XPO Inc Reports First Quarter 2024 Earnings: Performance Analysis and Comparison with Analyst ...

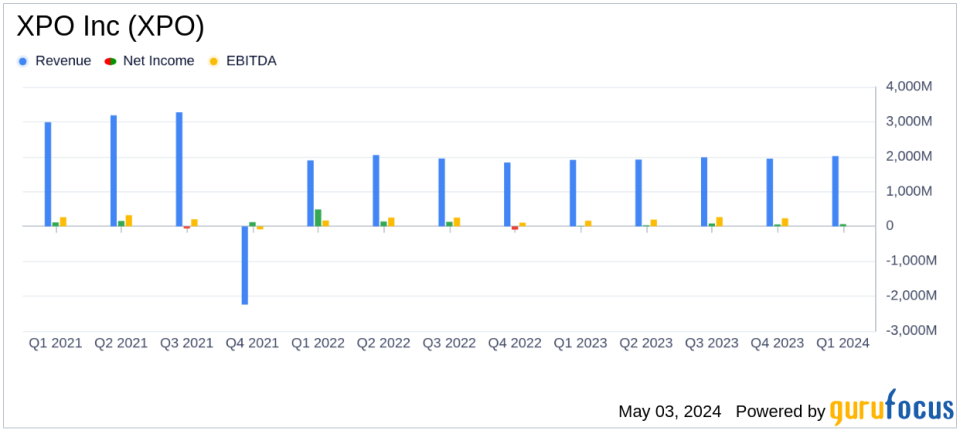

Revenue: Reached $2.02 billion, marking a 5.8% increase from the previous year's $1.91 billion, slightly exceeding the estimated $2.006 billion.

Net Income: Reported at $67 million from continuing operations, significantly up from $17 million the previous year, falling short of the estimated $78.72 million.

Diluted EPS: Recorded at $0.56, up from $0.15 year-over-year, falling short of the estimated $0.67.

Adjusted EBITDA: Increased to $288 million, up 37.1% from $210 million in the previous year.

Operating Income: Grew substantially to $138 million, a 137.9% increase from $58 million in the prior year.

Adjusted Operating Income: For the North American Less-Than-Truckload segment increased by 49.6% to $175 million.

Cash Flow: Generated $145 million from operating activities, ending the quarter with $229 million in cash and cash equivalents after $299 million in net capital expenditures.

XPO Inc (NYSE:XPO) released its 8-K filing on May 3, 2024, unveiling its financial results for the first quarter of 2024. The company reported a diluted earnings per share (EPS) from continuing operations of $0.56, a significant increase from $0.15 in the same period last year. Adjusted diluted EPS also rose to $0.81 from $0.56 year-over-year. However, these figures fell short of analyst expectations, which estimated an EPS of $0.67.

Following the strategic divestitures of its logistics and freight brokerage operations, XPO is honing its focus on its core asset-based less-than-truckload (LTL) shipping, which now constitutes 60% of its revenue, with European operations making up the remainder. This shift is part of XPO's broader strategy to enhance operational efficiency and shareholder value.

Quarterly Financial Performance

For Q1 2024, XPO's revenue was $2.02 billion, marking a 5.8% increase from $1.91 billion in the previous year. This growth was primarily driven by a robust performance in the North American LTL segment, which saw a 9.0% increase in revenue to $1.221 billion. The segment's operating income surged by 60.2% to $165 million, reflecting efficient execution of the company's LTL 2.0 strategy, which focuses on yield growth and operational enhancements.

Despite these gains, the European Transportation segment experienced modest growth, with revenue up only 1.3% to $797 million. The segment faced challenges, including a slight decline in adjusted operating income.

XPO's net income from continuing operations dramatically increased to $67 million, up from $17 million in Q1 2023, a 294.1% rise. This improvement was underpinned by enhanced operational efficiencies and cost management strategies.

Operational Highlights and Future Outlook

Mario Harik, CEO of XPO, highlighted the success of the LTL 2.0 plan, noting significant improvements in key financial and operational metrics. The company reported a 390-basis-point improvement in the adjusted operating ratio for the North American LTL segment to 85.7%, supported by a 9.8% growth in yield excluding fuel and a 4.7% increase in shipments per day.

Looking ahead, XPO is focused on continuous improvement and is still in the early stages of realizing the full potential of its strategic initiatives. The company remains committed to providing superior service and leveraging its technology-driven solutions to lead the LTL market.

Challenges and Strategic Moves

While XPO is making significant strides in its core operations, the company faces ongoing challenges, including fluctuating fuel prices and the complexities of international logistics. Additionally, the divestiture of its European trucking division remains a critical strategic focus, as the company seeks to streamline operations and concentrate on its most profitable segments.

In conclusion, XPO Inc's first quarter of 2024 demonstrated strong financial and operational performance, although earnings per share fell short of analyst expectations. With strategic initiatives firmly in place, XPO is well-positioned to build on its current successes and navigate future challenges in the dynamic transportation industry.

Explore the complete 8-K earnings release (here) from XPO Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance