Yield vs. Growth: Striking the Right Balance in Canadian Dividend Investing

Written by Kay Ng at The Motley Fool Canada

Seldom do we find stocks that have both a high dividend yield and high growth. In other words, stocks with big dividends tend to experience slow growth. Then, there are stocks with low yields that may have higher growth than big-dividend stocks.

Ultimately, striking the right income versus growth balance in your Canadian dividend stock investing depends on your income and total return goals. Currently, would you prioritize higher income or greater growth? What about 5, 10, 20, or 30 years from now? For example, retirees or soon-to-be retirees would likely prioritize current income generation.

Dividend stock example for income investors

Income-focused investors care about maximizing income now. If so, they might consider a high-yield stock like Enbridge (TSX:ENB). ENB has a long dividend-paying history, having paid dividends for about 70 years. Its dividend growth track record of about 27 consecutive years is also strong.

As growth has slowed in the mature company in recent years, especially in a higher interest rate environment that’s dragging down growth, Enbridge stock’s recent dividend growth rate has slowed to about 3%. Investors should expect this kind of dividend growth rate through 2025. However, the company could bump up its dividend growth rate to about 5% post-2025.

If investors bought the energy stock in 2018 for an initial dividend yield of about 5.3% and didn’t buy anymore shares, they would have seen their yield on cost grow to about 7%.

Despite slower growth, today, ENB stock investors are compensated with a high dividend yield of close to 7.7%, based on the recent stock price of $47.56, which analysts believe to be fairly valued. Enbridge is a blue chip stock that investors can buy on dips and earn dependable income on.

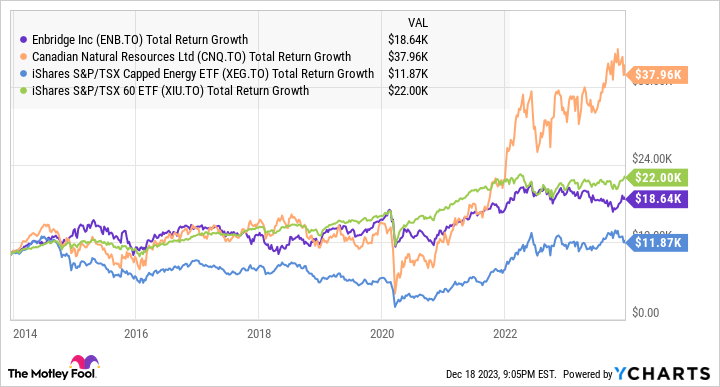

In the last decade, Enbridge stock’s total return beat the energy sector (using iShares S&P/TSX Capped Energy Index ETF as a proxy). However, it wasn’t able to beat the Canadian stock market (using iShares S&P/TSX 60 Index ETF as a proxy). This suggests that there’s typically a tradeoff between income and growth, which is something income-focused investors should be aware of.

ENB, CNQ, XIU, and XEG 10-year Total Return Level data by YCharts

Example with higher income growth

If investors bought another energy stock, Canadian Natural Resources (TSX:CNQ) in 2018 instead, despite starting with a lower dividend yield of about 3%, they would have witnessed their yield on cost grow to about 8.8%.

CNQ has increased its dividend for about 22 consecutive years. It’s amazing that its 3, 5, 10, 15, and 20-year dividend growth rates are all over 21%. The high growth rate has also driven stronger performance in the stock.

In the last decade, CNQ stock greatly outperformed the energy sector and Canadian stock market with total returns of close to 14.3% per year. In other words, the investment would have transformed an initial $10,000 into into about $37,960, as shown in the graph.

As a large oil and gas producer, Canadian Natural Resources’s performance will be more or less impacted by the price changes in the underlying commodities. However, it looks like management is committed to a growing dividend.

At $84.82 per share at writing, CNQ stock yields 4.7%, and analysts believe it trades at a discount of about 14%.

If you have decades until retirement or until you need current income, you can weigh more towards lower-yielding stocks that have higher growth prospects to target greater wealth creation in the long run. Striking the right balance between yield and growth is both an art and a science.

The post Yield vs. Growth: Striking the Right Balance in Canadian Dividend Investing appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Canadian Natural Resources?

Before you consider Canadian Natural Resources, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2023... and Canadian Natural Resources wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 24 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/14/23

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends Canadian Natural Resources and Enbridge. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance