Workday's (NASDAQ:WDAY) Q1: Beats On Revenue But Stock Drops

Finance and HR software company Workday (NASDAQ:WDAY) reported Q1 CY2024 results topping analysts' expectations , with revenue up 18.1% year on year to $1.99 billion. It made a non-GAAP profit of $1.74 per share, improving from its profit of $1.31 per share in the same quarter last year.

Is now the time to buy Workday? Find out in our full research report.

Workday (WDAY) Q1 CY2024 Highlights:

Revenue: $1.99 billion vs analyst estimates of $1.97 billion (small beat)

EPS (non-GAAP): $1.74 vs analyst estimates of $1.58 (10.1% beat)

Full year 2025 subscription revenue guidance: $7.71 billion vs analyst estimates of $7.77 billion (small miss) (next quarter's subscription revenue guidance also slightly below)

Gross Margin (GAAP): 75.4%, in line with the same quarter last year

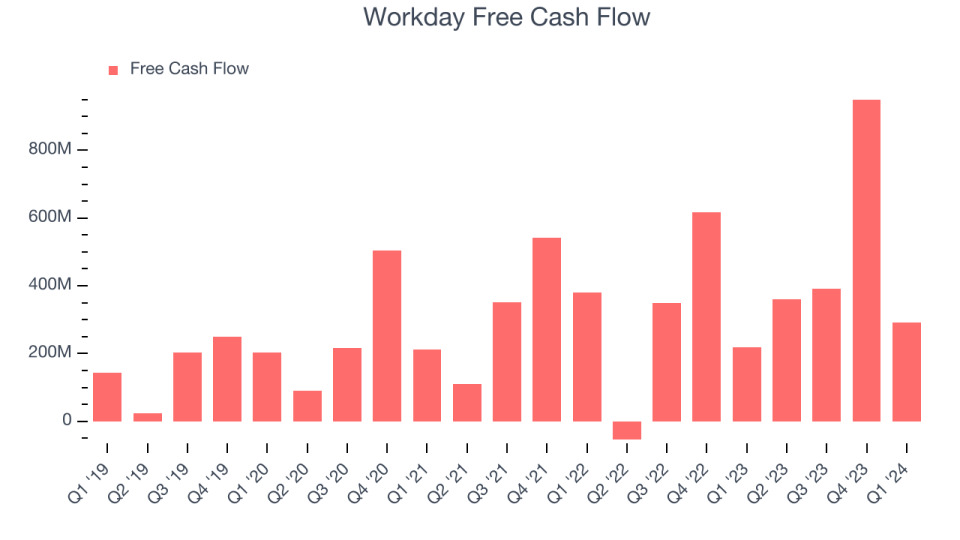

Free Cash Flow of $291 million, down 69.4% from the previous quarter

Market Capitalization: $68.94 billion

"Q1 was another solid quarter of revenue growth and non-GAAP operating margin expansion for Workday, as we drive toward long-term, durable growth," said Workday CEO Carl Eschenbach.

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

Sales Growth

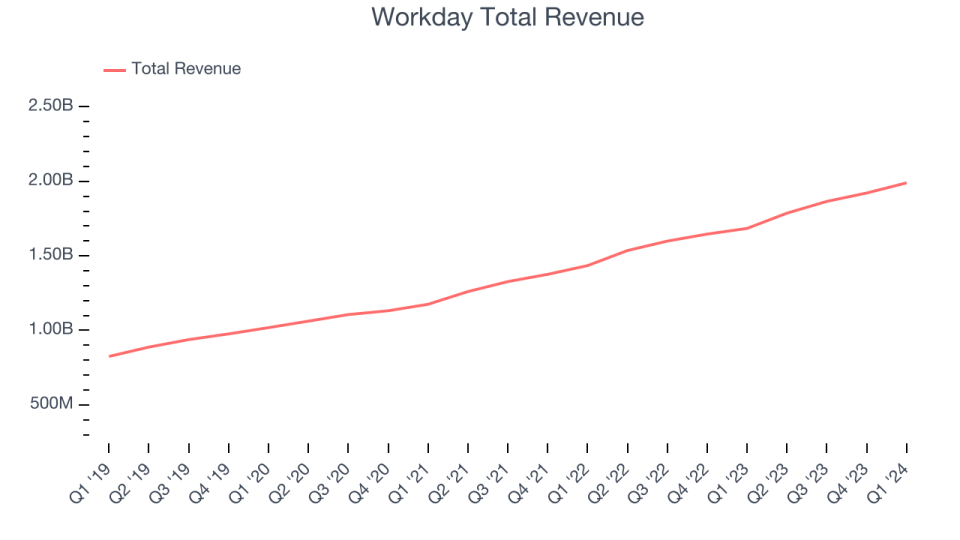

As you can see below, Workday's revenue growth has been solid over the last three years, growing from $1.18 billion in Q1 2022 to $1.99 billion this quarter.

This quarter, Workday's quarterly revenue was once again up 18.1% year on year. We can see that Workday's revenue increased by $68 million quarter on quarter, which is a solid improvement from the $56.33 million increase in Q4 CY2023. Shareholders should applaud the acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 15.2% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Workday's free cash flow came in at $291 million in Q1, up 33.4% year on year.

Workday has generated $1.99 billion in free cash flow over the last 12 months, an eye-popping 26.4% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Workday's Q1 Results

We struggled to find many strong positives in these results. Its billings unfortunately missed analysts' expectations. Subscription revenue guidance for next quarter and the full year also came in slightly below expectations. Overall, this was a mediocre quarter for Workday. The company is down 6.6% on the results and currently trades at $243.94 per share.

Workday may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance