WW (NASDAQ:WW) Surprises With Q1 Sales

Personal wellness company WW (NASDAQ:WW) reported Q1 CY2024 results topping analysts' expectations , with revenue down 14.6% year on year to $206.5 million. The company expects the full year's revenue to be around $845 million, in line with analysts' estimates. It made a GAAP loss of $4.39 per share, down from its loss of $1.68 per share in the same quarter last year.

Is now the time to buy WW? Find out in our full research report.

WW (WW) Q1 CY2024 Highlights:

Revenue: $206.5 million vs analyst estimates of $199.4 million (3.6% beat)

EPS: -$4.39 vs analyst estimates of -$0.55 (-$3.84 miss due to a one-time franchise rights acquired impairment charge of $258 million)

The company reconfirmed its revenue guidance for the full year of $845 million at the midpoint

The company lowered its operating profit for the full year of a $159 million LOSS at the midpoint

Gross Margin (GAAP): 66.7%, up from 57.1% in the same quarter last year

Free Cash Flow was -$40.84 million, down from $7.50 million in the previous quarter

Members: 3.3 million

Market Capitalization: $144.9 million

“We delivered solid performance in the first quarter with end of period subscribers of 4.0 million, improved retention and engagement in our core business, and continued strong growth in our clinical business with 91 thousand end of period clinical subscribers,” said Sima Sistani, the Company’s CEO.

Formerly known as Weight Watchers, WW (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

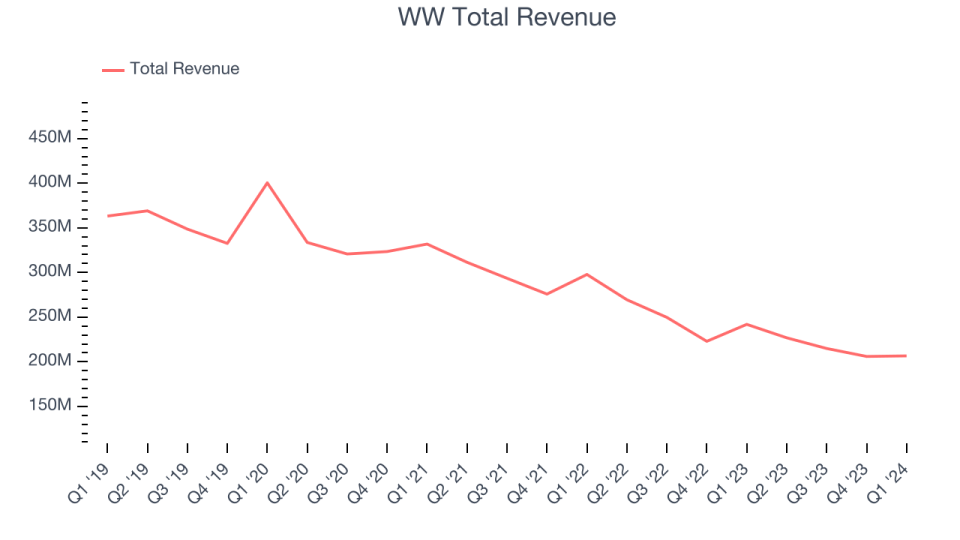

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. WW's revenue declined over the last five years, dropping 10.3% annually.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. WW's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 14.9% over the last two years.

This quarter, WW's revenue fell 14.6% year on year to $206.5 million but beat Wall Street's estimates by 3.6%. Looking ahead, Wall Street expects sales to grow 1.8% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

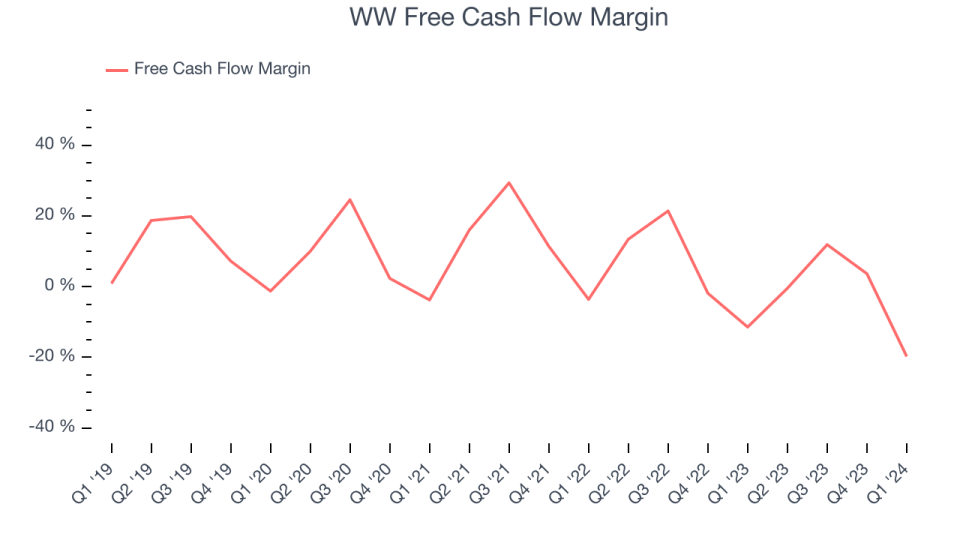

Over the last two years, WW has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.7%, subpar for a consumer discretionary business.

WW burned through $40.84 million of cash in Q1, equivalent to a negative 19.8% margin, reducing its cash burn by 47.4% year on year.

Key Takeaways from WW's Q1 Results

It was good to see WW beat analysts' revenue expectations this quarter. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates, but this was due to a one-time franchise rights acquired impairment charge of $258 million. The stock is up 2.1% after reporting and currently trades at $1.93 per share.

So should you invest in WW right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance