Yahoo U: What are super voting shares?

The IPO market took another hit this week as shares of fitness company Peloton (PTON) sank 11.2% in its first day of trading.

The company’s IPO included super voting shares, which give executives and early backers extra power over the company. This structure has become increasingly common among other highly-valued and hyped tech startups.

Many companies going public will issue one form of common stock, where each share is equal to one vote. These votes give you a say in critical company decisions like who sits on the board of directors, issuance of new securities, and even specific decisions on corporate strategy. In a one-for-one issuance, shareholders wanting more power would just have to buy more shares if they wanted more voting strength.

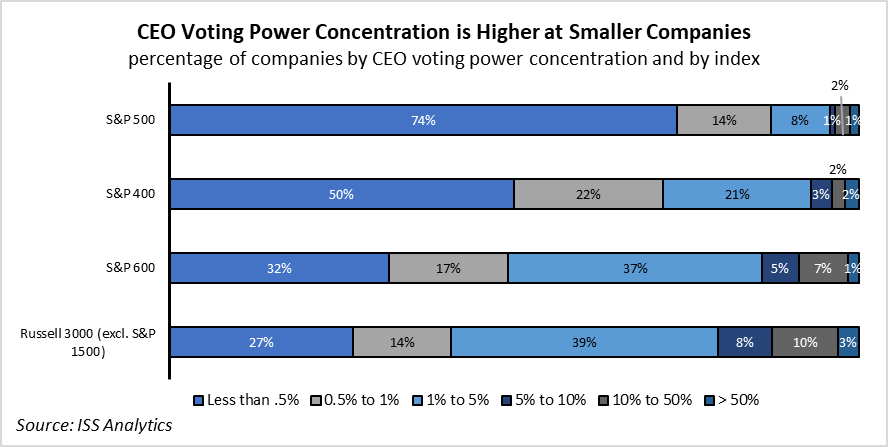

Some might think that CEOs, especially those with richer equity compensation, would have more voting power. But almost three-fourths of S&P 500 CEOs have less than 0.5% voting power, according to data from ISS Analytics. Currently, only 12% of S&P 500 CEOs have more than 1% voting power. But recently, super voting shares have become more common, particularly among tech companies.

When a company implements the dual-class voting structure in their public offering, they have two classes for shareholders. In Class A, shareholders get one vote per share, but executives in Class B can have 20 votes per share. This model gives CEOs more power for their company. Some companies implement even more than two classes, in which case it would be called a multi-class structure.

This is becoming a prevailing trend for Silicon Valley firms taking over Wall Street after Google (GOOG, GOOGL) first made it cool in 2004, and has been a component of Lyft (LYFT), Peloton (PTON), and Snap (SNAP) shares. In 2017, one in five tech companies going public incorporated a dual-class structure, based on data from the University of Florida’s Jay Ritter.

There’s nothing illegal about this. The idea is investors can decide if they want to invest in such a management structure or not. But it raises the question of whether or not this has led to some of the leadership kerfuffles recently.

Valentina Caval is a producer at Yahoo Finance. Brian Cheung is a reporter at Yahoo Finance.

Read and watch more of Yahoo U here

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance