Workiva Inc (WK) Q1 2024 Earnings: Surpasses Revenue Expectations with Robust Growth

Revenue: Reported $176 million in Q1 2024, up 17% year-over-year, surpassing estimates of $174.08 million.

Net Loss: GAAP net loss of $12 million in Q1 2024, significantly improved from a loss of $46 million in Q1 2023.

Earnings Per Share: Non-GAAP net income per diluted share was $0.22, exceeding the estimated $0.17.

Gross Margin: Non-GAAP gross margin increased to 77.7% in Q1 2024 from 75.5% in Q1 2023.

Customer Growth: Ended Q1 2024 with 6,074 customers, a net increase of 320 from Q1 2023.

Large Contracts: 34% year-over-year increase in customers with an annual contract value over $300K, totaling 332 at the end of Q1 2024.

Liquidity: Cash, cash equivalents, and marketable securities totaled $838 million as of March 31, 2024.

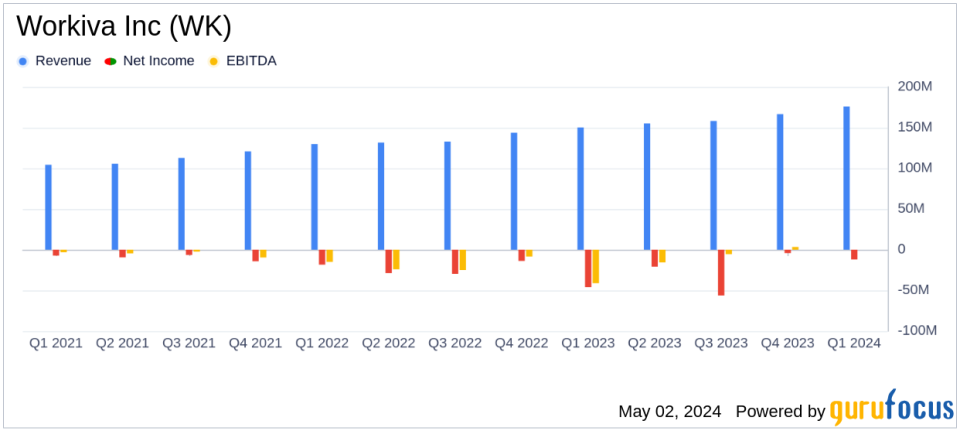

On May 2, 2024, Workiva Inc (NYSE:WK) released its 8-K filing, announcing the financial results for the first quarter ended March 31, 2024. The company reported a significant year-over-year revenue increase, surpassing analyst expectations with a total revenue of $176 million against the estimated $174.08 million. This represents a 17% increase from the $150 million reported in the first quarter of 2023.

Company Overview

Workiva Inc, a leader in cloud-based reporting solutions, continues to empower organizations worldwide by simplifying complex reporting and compliance through its innovative platform. The platform integrates data from various systems enabling consistent, accurate, and productive financial and compliance reporting. Serving over 6,000 organizations globally, Workiva's solutions address some of the most challenging aspects of reporting and disclosure.

Financial Performance Highlights

The first quarter saw Workiva achieving a gross profit of $134 million, reflecting a gross margin improvement to 76.4% from 74.3% in Q1 2023. Subscription and support revenue was particularly strong, amounting to $155 million, a 20% increase year-over-year. This growth is attributed to the increased adoption of Workiva's multi-solution offerings, with significant contributions from larger customer contracts.

Despite these gains, Workiva reported a GAAP net loss of $12 million, an improvement from the $46 million net loss in the prior year's first quarter. The non-GAAP net income stood at $13 million, a significant turnaround from a non-GAAP net loss of $7 million in Q1 2023. These figures highlight Workiva's ongoing efforts to optimize its operational efficiency and cost management.

Operational and Strategic Developments

Workiva's operational success is evident in its expanding customer base, now standing at 6,074, marking a net increase of 320 customers from the previous year. The company also reported a robust revenue retention rate of 111%, including add-on revenue, which underscores the high value and stickiness of Workiva's offerings. Notably, the number of customers with an annual contract value over $300,000 grew by 34%, totaling 332.

Future Financial Outlook

Looking ahead, Workiva provided guidance for Q2 2024, expecting total revenue to be between $174 million and $176 million. The company anticipates a GAAP loss from operations ranging from $24 million to $22 million and a non-GAAP income from operations between $2 million and $4 million. For the full year, Workiva forecasts total revenue to be in the range of $719 million to $723 million, with a non-GAAP net income per basic share projected between $0.96 and $1.03.

Conclusion and Analyst Perspective

Workiva's first-quarter results demonstrate robust growth and operational improvements, positioning the company well for sustained success. The company's focus on expanding its high-value contracts and enhancing platform capabilities continues to resonate well with its growing customer base. As Workiva progresses through 2024, investors and stakeholders will likely keep a close watch on its ability to maintain momentum and capitalize on its strategic initiatives.

For detailed financial figures and future projections, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Workiva Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance