3 Airline Stocks to Watch From a Promising Industry

The Zacks Transportation - Airline industry is being driven by upbeat air travel demand. Moreover, efforts to reward shareholders by the industry players indicate financial strength.

However, high labor and fuel costs represent major headwinds. Moreover, production delays at Boeing BA are hurting the fleet-related plans of airlines in the United States.

Despite the headwinds, we believe that investors interested in the industry would do well to keep stocks like United Airlines UAL, Alaska Air Group ALK and Copa Holdings CPA on their radar.

About the Industry

The Zacks Airline industry players are engaged in transporting passengers and cargo to various destinations globally. Most operators maintain a fleet of multiple mainline jets in addition to several regional planes. Their operations are aided by their regional airline subsidiaries and third-party regional carriers. Additionally, industry players utilize their respective cargo divisions to offer a wide range of freight and mail services. The players invest substantially to upgrade technology. The industry, apart from comprising legacy carriers, includes low-cost players. The well-being of companies in this group is linked to the health of the overall economy. This is evident from the fact that the aviation space was one of the worst-hit corners during the pandemic, with passenger revenues taking a beating. However, air travel demand is strong now.

Factors Relevant to the Industry's Fortunes

Upbeat Passenger Volumes: Air travel demand remains strong, leading to impressive top-line performance by airlines. While air travel demand is particularly strong on the leisure front, it is heartening to note that business demand has made an encouraging comeback. UAL’s top line increased 9.7% year over year in first-quarter 2024. This was driven by a 10.1% rise in passenger revenues.

Boeing-Led Woes: Jet delivery delays from Boeing have forced airlines to cut expectations for plane deliveries. While releasing first-quarter 2024 results, United Airlines management trimmed its current-year guidance for capital expenditure. The company now expects full-year 2024 total capital expenditure to be approximately $6.5 billion, down from $9 billion expected earlier. Due to aircraft delivery delays, UAL now anticipates 61 narrowbody aircraft and five widebody aircraft deliveries in 2024. The earlier expectation was for a delivery of 101 narrowbody jets. Chicago-based UAL, with 79 Boeing Max 9 planes in its fleet, is the largest operator of such jets across the globe.

Plane manufacturer Boeing has been under intense regulatory scrutiny following the Jan 5 mid-air scare involving an Alaska Airlines plane. Alaska Airlines’ Ontario, CA-bound flight (1282) saw a panel and window being blown out of the Boeing 737 MAX 9 jet shortly after takeoff from Portland, OR.

Northbound Fuel Costs: The increase in fuel expenses is another headwind for the industry. Notably, oil price spiked 16% in the January-March period. This does not bode well for the bottom-line growth of airlines. This is because fuel expenses are a significant input cost for airline stocks. The northward movement in crude price is primarily due to the ongoing production cut by major oil-producing nations and geopolitical tensions.

Strong Returns for Shareholders: With economic activities becoming normal after the pandemic, more and more companies are allocating their increasing cash pile by way of dividends and buybacks to pacify long-suffering shareholders. This underlines their financial strength and confidence in business. Among airline players, Alaska Air resumed share buybacks in 2023. The restrictions, under the CARES Act, prohibited airlines from paying dividends or buying back shares till Sep 30, 2022. During 2023, ALK repurchased nearly 3.5 million shares for $145 million

Uptick in Labor Costs: The increase in expenses on the labor front represents another challenge for airlines. With U.S. airlines grappling with a labor shortage in the post-COVID-19 high-demand scenario, the bargaining power of various labor groups has naturally increased. As a result, we have seen pay-hike deals being inked in the space. This is resulting in a spike in labor costs. For example, at United Airlines, consolidated cost per available seat mile, excluding fuel, third-party business expenses, profit-sharing and special charges, increased 4.7% year over year in first-quarter 2024.

Zacks Industry Rank Signals Bright Prospects

The Zacks Airline industry is a 30-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #85, which places it in the top 34% of 250 plus Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to add or retain in your portfolio, let’s look at the industry’s recent stock-market performance and its valuation picture.

Industry Surpasses S&P 500 and Sector

Over the past year, the Zacks Transportation - Airline industry has gained 34.9% compared with the S&P 500 composite’s rise of 23.5%. The broader sector has gained 9% in the said time frame.

One-Year Price Performance

Valuation Picture

The price/sales (P/S) ratio is often used to value airline stocks. The industry currently has a forward 12-month P/S of 1.04X compared with the S&P 500’s 3.86X. It is also below the sector’s forward-12-month P/S of 1.87X.

Over the past five years, the industry has traded as high as 1.04X, as low as 0.40X and at the median of 0.65X.

Forward 12-Month Price-to-Sales Ratio (Past Five Years)

3 Airline Stocks to Watch

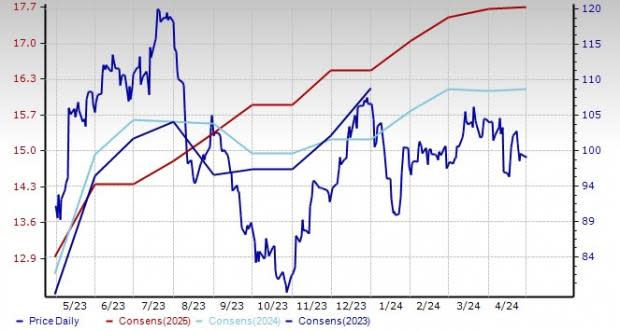

Alaska Air: The company, based in Seattle, WA, is being aided by the uptick in air travel demand. The carrier’s shareholder-friendly attitude also bodes well.

Over the past 60 days, the Zacks Consensus Estimate for 2024 earnings has been revised 8.3% upward. ALK currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Price and Consensus: ALK

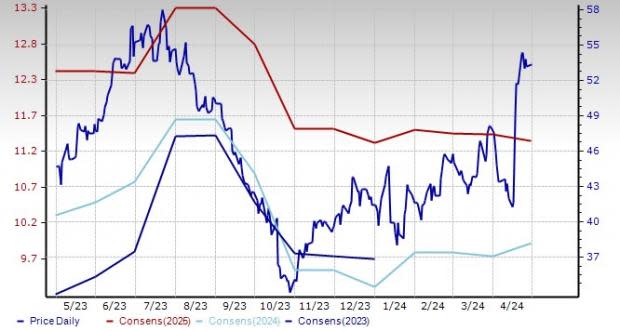

Latin American carrier Copa Holdings is being aided by upbeat air travel demand. We are also encouraged by Copa Holdings' initiatives to modernize its fleet.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2024 earnings being revised 1.2% upward. CPA currently carries a Zacks Rank #2.

Price and Consensus: CPA

United Airlines is based in Chicago. The gradual increase in air travel demand (particularly for leisure) is aiding AAL. However, high operating costs are hurting the bottom line.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2024 earnings being revised 1.5% upward. UAL currently carries a Zacks Rank #3 (Hold).

Price and Consensus: UAL

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

The Boeing Company (BA) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance