CITIC Securities Company Limited (CIIHF)

| Previous Close | 1.8301 |

| Open | 1.8000 |

| Bid | 0.0000 x 0 |

| Ask | 0.0000 x 0 |

| Day's Range | 1.8000 - 1.8000 |

| 52 Week Range | 1.7200 - 2.1300 |

| Volume | |

| Avg. Volume | 4,447 |

| Market Cap | 36.043B |

| Beta (5Y Monthly) | 0.92 |

| PE Ratio (TTM) | 10.00 |

| EPS (TTM) | 0.1800 |

| Earnings Date | Aug 27, 2024 - Sept 02, 2024 |

| Forward Dividend & Yield | 0.07 (3.79%) |

| Ex-Dividend Date | Jul 03, 2023 |

| 1y Target Est | N/A |

Bloomberg

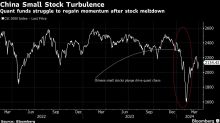

BloombergChina Quants Saw Assets Shrink After Stock Meltdown Hit Returns

(Bloomberg) -- China’s quantitative hedge funds saw their assets drop last quarter for the first time since late 2022, after the nation’s stock-market meltdown hit performance and eroded investor confidence in their algorithm-driven trading strategies.Most Read from BloombergWall Street Moves to Fastest Settlement of Trades in a CenturyIsraeli Airstrike and Egyptian Guard’s Death Ratchet Up TensionsFor Private Credit’s Top Talent, $1 Million a Year Is Not EnoughCatering to the Ultra-Rich Is a Bo

- Reuters

WRAPUP 1-CICC, Citic, JPMorgan cut investment banking jobs in China as deals stall

Two Chinese companies and JPMorgan have become the latest banking groups to cut jobs in China as a slow recovery in listing and dealmaking activities force them to ramp up cost controls, six sources with knowledge of the matter said. Beijing-based China International Capital Corp (CICC) is planning to reduce its investment banking headcount by at least 10% this year, two people with knowledge of the matter told Reuters.

Reuters

ReutersExclusive-China's CITIC to move dozens of Hong Kong bankers to mainland to cut costs -sources

China's CITIC Securities plans to move dozens of bankers from its offshore platform CLSA in Hong Kong to the mainland to cut costs and meet Beijing's call to bridge income inequality in the financial sector, people with knowledge of the matter said. In an unusually broad move for an industry where individual relocations are more common, CLSA is expected to demand the investment bankers move to the Chinese mainland with their pay lowered to local levels or face the likely prospect of losing their jobs, three people said.