New York Community (NYCB) Ratings View Changed by Moody's

Following the $1-billion cash infusion, New York Community Bancorp’s NYCB rating view has been changed to "review for upgrade" from "review for downgrade" by Moody’s Investors Service — a division of Moody’s Corporation MCO.

The company will raise more than $1 billion from a group of investors, led by former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Partners. Liberty, Hudson Bay and Reverence will invest $450 million, $250 million and $200 million, respectively.

New York Community will sell 59,750,000 common shares for $2 per share; and 192,062 and 273,188 convertible preferred shares of series B and series C, respectively, with a conversion price of $2 per share. Beside this, investors will receive seven-year warrants to purchase non-voting, common-equivalent stock of NYCB shares worth $315 million. This will be at an exercise price of $2.50 per share, indicating a 25% premium on the price paid on common stock of $2.

The capital raise will increase NYCB's common equity tier 1 (CET1) ratio to 10.3% (on a proforma basis), assuming the full conversion of the preferred equity to common, from 9.2% reported on Dec 31, 2023. Per the rating agency, NYCB's "planned capital raise could help stabilize its franchise following the tumultuous series of events that have occurred in recent weeks, and could improve its creditworthiness."

However, Moody’s continues to believe that the bank will further increase its provisions for credit losses. Last week, Moody's downgraded NYCB's long-term issuer rating to "B3" from "Ba2."

Last week, the company slashed its quarterly dividend by 80% to a penny. This comes after the lender reduced its dividend by 71% on Jan 30, 2024. NYCB announced the dividend cut to build capital.

New York Community also noted a 5% drop in its deposits since the 2023 end through Mar 5, 2024. As of the date, its deposits stood at $77.2 billion, down from $81.4 billion as of the December end.

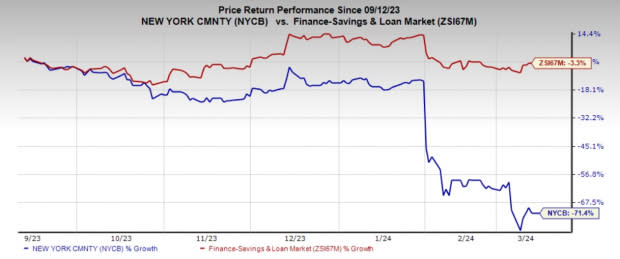

Over the past six months, NYCB shares have lost 71.4% compared with the industry’s 3.3% decline.

Image Source: Zacks Investment Research

Currently, NYCB carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Rating Actions of Other Companies

Truist Financial’s TFC decision to divest its remaining 80% stake in Truist Insurance Holdings (“TIH”) triggered reactions from two major credit rating agencies — Fitch Ratings and Moody's Investors Service.

Fitch Ratings downgraded TFC's long-term issuer default rating to 'A' from 'A+' alongside lowering the Viability Rating to 'a' from 'a+.' The rating agency viewed this transaction as a near-term credit positive but acknowledged the constraints that this narrower business mix places on Truist's business and earnings prospects.

Meanwhile, Moody's placed Truist’s long-term ratings on review for a downgrade. The firm cited concerns over TFC's reduced diversification post-sale, increased reliance on net interest income and heightened earnings volatility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance