Should You Worry About TransCanada Corporation’s (TSE:TRP) CEO Pay Cheque?

Russ Girling became the CEO of TransCanada Corporation (TSE:TRP) in 2010. First, this article will compare CEO compensation with compensation at other large companies. Next, we’ll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for TransCanada

How Does Russ Girling’s Compensation Compare With Similar Sized Companies?

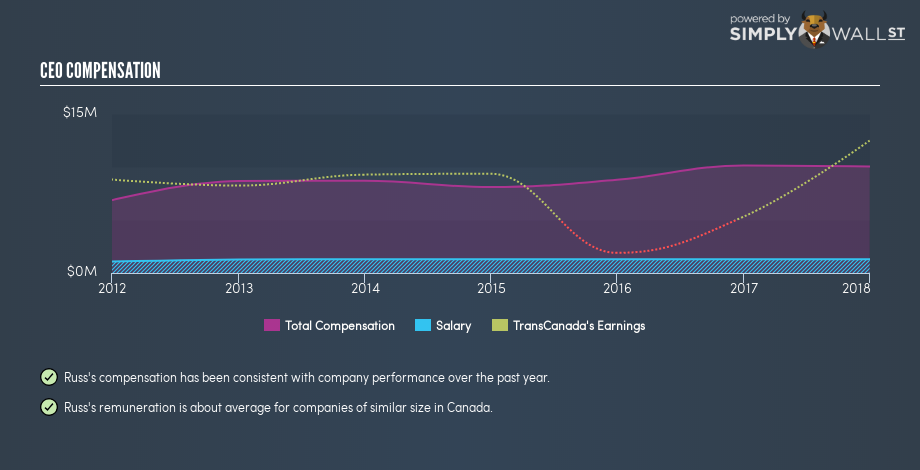

According to our data, TransCanada Corporation has a market capitalization of CA$51b, and pays its CEO total annual compensation worth CA$10m. (This is based on the year to 2017). While we always look at total compensation first, we note that the salary component is less, at CA$1.3m. When we examined a group of companies with market caps over CA$11b, we found that their median CEO compensation was CA$9.2m. There aren’t very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

So Russ Girling receives a similar amount to the median CEO pay, amongst the companies we looked at. While this data point isn’t particularly informative alone, it gains more meaning when considered with business performance.

You can see, below, how CEO compensation at TransCanada has changed over time.

Is TransCanada Corporation Growing?

On average over the last three years, TransCanada Corporation has grown earnings per share (EPS) by 82% each year. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. Revenue growth is a real positive for growth, but ultimately profits are more important.

Shareholders might be interested in this free visualization of analyst forecasts. .

Has TransCanada Corporation Been A Good Investment?

Boasting a total shareholder return of 43% over three years, TransCanada Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary…

Russ Girling is paid around what is normal the leaders of larger companies.

Few would be critical of the leadership, since returns have been juicy and earnings per share are moving in the right direction. So one could argue the CEO compensation is quite modest, if you consider company performance! If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at TransCanada.

Or you might prefer this data-rich interactive visualization of historic revenue and earnings.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance