3 Leisure & Recreation Products Stocks to Watch Amid Industry Woes

The Zacks Leisure and Recreation Products industry faces challenges due to high inflation and elevated interest rates. Nevertheless, there is a positive trend in sales of fitness products, driven by growing health and fitness awareness and strong boat sales. Industry participants — which design, market, retail and distribute products for the outdoor and recreation market — are witnessing solid demand. Stocks like Acushnet Holdings Corp. GOLF, American Outdoor Brands, Inc. AOUT and Lazydays Holdings, Inc. GORV are likely to benefit from the trend mentioned above.

Industry Description

The Zacks Leisure and Recreation Products industry comprises companies that provide amusement and recreational products, swimming pools, marine products, golf courses, boat repair and maintenance services and other ancillary services. The services include indoor and outdoor storage, marine, boat rentals and personal watercraft. Some industry participants manufacture outdoor equipment and apparel for climbing, mountaineering, backpacking and skiing. A few companies also provide connected fitness products and subscriptions for multiple household users. Industry players primarily thrive on overall economic growth, which fuels consumer demand for products. The demand — highly dependent on business cycles — is driven by a healthy labor market, rising wages and growing disposable income.

3 Trends Shaping the Future of the Leisure and Recreation Products Industry

High Inflation & Interest Rates: In April, Americans unexpectedly halted their spending compared with March levels. This pause was influenced by ongoing inflation, which continued to affect their purchasing power and high interest rates, which made borrowing more expensive. In April, inflationary pressures showed signs of easing, with the Consumer Price Index (CPI) on a ‘core’ basis rising 3.6% year over year, in line with expectations. This marked a cooling from the 3.8% increase observed in March. Even though the inflation rate was slightly lower than the previous month’s tally, it is significantly above the Federal Reserve's target of 2%.

New Boat Sales: New boat sales are likely to have declined in 2023 owing to higher interest rates. For the calendar year 2024, the recreational boating sector is expected to maintain sales volumes of new units consistent with those of 2023, even as it deals with fluctuating interest rates and changes in consumer sentiment. Companies within the recreational marine sector are concentrating on the ongoing introduction of innovative products and plan to feature new technologies at numerous upcoming boat shows nationwide. These innovations include marine engines powered by hydrogen and boats that operate entirely on eco-friendly marine fuels.

Booming Golf Business: The golf industry has been doing exceptionally well in the past couple of years. The demand for golf equipment is rising due to advancements in technology. Innovations such as adjustable hosels, aerodynamic clubhead designs and the use of various materials are enhancing the performance and customization options available to golfers. Golf is benefiting from an increase in the participation of young people. Technology is also playing a vital role in reshaping the sport. India and China have become two of the most significant emerging golf markets.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks Leisure and Recreation Products industry is grouped within the broader Consumer Discretionary sector.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects.

The Leisure and Recreation Products industry currently carries a Zacks Industry Rank #173, which places it in the bottom 31% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries results from the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are losing confidence in this group’s earnings growth potential. Since Dec 31, 2023, the industry's earnings estimates for 2024 have declined 18.9%.

Before we present a few stocks from the industry that you may want to hold, let’s look at the industry’s recent stock market performance and valuation picture.

Industry Underperforms the S&P 500

The Zacks Leisure and Recreation Products industry underperformed the Zacks S&P 500 composite but outperformed its sector over the past year. Stocks in this industry have collectively dropped 4.5% in the past year compared with the S&P 500’s rally of 26.4%. The Zacks Consumer Discretionary sector has risen 5% in the same time frame.

One-Year Price Performance

Valuation

On the basis of forward 12-month price-to-earnings, which is a commonly used multiple for valuing leisure products stocks, the industry trades at 24.41X compared with the S&P 500’s 21.21X and the sector’s 17.99X. In the past five years, the industry has traded as high as 44.80X and as low as 12.99X, with the median being at 22.67X, as the charts show.

Forward Price to Earnings Ratio Compared With S&P

3 Leisure & Recreation Products Stocks to Watch

Lazydays GORV: Lazydays runs recreational vehicle dealerships across the United States under the Lazydays brand. Despite the ongoing economic challenges and competition within the industry, it remains confident in the earning capabilities of its stores and anticipates realizing its full potential as the industry rebounds.

This Zacks Rank #2 (Buy) company’s sales and earnings in 2024 are expected to witness growth of 7.5% and 62.1% year over year, respectively. The stock has increased 4.6% in the past month. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: GORV

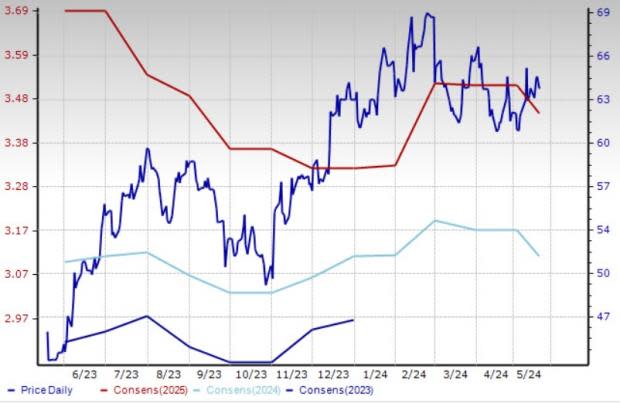

Acushnet Holdings: This Fairhaven, MA-based company designs, develops, manufactures and distributes golf products in the United States, Europe, the Middle East, Africa, Japan and Korea. This Zacks Rank #3 (Hold) company will likely benefit from increased demand for golf balls. The company gains from a healthy order backlog, strong at-once demand and gradually increasing output levels.

The company’s sales and earnings in 2024 are expected to witness growth of 4.1% and 5.8% year over year, respectively. The stock has increased 38.3% in the past year.

Price & Consensus: GOLF

American Outdoor Brands: Headquartered in Columbia, MO, the company supplies outdoor goods and accessories designed for adventurous individuals in the United States and globally. The firm is experiencing positive results from strong net sales, effective capital management and continual advancement toward achieving its long-term strategic goals.

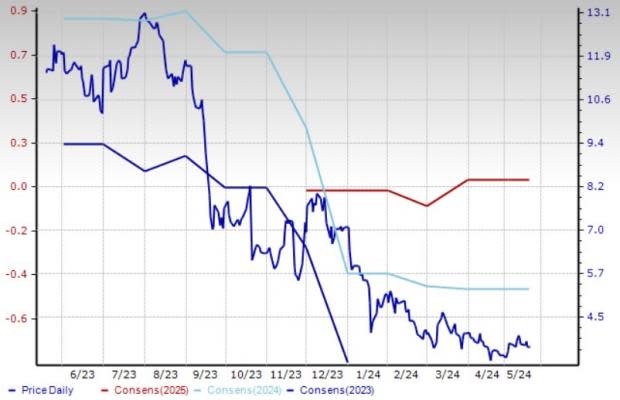

The company’s sales and earnings in fiscal 2025 are expected to witness growth of 4.6% and 77.1% year over year, respectively. The stock has declined 3.8% in the past year.

Price & Consensus: AOUT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acushnet (GOLF) : Free Stock Analysis Report

American Outdoor Brands, Inc. (AOUT) : Free Stock Analysis Report

LAZYDAYS HOLDINGS, INC. (GORV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance