YUM! Brands' (YUM) Q1 Earnings Miss, Revenues Top Estimates

YUM! Brands, Inc. YUM reported mixed first-quarter 2023 results, with earnings missing the Zacks Consensus Estimate but revenues beating the same.

The top and the bottom lines increased on a year-over-year basis. Following the results, the shares of the company declined 2.4% in the pre-market trading session on May 3.

David Gibbs, CEO of YUM! Brands, stated, “The demand for our iconic brands is evident as our incredible teams and franchise partners delivered another strong quarter with system sales growth of 13% excluding Russia, driven by 8% same-store sales growth and continued development momentum. We're seeing broad-based accelerating digital sales growth leading to a record quarter for both digital system sales of nearly $7 billion and digital sales mix that exceeded 45%.”

Earnings and Revenue Discussion

In first-quarter 2023, the company's adjusted earnings per share (EPS) came in at $1.06, missing the Zacks Consensus Estimate of $1.14. In the prior-year quarter, the company reported an adjusted EPS of $1.05.

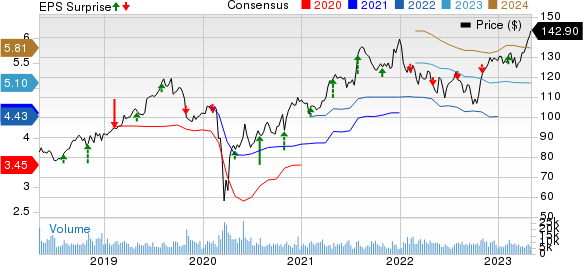

Yum! Brands, Inc. Price, Consensus and EPS Surprise

Yum! Brands, Inc. price-consensus-eps-surprise-chart | Yum! Brands, Inc. Quote

Quarterly revenues of $1,645 million beat the consensus mark of $1,632 million by 0.8%. Also, the top line increased 6.3% year over year. The upside can be attributed to an increase in the revenues of all its operating divisions.

Worldwide system sales — excluding foreign currency translation — increased 11% year over year, with Taco Bell rising 12% year over year, KFC 11% and Pizza Hut 10%.

Divisional Performance

YUM! Brands primarily announces results under four divisions — KFC, Pizza Hut, Taco Bell and Habit Burger Grill.

For first-quarter 2023, revenues from KFC totaled $687 million compared with $660 million reported in the prior-year quarter. Comps in the division increased 9% year over year compared with 3% growth reported in the previous quarter.

The segment's operating margin increased 30 basis points (bps) year over year to 44.4%. In the quarter under review, the KFC Division opened 385 gross new restaurants in 47 countries.

At Pizza Hut, revenues amounted to $254 million, up 4% year over year. Comps in the quarter increased 7% year over year, on par with the prior-year quarter.

The segment's operating margin declined 90 bps year over year to 41.2%. Pizza Hut Division opened 271 gross new restaurants in 31 countries in the quarter under review.

Taco Bell's revenues were $572 million, up 11% from the year-ago quarter's levels. Comps in the segment increased 8% year over year compared with 5% growth reported in the year-ago quarter. Its operating margin declined 10 bps year over year to 35.6%.

Taco Bell opened 79 gross new restaurants in 16 countries in the quarter under review.

In the first quarter, the Habit Burger Grill division’s revenues amounted to $132 million compared with $126 million reported in the previous quarter. Comps in the division grew 3%, on par with the prior-year quarter. In the quarter under review, the division opened 11 gross new restaurants in the United States and Cambodia.

Other Financial Details

As of Mar 31, 2023, cash and cash equivalents totaled $349 million compared with $367 million at 2022-end. Long-term debt, as of Mar 31, 2023, was $11,349 million compared with $11,453 million as of 2022-end.

The company announced a hike in its quarterly dividend payout. The company raised the quarterly dividend to 60 cents per share (or $2.42 annually) from the previous payout of 57 cents (or $2.28 annually). The hiked dividend was paid out on Mar 10 to shareholders of record as of Feb 22.

Zacks Rank & Key Picks

YUM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some better-ranked stocks from the Zacks Retail-Wholesale sector.

Arcos Dorados Holdings Inc. ARCO currently sports a Zacks Rank #1. ARCO has a long-term earnings growth rate of 7.8%. The shares of the company have gained 5.6% in the past year.

The Zacks Consensus Estimate for ARCO’s 2023 sales suggests growth of 13.4% from the year-ago period’s levels.

Chipotle Mexican Grill, Inc. CMG sports a Zacks Rank #1. CMG has a long-term earnings growth rate of 31.8%. The shares of the company improved 42.7% in the past year.

The Zacks Consensus Estimate for CMG’s 2023 sales and EPS suggests growth of 13.8% and 32.3%, respectively, from the year-ago period’s levels.

Chuy's Holdings, Inc. CHUY carries a Zacks Rank #2 (Buy). CHUY has a trailing four-quarter earnings surprise of 19.1%, on average. Shares of the company have increased 43.1% in the past year.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS suggests growth of 10.9% and 19%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance