Xcel Energy (XEL) to Report Q4 Earnings: What's in Offing?

Xcel Energy Inc. XEL is scheduled to release fourth-quarter 2021 earnings on Jan 27 before the market opens. The company delivered a negative earnings surprise of 5.04% in the last reported quarter.

Let’s see how things have shaped up before the upcoming earnings announcement.

Factors to Note

An expanding customer base and approval for a hike in North Dakota electric rates and interim natural gas rate hikes are likely to boost revenues in the fourth quarter.

Fourth-quarter results are likely to have been impacted by an increase in operating expenses.

Expectation

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at 56 cents per share, indicating a 3.70% rise from the year-ago reported figure.

The Zacks Consensus Estimate for fourth-quarter sales is pegged at $3.14 billion, suggesting growth of 6.43% from the year-ago reported figure.

What the Quantitative Model Predicts

Our proven model predictsan earnings beat for Xcel Energy Inc. this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here as you will see below.

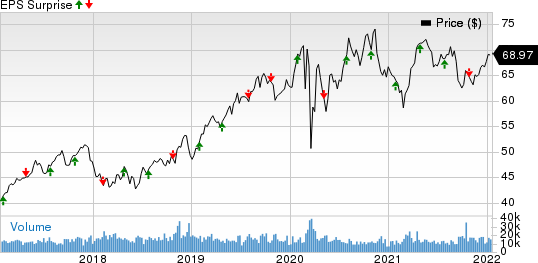

Xcel Energy Inc. Price and EPS Surprise

Xcel Energy Inc. price-eps-surprise | Xcel Energy Inc. Quote

Earnings ESP: Xcel Energy Inc. has an Earnings ESP of +0.45%.You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Zacks Rank: Currently, XEL carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to Consider

Investors can also consider the following players from the same industry who have the right combination of elements to beat earnings in the upcoming releases.

Brookfield Renewable Partners LP BEP is likely to come up withan earnings beat when it reports fourth-quarter results on Feb 4 before the market opens. Brookfield Renewable Partners LP has an Earnings ESP of +984.62% and a Zacks Rank of #3 at present.The Zacks Consensus Estimate for BEP’s 2022 earnings per share (EPS) has gained 114.74% year over year.

Dominion Energy Inc. D is likely to come up withanearnings beat when it reports fourth-quarter results on Feb 11 before the market opens. Dominion Energy Inc. has an Earnings ESP of +1.44% and a Zacks Rank of #3 at present. The Zacks Consensus Estimate for Dominion Energy Inc.’s 2022 EPS has gained 6.79% year over year.

The Southern Company SO is likely to come up withan earnings beat when it reports fourth-quarter results on Feb 17 before the market opens. The Southern Company has an Earnings ESP of +4.35% and a Zacks Rank of #3 at present. The Zacks Consensus Estimate for SO’s 2022 EPS has gained 4.68% year over year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Southern Company The (SO) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Brookfield Renewable Partners L.P. (BEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance