Accelya Solutions India Leads Three Prime Dividend Stocks

The Indian stock market has experienced a notable fluctuation recently, with a 2.5% drop over the last week, yet showing a robust growth of 40% over the past year. In this dynamic environment, dividend stocks like Accelya Solutions India offer potential stability and consistent returns, aligning well with the anticipated earnings growth of 17% per annum.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Bhansali Engineering Polymers (BSE:500052) | 4.21% | ★★★★★★ |

Castrol India (BSE:500870) | 3.96% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.95% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.01% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.85% | ★★★★★☆ |

Balmer Lawrie Investments (BSE:532485) | 4.35% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.97% | ★★★★★☆ |

Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.63% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.68% | ★★★★★☆ |

Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.81% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Accelya Solutions India

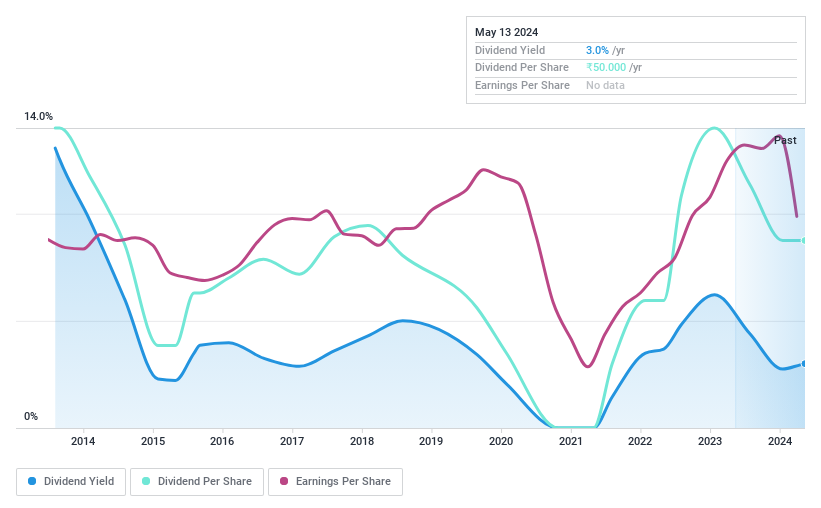

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accelya Solutions India Limited provides software solutions to the airline, cargo, and travel industries across various regions including the Asia Pacific, the Middle East, Africa, the Americas, and Europe, with a market capitalization of approximately ₹24.86 billion.

Operations: Accelya Solutions India Limited generates revenue primarily from its Travel and Transportation Vertical, amounting to ₹5.06 billion.

Dividend Yield: 3%

Accelya Solutions India has demonstrated a mixed performance in its dividend metrics. While the company maintains a reasonable cash payout ratio of 67.6%, ensuring that dividends are covered by cash flows, it has faced challenges with volatility and reliability in its dividend history over the past decade. Despite this, Accelya's Price-To-Earnings ratio of 26.2x is below the Indian market average, suggesting some value potential. However, investors should note recent earnings showing a significant drop in net income to INR 2.02 million from INR 362.95 million year-over-year for Q3 2024, which could raise concerns about future dividend sustainability despite current coverage by earnings and cash flow.

