Yacktman Fund's Biggest Buys of 1st-Quarter 2020

The Yacktman Fund (Trades, Portfolio) recently disclosed its portfolio updates for the first quarter of 2020.

The Yacktman Fund (Trades, Portfolio) is based in Austin, Texas and is an affiliate of Affiliated Managers Group Inc. (AMG), a global asset management company. Its investing strategy has a focus on value equity investing, employing a patient and diligent research approach and investing in both U.S. and foreign equities in order to reduce risk. Chief Investment Officer Stephen Yacktman leads the fund's team of investors, which uses a generalist rather than a specialist approach, with each member responsible for following all investments rather than focusing on a specific sector.

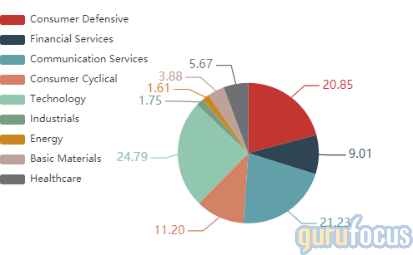

As of the end of the fourth quarter, the fund's equity portfolio consisted of 48 stocks valued at $4.67 billion. The top equity holdings at the end of the quarter were Samsung (XKRX:005935) with 11.65%, Bollore SA (XPAR:BOL) with 5.61% and Johnson & Johnson (JNJ) with 4.21%. In terms of sector weightings, the fund is most heavily invested in technology, communication services and consumer defensive.

Based on its investing criteria, the fund established nine new positions during the quarter, the largest of which were Continental AG (XTER:CON), Huntsman Corp. (NYSE:HUN) and MSC Industrial Direct Co Inc. (NYSE:MSM).

Continental AG

The fund's biggest new buy was 2,650,000 shares of Continental AG, which had a 4.91% weight in the equity portfolio. During the quarter, the average share price was 96.71 euros ($104.80).

Continental is a German auto parts company that specializes in manufacturing brake systems, interior electronics, power train and chassis components, safety parts and tires. Founded in 1871, the company aims to provide safe, efficient, intelligent and affordable products for the transportation and traffic control industries.

On April 16, shares of Continental traded around 69.06 euros for a market cap of 14.63 billion euros. GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rating of 7 out of 10 and a valuation rating of 9 out of 10.

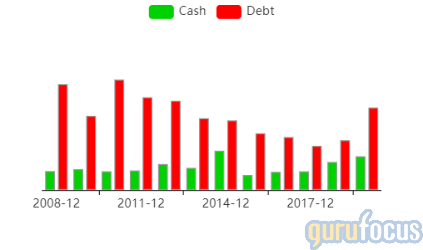

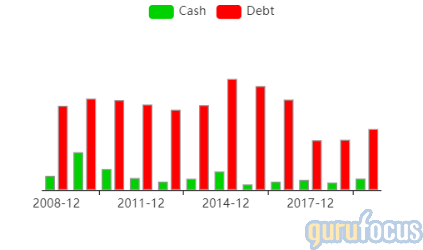

Continental's cash-debt ratio of 0.41, current ratio of 1.06 and Altman Z-Score of 1.82 indicate that the company may have some financial difficulties, but the return on invested capital of 33.19% is significantly higher than the weighted average cost of capital of 7.88%.

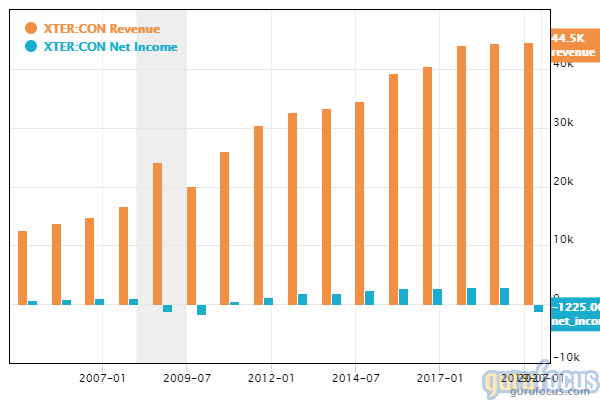

The net margin is 8.21%, which is higher than the industry median of 4.21%. Overall, the company has grown its revenue and net income throughout its history, though a slowdown in the automobile industry contributed to an overall net loss for full-year 2019.

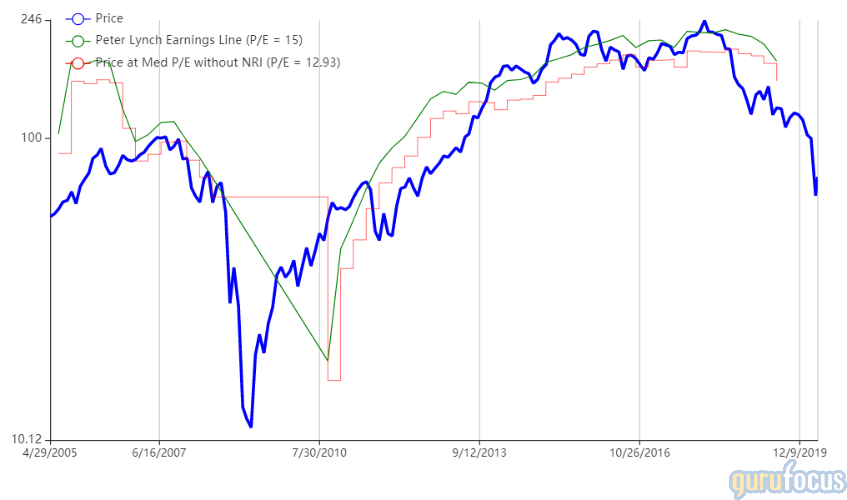

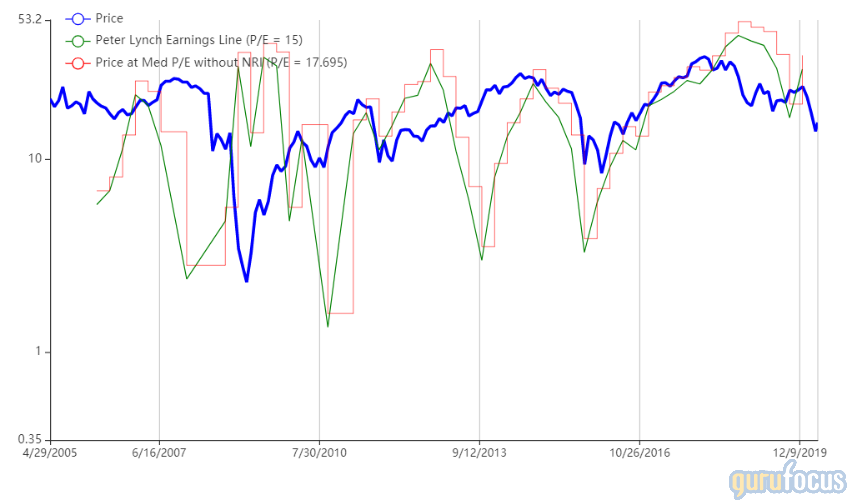

The price-book ratio of 0.98 and price-sales ratio of 0.34 indicate that the stock is trading cheaply, as does the Peter Lynch chart below.

Huntsman

The fund also invested in 3,500,000 shares of Huntsman, impacting the equity portfolio by 1.08%. Shares traded for an average price of $19.65 during the quarter.

Texas-based Huntsman is a manufacturer and marketer of chemical products. Its products include polyurethanes and adhesives for companies in several industries, including automotive and pharmaceutical.

On April 16, shares of Huntsman traded around $14.72 for a market cap of $3.32 billion and a price-earnings ratio of 6.08. GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rating of 6 out of 10 and a valuation rating of 6 out of 10.

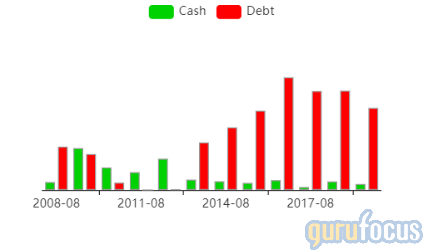

The cash-debt ratio of 0.19 is below 80.07% of competitors, while the Altman Z-Score of 1.87 suggests that the company may be in slight danger of bankruptcy. However, the current ratio of 1.87 indicates short-term financial stability.

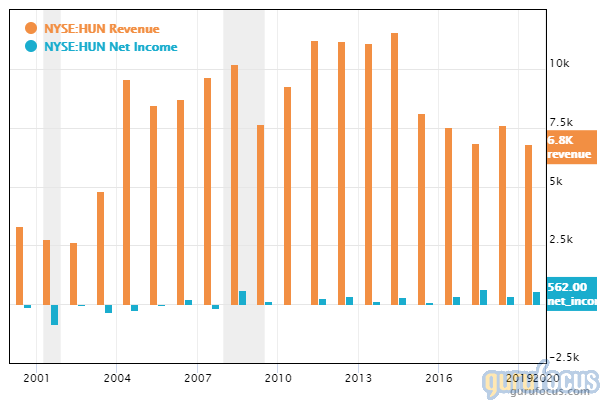

The operating margin of 6.72% is average for the industry, as is the return on capital of 13.51%. Revenue has dropped in recent years, though net income has remained around a similar range.

The price-earnings ratio of 6.08 and price-sales ratio of 0.45 indicate that this stock could be a value opportunity, as does the Peter Lynch chart below.

MSC Industrial Direct

The fund purchased 693,055 shares of MSC Industrial Direct, which had a 0.82% impact on the equity portfolio. During the quarter, shares traded for an average price of $66.31.

MSC Industrial Direct is one of the largest industrial equipment companies in the world. Based in Melville, New York, the company's products include hand and power tools, pneumatics, hydraulics, janitorial supplies, heat stress equipment, safety gear, emergency preparedness supplies and more.

On April 16, shares of MSC Industrial Direct traded around $58.66 for a market cap of $3.26 billion and a price-earnings ratio of 12.19. GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rating of 8 out of 10 and a valuation rating of 8 out of 10.

MSC's cash-debt ratio of 0.06 is lower than 84.56% of competitors, though its Altman Z-Score of 4.35 and current ratio of 1.75 suggest that the company is not in danger of bankruptcy. The company has managed to reduce its debt slightly over the past few years.

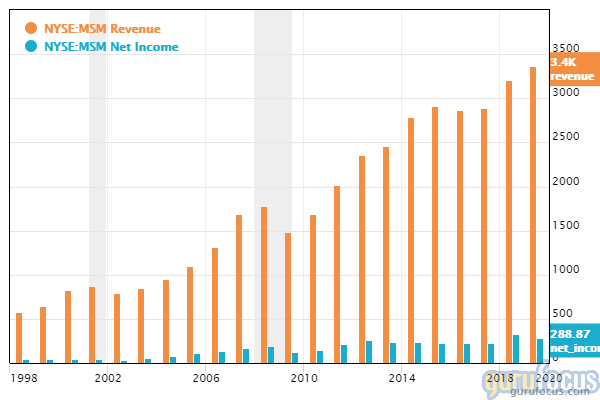

With an operating margin of 11.12% and a net margin of 8.05%, MSC ranks higher than 84.97% of its competitors in terms of profitability. The company has grown its top and bottom lines steadily over the years, except for the years immediately following recessions.

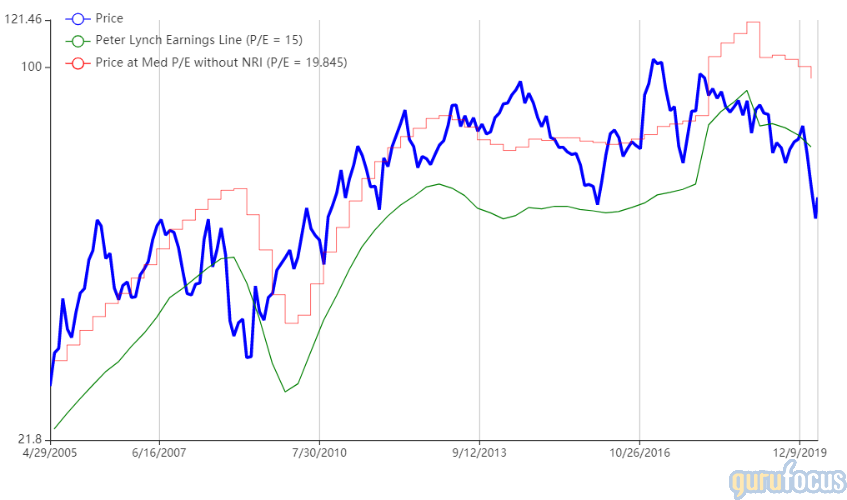

The price-earnings ratio of 12.19 and price-sales ratio of 0.98 indicate a potential value opportunity, though these metrics are higher than the industry median. The Peter Lynch chart suggests that the stock is trading below its intrinsic value.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

Top 1st-Quarter Buys of the T Rowe Price Equity Income Fund

Investing in Turbulent Real Estate Stocks

Top 1st-Quarter Buys of Jerome Dodson's Parnassus Fund

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance