Fremont Gold Ltd. (FRE.V)

| Previous Close | 0.1000 |

| Open | 0.1000 |

| Bid | 0.0950 x N/A |

| Ask | 0.1000 x N/A |

| Day's Range | 0.0950 - 0.1000 |

| 52 Week Range | 0.0500 - 0.1400 |

| Volume | |

| Avg. Volume | 28,250 |

| Market Cap | 5.517M |

| Beta (5Y Monthly) | 0.43 |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | -0.1300 |

| Earnings Date | N/A |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | N/A |

| 1y Target Est | N/A |

Newsfile

NewsfileFremont Gold Announces Debt Settlement Agreement

Vancouver, British Columbia--(Newsfile Corp. - October 1, 2024) - Fremont Gold Ltd. (TSXV: FRE) (OTCQB: FRERF) (FSE: FR20) ("Fremont" or the "Company") announces that it has agreed to settle outstanding debts owed to two current and one former member of its management team totalling $499,333. The debts relate to unpaid remuneration and unreimbursed expenses that began accumulating in mid 2021. The Company has entered into debt settlement agreements with each ...

Newsfile

NewsfileFremont Announces Detailed Mapping and Additional Soil Geochemistry Results from Urasar Mineral District, Armenia

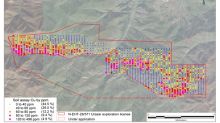

Vancouver, British Columbia--(Newsfile Corp. - September 24, 2024) - Fremont Gold Ltd. (TSXV: FRE) (OTCQB: FRERF) (FSE: FR2) ("Fremont" or the "Company) is pleased to announce the results of detailed geological and structural mapping, as well as an expanded geochemical soil survey at the Company's Urasar Mineral District exploration permit in northern Armenia. This work underscores a major expansion in both the geological understanding and the mineral potential of the area.Figure 1. Copper ...

Newsfile

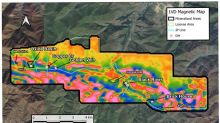

NewsfileFremont Gold Completes Mag Survey over Urasar District

Vancouver, British Columbia--(Newsfile Corp. - September 11, 2024) - Fremont Gold Ltd. (TSXV: FRE) (OTCQB: FRERF) (FSE: FR20) ("Fremont" or the "Company") is pleased to announce the completion of a ground magnetic survey over the Company's 100% owned Urasar Mineral District exploration permit. The survey comprises 74 north-south lines, spaced 200 meters apart, totaling 240 line kilometers. Data collection was conducted by Fremont personnel over a fifteen-week period, with quality control and pro