3 Leading US Growth Companies With Insider Ownership Reaching 20%

As the Dow Jones Industrial Average approaches the historic 40,000 mark, reflecting a robust economic backdrop and resilient corporate earnings, investors are keenly observing market trends and opportunities. In such a buoyant environment, growth companies with high insider ownership often signal strong confidence in the company's future prospects from those who know it best—its insiders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 27.5% | 21% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Li Auto (NasdaqGS:LI) | 29.3% | 21.6% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.8% | 98% |

EHang Holdings (NasdaqGM:EH) | 33% | 97.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 75.4% |

Let's uncover some gems from our specialized screener.

CarGurus

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. is an online automotive marketplace facilitating the buying and selling of vehicles, both in the United States and internationally, with a market capitalization of approximately $2.55 billion.

Operations: The company generates revenue primarily through its U.S. Marketplace and Digital Wholesale segments, which respectively brought in $664.65 million and $179.75 million.

Insider Ownership: 16.2%

CarGurus, a growth-oriented company with high insider ownership, is trading significantly below its estimated fair value and has shown promising financial trends. Despite a decline in profit margins from 18.7% to 4%, CarGurus reported solid year-over-year earnings growth in Q1 2024 and provided an optimistic revenue forecast for Q2 ranging between US$202 million to US$222 million. The company's earnings and revenue are expected to outpace the market, with substantial annual growth rates projected for the coming years.

LGI Homes

Simply Wall St Growth Rating: ★★★★★☆

Overview: LGI Homes, Inc. is a company that designs, constructs, and sells homes, with a market capitalization of approximately $2.39 billion.

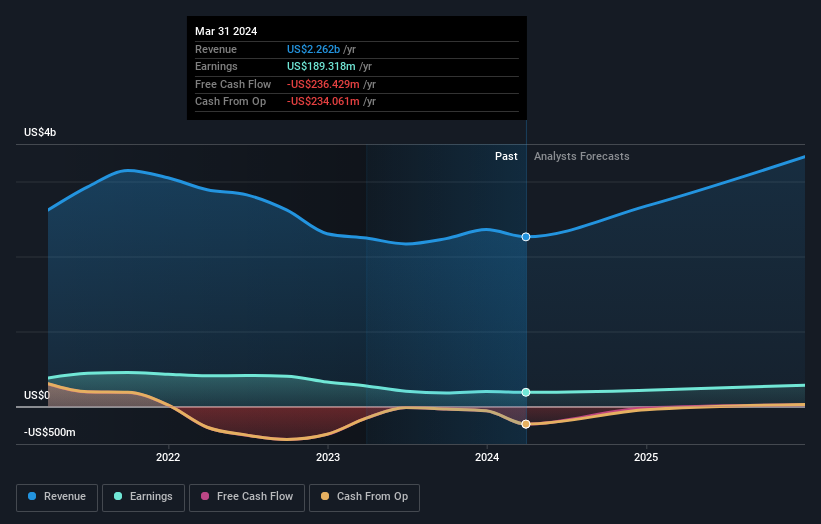

Operations: The primary revenue stream is generated from the homebuilding business, contributing approximately $2.26 billion.

Insider Ownership: 12.3%

LGI Homes, a company with high insider ownership, recently expanded its portfolio by opening new communities in California and other states, enhancing its growth prospects. Despite this positive development, the company reported a decrease in net income from US$26.96 million to US$17.05 million year-over-year for Q1 2024. Analysts forecast LGI's revenue to grow at 22.2% annually, outpacing the market prediction of 8.3%. However, concerns exist over significant insider selling and debt not being well covered by operating cash flow.

Full Truck Alliance

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in China, connecting shippers with truckers to facilitate various types of shipments, with a market capitalization of approximately $9.18 billion.

Operations: The company generates its revenue primarily through its internet information services, amounting to CN¥8.44 billion.

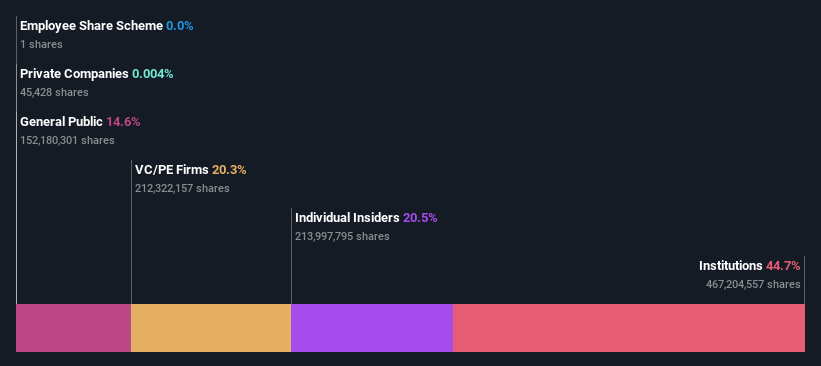

Insider Ownership: 20.5%

Full Truck Alliance, a growth company with high insider ownership, is trading at 63.3% below its estimated fair value, signaling potential undervaluation. The company's earnings have surged by 444% over the past year and are expected to grow by 26.89% annually over the next three years, outpacing the US market forecast of 14.5%. However, its return on equity is projected to remain low at 11.5%, and it has an unstable dividend track record with a recent payout totaling US$150 million.

Make It Happen

Gain an insight into the universe of 189 Fast Growing US Companies With High Insider Ownership by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:CARG NasdaqGS:LGIH and NYSE:YMM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance