group And 2 Other ASX Dividend Stocks To Explore

The Australian stock market has shown a mixed performance recently, with the ASX200 seeing a modest increase driven primarily by strength in the materials sector, buoyed by government budget promises around critical minerals and hydrogen. Amidst this backdrop, dividend stocks remain an attractive option for investors looking to generate steady income from their portfolios. In light of current market conditions, understanding what defines a robust dividend stock is crucial—particularly those that can sustain payouts even in fluctuating economic landscapes.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.32% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.97% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.83% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.86% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.63% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.53% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.71% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.98% | ★★★★☆☆ |

New Hope (ASX:NHC) | 9.21% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Accent Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited, operating in Australia and New Zealand, specializes in the retail, distribution, and franchise of lifestyle footwear, along with apparel and accessories, with a market capitalization of approximately A$1.03 billion.

Operations: Accent Group Limited generates A$1.40 billion from its multi-channel retail operations, focusing on performance and lifestyle footwear.

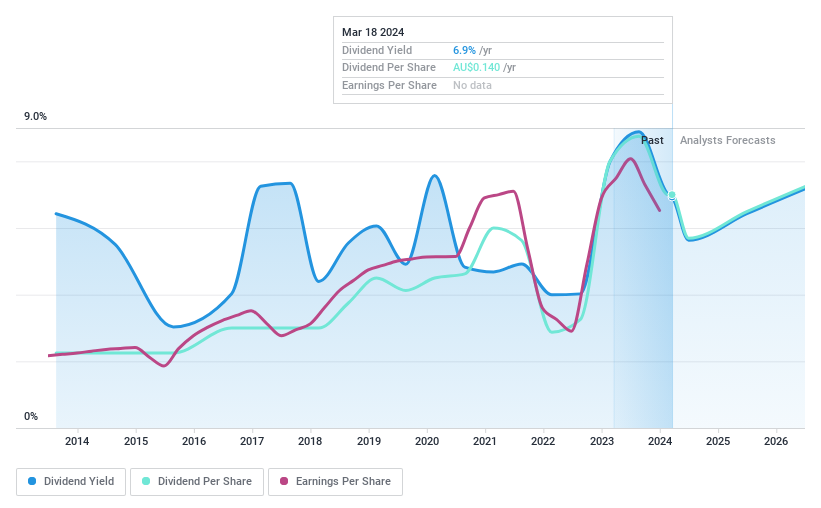

Dividend Yield: 7.7%

Accent Group offers a dividend yield of 7.65%, placing it in the top 25% of Australian dividend payers. However, its high payout ratio of 107.2% raises concerns about sustainability despite a history of increasing dividends over the past decade. The dividends are better supported by cash flows, with a cash payout ratio at 39%. Recent financials show a dip in net income from A$58.33 million to A$42.24 million and a slight decrease in sales year-over-year, suggesting potential challenges ahead in maintaining dividend growth and stability.

Unlock comprehensive insights into our analysis of Accent Group stock in this dividend report.

Our valuation report here indicates Accent Group may be undervalued.

Commonwealth Bank of Australia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers financial services across Australia, New Zealand, and other international markets, with a market capitalization of approximately A$200.54 billion.

Operations: Commonwealth Bank of Australia's revenue is primarily generated from Retail Banking Services, including Bankwest, which contributes A$11.77 billion, followed by Business Banking at A$8.54 billion, Institutional Banking and Markets with A$2.58 billion, and operations in New Zealand accounting for A$2.97 billion.

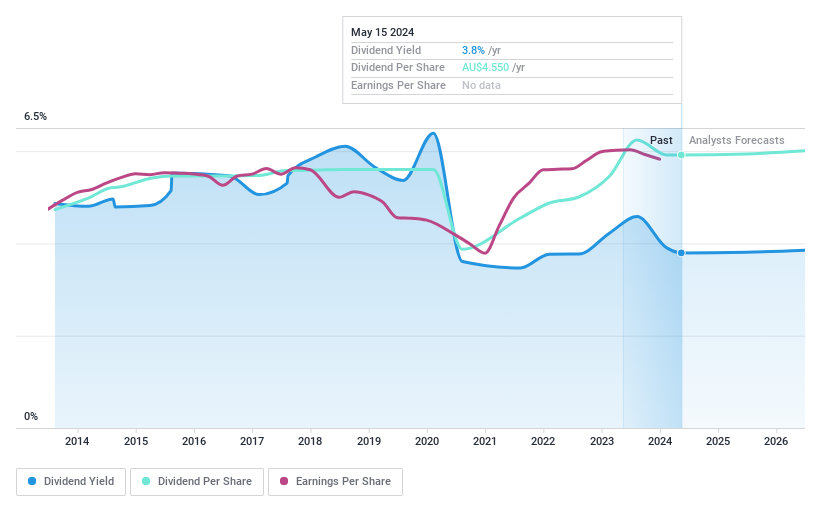

Dividend Yield: 3.8%

Commonwealth Bank of Australia's dividend yield stands at 3.79%, which is lower than the top quartile of Australian dividend stocks at 6.25%. Despite this, the bank has shown a capacity to cover its dividends, with a current payout ratio of 78.1% and a projected coverage in three years at 77.6%. However, the dividend track record over the past decade has been marked by volatility and inconsistency in growth, indicating potential concerns for long-term stability in payouts.

Premier Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited is a specialty retail fashion company with operations across Australia, New Zealand, Asia, and Europe, boasting a market capitalization of approximately A$4.79 billion.

Operations: Premier Investments Limited generates revenue primarily through its retail segment, which contributed A$1.63 billion, and its investment activities, which added A$217.83 million.

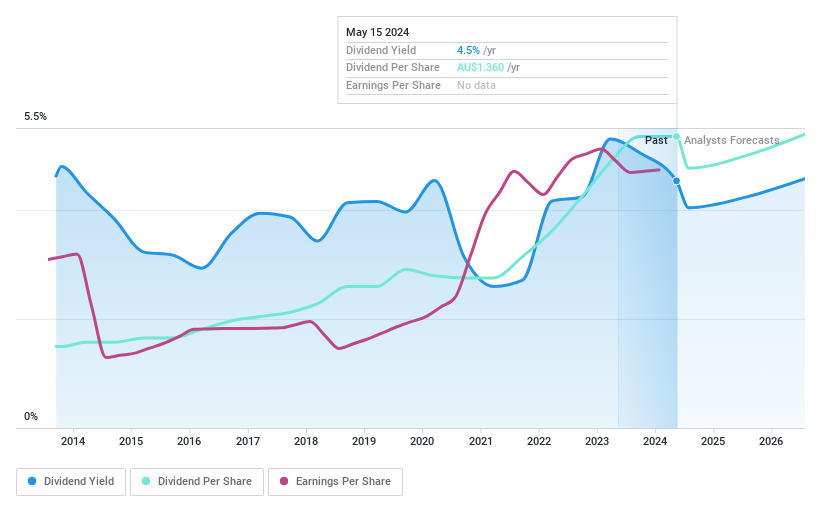

Dividend Yield: 4.5%

Premier Investments reported a slight increase in net income to A$177.23 million and is exploring a demerger of its Smiggle and Peter Alexander brands, potentially enhancing future growth opportunities. Despite a modest dividend yield of 4.53%, the company's dividends are well-covered by both earnings (payout ratio: 71.5%) and cash flows (cash payout ratio: 55%), indicating sustainability. However, its yield remains below the top quartile of Australian dividend payers at 6.25%.

Delve into the full analysis dividend report here for a deeper understanding of Premier Investments.

Taking Advantage

Dive into all 31 of the Top ASX Dividend Stocks we have identified here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:AX1 ASX:CBA and ASX:PMV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance