Xtep International Holdings And Two Other Undervalued Small Caps With Insider Action In Hong Kong

In Hong Kong, the Hang Seng Index saw a modest gain of 0.46% during a holiday-shortened week, reflecting cautious optimism in a mixed economic environment marked by underwhelming manufacturing data and ongoing property market challenges. This backdrop sets an intriguing stage for investors to explore undervalued small-cap stocks that may offer potential growth opportunities amidst broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

China Overseas Grand Oceans Group | 2.7x | 0.1x | 2.85% | ★★★★★☆ |

Wasion Holdings | 11.6x | 0.8x | 31.39% | ★★★★☆☆ |

Xtep International Holdings | 11.4x | 0.8x | 41.12% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 7.9x | 0.7x | -23.01% | ★★★★☆☆ |

Ever Sunshine Services Group | 5.8x | 0.4x | 15.78% | ★★★★☆☆ |

China Leon Inspection Holding | 9.4x | 0.7x | 30.64% | ★★★★☆☆ |

Kinetic Development Group | 3.9x | 1.7x | 20.88% | ★★★★☆☆ |

Nissin Foods | 14.6x | 1.3x | 40.40% | ★★★★☆☆ |

Transport International Holdings | 11.6x | 0.6x | 44.35% | ★★★★☆☆ |

Giordano International | 8.4x | 0.8x | 37.68% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

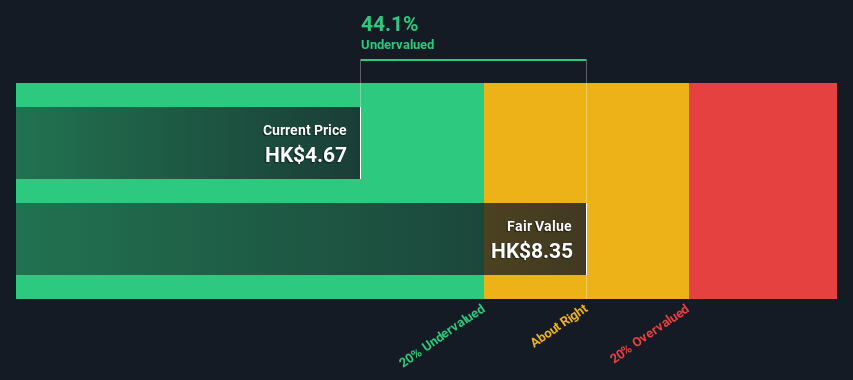

Xtep International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xtep International Holdings is a sportswear company that operates in mass market, fashion sports, and professional sports segments with a market capitalization of approximately CN¥7.64 billion.

Operations: The company generates its revenue primarily through three segments: Mass Market, Fashion Sports, and Professional Sports, with the Mass Market segment contributing significantly with CN¥11.95 billion. Over recent periods, it has experienced a gross profit margin of approximately 42.17%, indicating the cost-effectiveness of its operations relative to sales.

PE: 11.4x

Recently, Xtep International Holdings demonstrated strong insider confidence with a significant purchase by Shui Po Ding, who acquired 2 million shares for HK$14.15 million. This move underscores belief in the company's value amidst its positive retail growth projections of 10% year-on-year for the next quarter and high single digits for the half-year period. Despite operational shifts and executive changes enhancing focus on financial strategy, Xtep maintains commitment to shareholder returns, evidenced by a recent dividend increase to HK$0.08 per share.

K. Wah International Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: K. Wah International Holdings is a diversified company primarily engaged in property development in Hong Kong and Mainland China, as well as property investment, with a market capitalization of approximately HK$7.36 billion.

Operations: The company generates significant income from property development, particularly in Mainland China which contributed HK$4.45 billion to revenues, alongside notable contributions from Hong Kong property development and investment properties. Over recent periods, it has experienced a gross profit margin ranging around 30% to 60%, reflecting varying profitability across different reporting dates.

PE: 6.8x

K. Wah International Holdings, a notable player in the Hong Kong market, recently saw insider Mo Chi Cheng purchase 200,000 shares, signaling strong confidence in the company's prospects. This move aligns with K. Wah’s financial strategy amidst its earnings forecast of an 8.63% annual growth rate and reliance on higher-risk external borrowing for funding. Despite a reduction in dividends announced on June 26, 2024, to HK$0.09 per share with a scrip option effective July 24, Cheng's investment highlights potential unrecognized value within this enterprise.

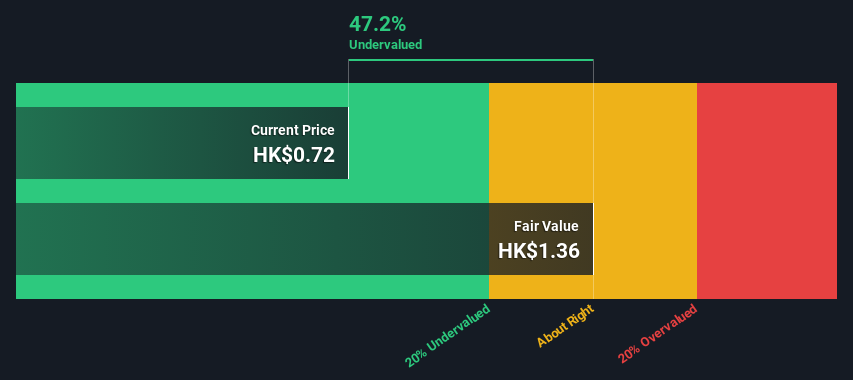

Comba Telecom Systems Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings specializes in wireless telecommunications network system equipment and services, primarily serving operator telecommunication services with a market cap of approximately HK$1.48 billion.

Operations: The business generates a significant portion of its revenue from wireless telecommunications network system equipment and services, amounting to HK$5.82 billion, compared to HK$157.83 million from operator telecommunication services. Over recent periods, it has experienced a gross profit margin of approximately 27.79%, reflecting the cost efficiency relative to its revenue generation in the highly competitive telecom sector.

PE: 315.8x

Recently, Comba Telecom Systems Holdings demonstrated insider confidence as Executive Chairman Tung Ling Fok invested US$930,371 in the company by acquiring 1.83 million shares. This move underscores a strong belief in the company's prospects despite its modest profit margins of 0.1%, down from last year’s 3%. At a recent conference in Shanghai, leadership highlighted strategic initiatives likely to enhance shareholder value. With no customer deposits and all liabilities funded through external borrowing, financial agility remains central to their strategy.

Turning Ideas Into Actions

Gain an insight into the universe of 19 Undervalued SEHK Small Caps With Insider Buying by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1368 SEHK:173 and SEHK:2342.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance