3 High Insider Ownership US Growth Companies With At Least 11% Revenue Growth

Amid a backdrop of fluctuating global markets and cautious optimism for interest rate cuts, investors continue to seek robust growth opportunities within the U.S. market. Companies with high insider ownership and significant revenue growth are particularly appealing, as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 20.9% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 102.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Spotify Technology (NYSE:SPOT) | 18% | 40.3% |

Underneath we present a selection of stocks filtered out by our screen.

Endava

Simply Wall St Growth Rating: ★★★★☆☆

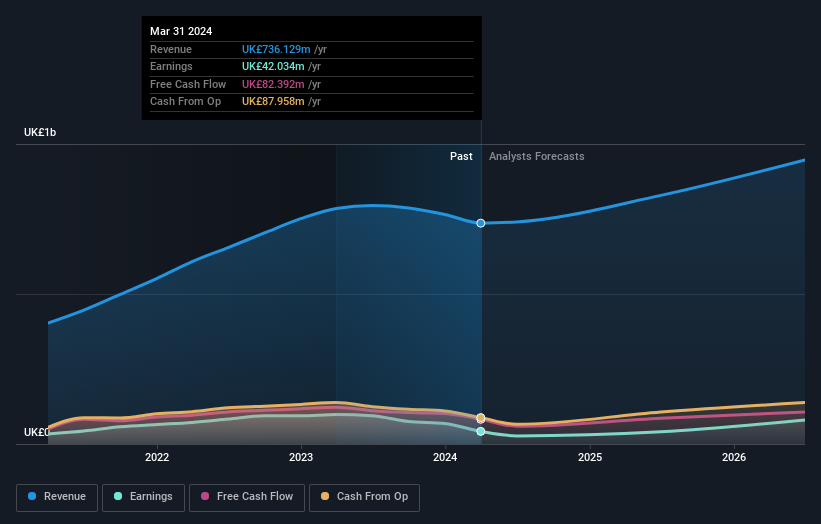

Overview: Endava plc is a global technology service provider specializing in consumer products, healthcare, mobility, and retail sectors, with a market capitalization of approximately $1.75 billion.

Operations: The company generates its revenue primarily from computer services, totaling £736.13 million.

Insider Ownership: 23%

Revenue Growth Forecast: 12% p.a.

Endava, a growth-oriented company with significant insider ownership, is navigating a complex financial landscape. Despite a recent revenue forecast showing a slight decline for 2024, the company remains innovative with its launch of the Morpheus AI accelerator aimed at regulated industries. While Endava's profit margins have decreased compared to last year, its earnings are expected to grow significantly over the next three years. The stock is currently trading below what is estimated as its fair value, indicating potential undervaluation.

Get an in-depth perspective on Endava's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility Endava's shares may be trading at a discount.

Paymentus Holdings

Simply Wall St Growth Rating: ★★★★☆☆

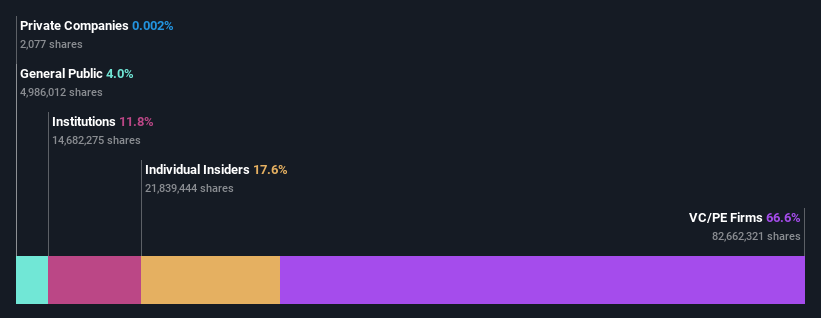

Overview: Paymentus Holdings, Inc. operates internationally, offering cloud-based bill payment technology and solutions, with a market capitalization of approximately $2.37 billion.

Operations: The company generates revenue primarily through services to financial companies, amounting to $651.04 million.

Insider Ownership: 17.6%

Revenue Growth Forecast: 15.8% p.a.

Paymentus Holdings has demonstrated robust financial growth, with a significant increase in both sales and net income as reported in its recent quarterly results. The company's revenue and earnings are expected to outpace the broader US market, with forecasts indicating strong growth rates for both metrics over the next few years. Despite these positive trends, Paymentus faces challenges with a forecasted low return on equity. Insider transactions have been balanced, showing no substantial buying or selling activities recently.

Riskified

Simply Wall St Growth Rating: ★★★★☆☆

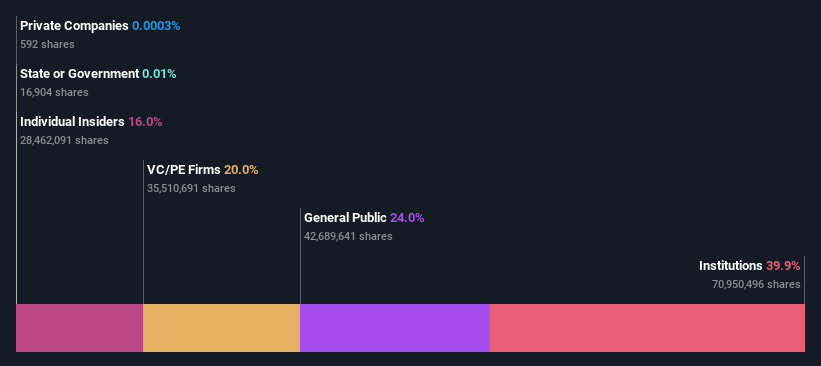

Overview: Riskified Ltd. operates a global e-commerce risk management platform that helps online merchants establish trusted relationships with consumers, with a market capitalization of approximately $1.11 billion.

Operations: The company generates its revenue primarily from its Security Software & Services segment, which amounted to $297.61 million.

Insider Ownership: 16%

Revenue Growth Forecast: 11.5% p.a.

Riskified Ltd. is navigating a path toward profitability with expectations to turn profitable within the next three years, outpacing average market growth. Despite trading at 55.9% below its estimated fair value and experiencing shareholder dilution last year, the company's revenue growth projections remain robust at 11.5% annually, surpassing the US market average of 8.4%. Recent buyback initiatives underscore a commitment to shareholder value, with significant repurchases funded from existing cash reserves enhancing investor confidence in its strategic direction.

Summing It All Up

Click here to access our complete index of 177 Fast Growing US Companies With High Insider Ownership.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:DAVA NYSE:PAY and NYSE:RSKD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance