Worried Bitcoin Is Overvalued? Here’s Why You Shouldn’t Be

More than a decade after its initial launch, Bitcoin continues to be a controversial topic. The revolutionary cryptocurrency continues to draw skepticism from several high-profile investors, yet it also continues to make many investors rich.

Bitcoin has always been considered a high-risk, high-reward investment. But for many, over the last year specifically, an investment in Bitcoin no longer seems like an impossibility.

Before investing in the cryptocurrency, the first thing to consider is volatility. Bitcoin regularly gains or loses more than 10% of its value in a single day. So it’s crucial you decide if you can handle the volatility as a prerequisite to an investment in the cryptocurrency space.

Bitcoin is a long-term investment

If you decided to go ahead and invest, you’ll also want to make sure you’re buying Bitcoin as a long-term investment. The volatility I just mentioned makes Bitcoin extremely difficult to trade.

So if you’re buying it in hopes it will rise in the short-term, that’s a bad investment strategy, and there’s a lot less potential of it working out.

Another problem investors have is the fear it’s a bubble, especially with the recent run-up in price the last two months. This is understandable. After all, Bitcoin just recently hit a new all-time high, then promptly gained another 100%. However, the revolutionary cryptocurrency has a tonne of potential and has been called a bubble many times before.

These days, the macroeconomic environment is much more accommodating for alternative assets as well. So with an investment that’s not as speculative, well-known investors as well as companies jumping on the bandwagon and investors desperately needing diversification from equities, Bitcoin is a very attractive option.

Furthermore, by taking a long-term position, investors can mitigate the risk of a pullback in the short term. Investors who speculated in Bitcoin during 2017 would have lost a tonne of money.

However, if you had decided to make a long-term investment and unfortunately bought at the very top, even though the timing couldn’t have been worse, by holding the investment for the long-term, you still would have made an incredible 60% return.

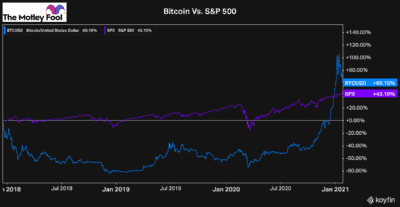

This chart starts at the very top of the 2017 “bubble.” You can see that over the last three years, Bitcoin has traded down significantly. However, it’s also clear that you would have made a more than 60% return if you held this entire time. That’s more than you could have made investing in the broader market.

That’s why, with an asset as volatile as Bitcoin, taking a long-term position is crucial to reduce risk.

How to gain exposure to Bitcoin

In the past, investors have had undergo the convoluted process of buying Bitcoin on unregulated exchanges where there is a tonne of risk that you can screw up the process and lose all your money as a result.

Today it’s much easier to gain exposure to Bitcoin. There are a variety of stocks you can buy in the cryptocurrency space. However, one of the most popular choices is just to buy a fund that holds the Bitcoin. That’s why The Bitcoin Fund has exploded in popularity the last few months.

Bottom line

There’s no question Bitcoin is a highly volatile and risky asset. It’s also a revolutionary concept with major growth potential for investors.

So whatever you decide, if you’re making an investment, it’s crucial you make a long-term commitment.

The post Worried Bitcoin Is Overvalued? Here’s Why You Shouldn’t Be appeared first on The Motley Fool Canada.

More reading

Fool contributor Daniel Da Costa has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2021

Yahoo Finance

Yahoo Finance