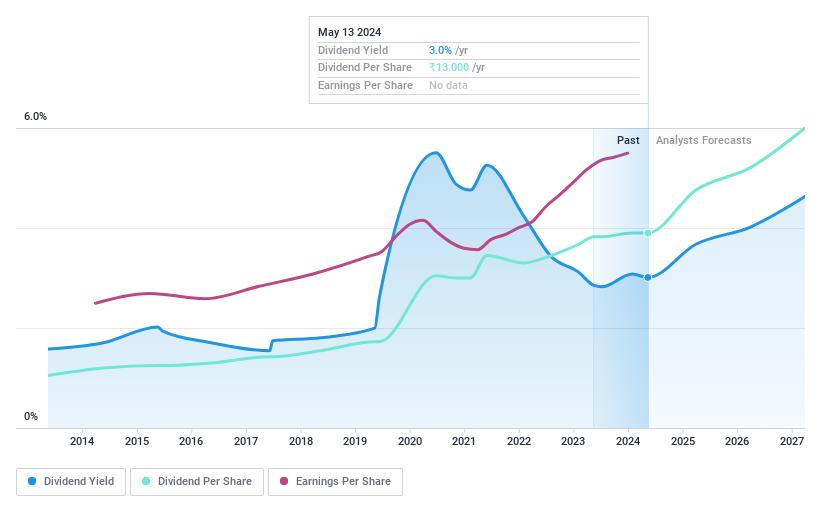

ITC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited operates in diverse sectors including fast-moving consumer goods, hotels, paperboards, paper and packaging, agriculture, and information technology across India and globally, with a market capitalization of approximately ₹5.39 trillion.

Operations: ITC Limited's revenue is generated from various segments including FMCG - Cigarettes at ₹330.61 billion, FMCG - Others at ₹206.45 billion, Agri Business at ₹165.95 billion, Paperboards, Paper & Packaging at ₹84.93 billion, and Hotels at ₹29.81 billion.

Dividend Yield: 3%

ITC's dividend yield stands at 3.01%, placing it in the top quartile of Indian dividend stocks, though its sustainability is questioned due to poor coverage by cash flows. The dividends have shown stability and growth over the past decade, but with a high cash payout ratio of 103.7%, there are concerns about future sustainability. Meanwhile, ITC's P/E ratio at 26.3x is below the market average, indicating potential value despite these challenges. Recent strategic moves include a demerger plan for ITC Hotels to enhance focus and potentially unlock value.

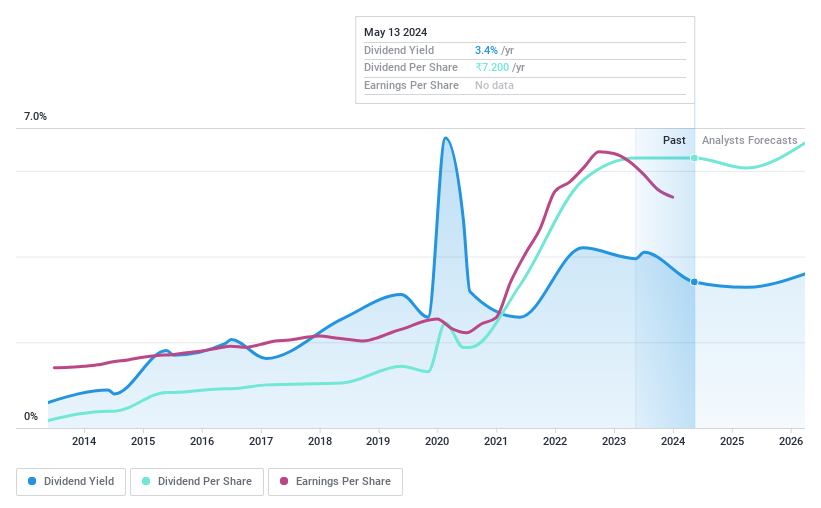

Redington

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Redington Limited operates as a supply chain solutions provider in India and internationally, with a market capitalization of approximately ₹165.15 billion.

Operations: Redington Limited generates its revenue from providing supply chain solutions across both domestic and international markets.

Dividend Yield: 3.4%

Redington, a technology distributor, recently expanded its partnership with SAS to distribute software in the Middle East, Africa, and Turkey, enhancing its market presence. Despite a low payout ratio of 40.4%, indicating good earnings coverage for dividends, Redington's dividend history has been marked by volatility and unreliability over the past decade. Additionally, while the stock trades at an attractive P/E ratio of 13.7x compared to the Indian market average of 30.9x and offers a competitive dividend yield of 3.41%, it faces challenges with free cash flow generation which raises concerns about the sustainability of future dividend payments.

Where To Now?

Click this link to deep-dive into the 26 companies within our Top Dividend Stocks screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:ACCELYA NSEI:REDINGTON and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance