Wish You Were Here: How Theratechnologies (TSE:TH) Shareholders Made A Stonking Gain Of 1270%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It might be of some concern to shareholders to see the Theratechnologies Inc. (TSE:TH) share price down 15% in the last month. But that does not change the realty that the stock's performance has been terrific, over five years. In fact, during that period, the share price climbed 1270%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. But the real question is whether the business fundamentals can improve over the long term.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Theratechnologies

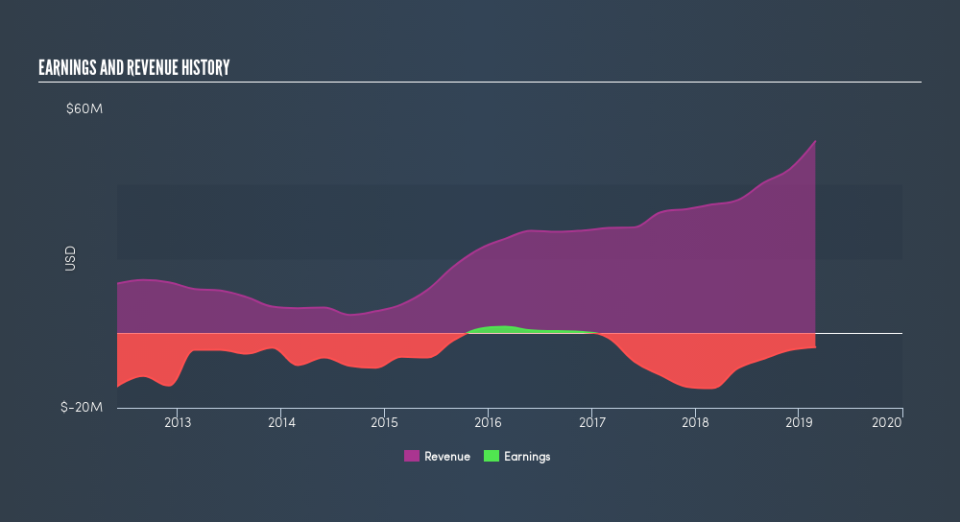

Because Theratechnologies is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Theratechnologies can boast revenue growth at a rate of 34% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 69% per year in that time. Despite the strong run, top performers like Theratechnologies have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Theratechnologies

A Different Perspective

While the broader market gained around 3.1% in the last year, Theratechnologies shareholders lost 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 69% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance