3 Swedish Dividend Stocks Offering Up To 5.5% Yield

Amidst a backdrop of fluctuating global markets, Sweden's economy presents a unique landscape for investors seeking stability through dividend stocks. With yields up to 5.5%, these stocks offer an appealing balance of income and potential growth in the current economic climate. A good dividend stock typically combines reliable payouts with strong business fundamentals, making it an attractive option for those looking to generate steady income while navigating uncertain market conditions.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.26% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.10% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.21% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.18% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.16% | ★★★★★☆ |

Duni (OM:DUNI) | 4.61% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.15% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.58% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.25% | ★★★★★☆ |

Husqvarna (OM:HUSQ B) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

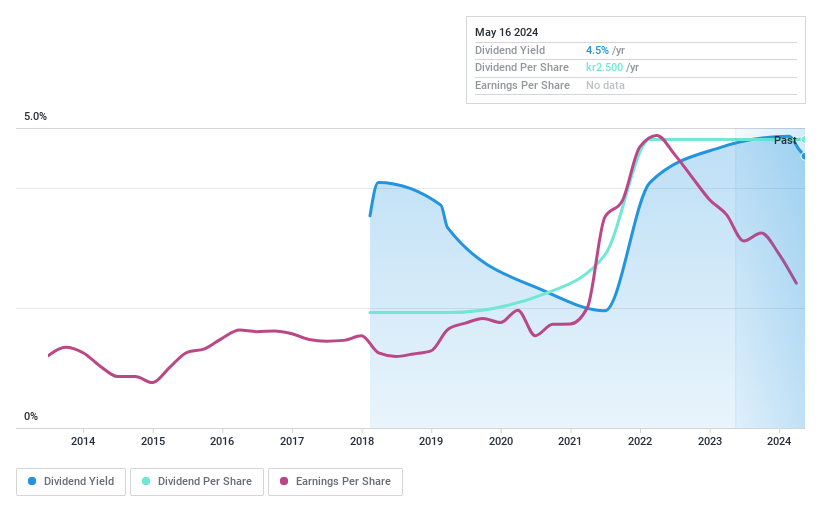

FM Mattsson

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in developing, manufacturing, and selling water taps and related products for bathrooms and kitchens across Sweden, Norway, Denmark, Finland, Benelux, the UK, Germany, and Italy with a market capitalization of approximately SEK 2.28 billion.

Operations: FM Mattsson AB generates SEK 783.23 million from international markets and SEK 1.12 billion from Nordic countries in revenue.

Dividend Yield: 4.6%

FM Mattsson's recent performance shows a decline with Q1 2024 sales at SEK 493.4 million, down from SEK 533.2 million year-over-year, and net income dropping to SEK 28.2 million from SEK 52.9 million. Despite this downturn, the dividend remains attractive at a yield of 4.63%, higher than the Swedish market average of 4.14%. The dividends are well-supported by both earnings and cash flows, with payout ratios at 86.3% and cash payout ratio at just under half (49.5%), indicating sustainability despite a shorter history of dividend payments (less than ten years). However, FM Mattsson trades significantly below estimated fair value, suggesting potential undervaluation or investor caution regarding its financial stability.

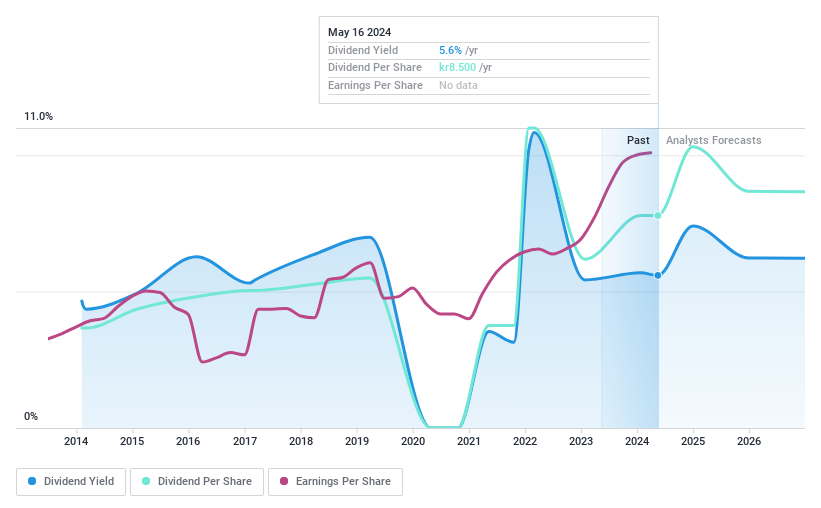

Skandinaviska Enskilda Banken

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ), commonly known as SEB, offers a range of financial services including corporate, retail, investment, and private banking, with a market capitalization of approximately SEK 314.01 billion.

Operations: Skandinaviska Enskilda Banken AB (SEB) generates revenue through various segments including Baltic (SEK 13.55 billion), Life (SEK 3.75 billion), Investment Management (SEK 3.16 billion), Large Corporates & Financial Institutions (SEK 31.98 billion), and Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK 25.42 billion).

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken (SEB A) offers a dividend yield of 5.58%, ranking in the top 25% in Sweden's market. Despite a volatile dividend history over the past decade, recent dividends are well-supported with a payout ratio of 46.3%. Earnings grew by 27.9% last year but are projected to decrease annually by 6.5% over the next three years. The bank trades at 49.4% below its estimated fair value, reflecting potential undervaluation amid financial challenges and strategic buybacks aimed at shareholder returns, as evidenced by recent repurchase programs totaling SEK 2 billion for Class A shares cancellation.

Zinzino

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company based in Sweden, offering dietary supplements and skincare products internationally with a market capitalization of approximately SEK 2.51 billion.

Operations: Zinzino AB generates its revenue primarily through two segments: Faun, which contributed SEK 161.20 million, and Zinzino (including VMA Life), which added SEK 1737.25 million.

Dividend Yield: 4.1%

Zinzino AB, a Swedish company, offers a moderate dividend yield of 4.1%, slightly below the top quartile of Swedish dividend stocks. The dividends are consistently covered by both earnings and cash flows with payout ratios near 59%. Over the past decade, Zinzino has demonstrated stable and growing dividends, supported by robust earnings growth of over 107% last year. Despite trading at a significant 62.5% below its estimated fair value, recent strategic moves include pursuing acquisitions in the US and Asia to bolster distribution and expand its product range in dietary supplements, aiming for sustained profitable expansion.

Click to explore a detailed breakdown of our findings in Zinzino's dividend report.

Our valuation report unveils the possibility Zinzino's shares may be trading at a discount.

Where To Now?

Unlock more gems! Our Top Dividend Stocks screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Top Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:FMM B OM:SEB A and OM:ZZ B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance