Zurich Insurance Group AG's Dividend Analysis

Insight into Zurich Insurance Group AG's Upcoming Dividend Payment

Zurich Insurance Group AG (ZURVY) recently announced a dividend of $2.94 per share, payable on an undisclosed future date, with the ex-dividend date set for 2024-04-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Zurich Insurance Group AG's dividend performance and assess its sustainability.

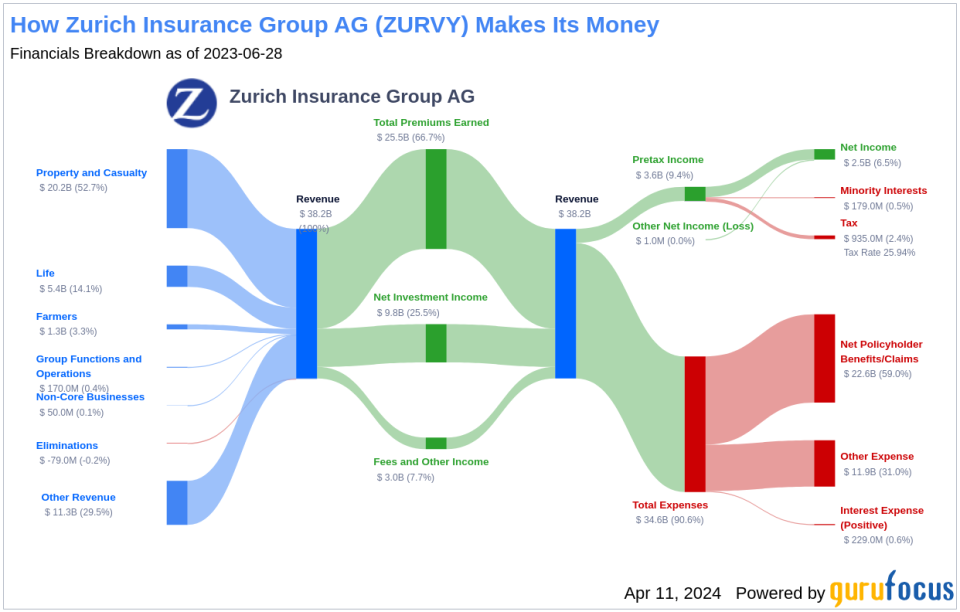

What Does Zurich Insurance Group AG Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Zurich Insurance Group AG is a leading multiline insurer that provides a suite of both life and non-life insurance products, along with owning Farmers Management Services. Founded in 1872 as a marine reinsurer, Zurich Insurance Group AG has grown significantly by expanding into various insurance sectors and adapting to technological advancements in transportation. The company has long been established as one of Europe's top insurers, balancing fair claims handling with adequate premium pricing to maintain its competitive edge and reputation.

A Glimpse at Zurich Insurance Group AG's Dividend History

Zurich Insurance Group AG has a strong track record of dividend payments, consistently distributing dividends to shareholders since 2016. These dividends are issued on an annual basis, reflecting the company's financial stability and commitment to returning value to its shareholders. Below is a chart that illustrates the historical trends of the company's annual Dividends Per Share.

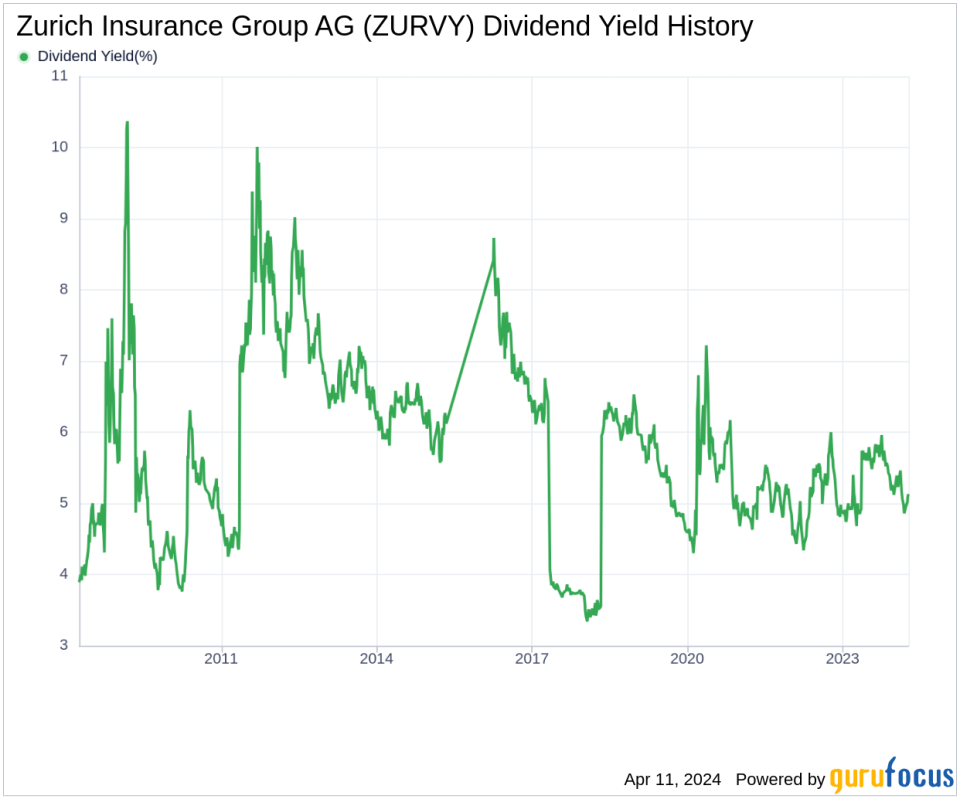

Breaking Down Zurich Insurance Group AG's Dividend Yield and Growth

As of today, Zurich Insurance Group AG boasts a trailing dividend yield of 5.10% and a forward dividend yield of 5.60%, indicating an anticipated increase in dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 7.70%, which drops slightly to 4.40% when looking at a five-year period. Over the past decade, the annual dividends per share growth rate has been 3.00%. Additionally, the 5-year yield on cost for Zurich Insurance Group AG stock is approximately 6.33% as of today.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of dividends, it is crucial to examine the dividend payout ratio, which indicates the proportion of earnings allocated to dividends. With a payout ratio of 0.89 as of December 31, 2023, there is an implication that Zurich Insurance Group AG's dividends could be at risk. However, the company's profitability rank of 5 out of 10, along with a consistent record of positive net income over the past decade, provides a more nuanced picture of its financial health and suggests fair profitability.

Growth Metrics: The Future Outlook

For dividends to be sustainable, a company must exhibit strong growth metrics. Zurich Insurance Group AG's growth rank of 5 out of 10 indicates a fair growth outlook. The company's revenue per share and 3-year revenue growth rate demonstrate a solid revenue model, despite underperforming approximately 52.22% of global competitors. Moreover, the 3-year EPS growth rate and 5-year EBITDA growth rate, while underperforming against a majority of global competitors, still show positive growth trends.

Concluding Thoughts on Zurich Insurance Group AG's Dividends

In conclusion, Zurich Insurance Group AG's attractive dividend yield, historical dividend growth, and commitment to shareholder returns are noteworthy. However, the payout ratio and mixed performance in growth metrics warrant a cautious approach. Investors should consider these factors in the context of their investment strategy and monitor the company's future earnings reports and strategic initiatives for any signs of improvement or decline. For those seeking high-dividend yield opportunities, the High Dividend Yield Screener available to GuruFocus Premium users is an excellent resource.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance