Winners And Losers Of Q1: YETI (NYSE:YETI) Vs The Rest Of The Leisure Products Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at leisure products stocks, starting with YETI (NYSE:YETI).

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 16 leisure products stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 4.3%. while next quarter's revenue guidance was 3.5% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the leisure products stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.5% on average since the previous earnings results.

YETI (NYSE:YETI)

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

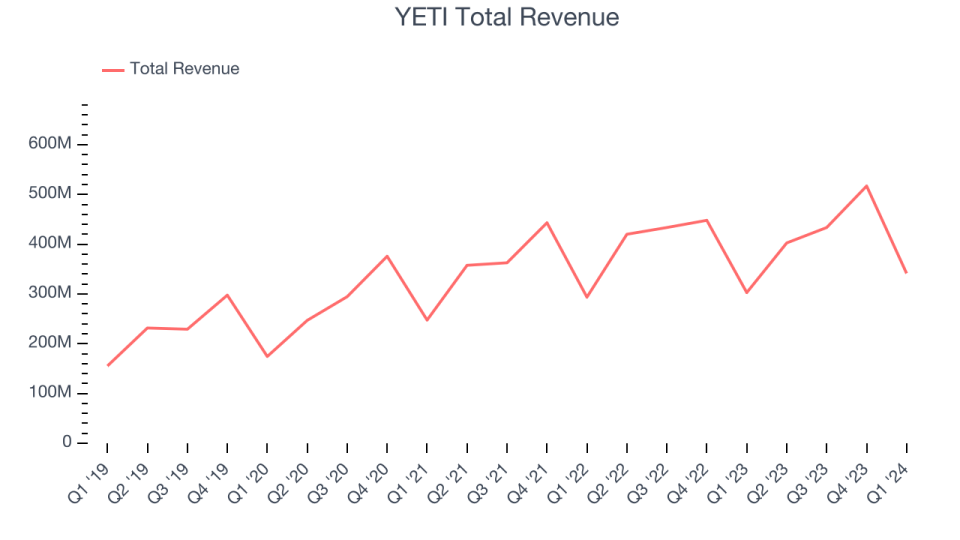

YETI reported revenues of $341.4 million, up 12.7% year on year, topping analysts' expectations by 2.4%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and strong earnings guidance for the full year.

Matt Reintjes, President and Chief Executive Officer, commented, “First quarter results were highlighted by balanced, double-digit growth across both our wholesale and direct-to-consumer channels, as well as our Drinkware and Coolers & Equipment categories. This performance was punctuated by our international sales mix reaching a record 19% coupled with re-acceleration in domestic growth. Profitability continued to show strength with both adjusted gross margin and adjusted operating margin expanding nearly 450 basis points during the period. Additionally, we completed our previously announced acquisitions, and entered into a $100 million accelerated share repurchase agreement.”

YETI scored the fastest revenue growth of the whole group. The stock is up 9% since the results and currently trades at $38.

Is now the time to buy YETI? Access our full analysis of the earnings results here, it's free.

Best Q1: Smith & Wesson (NASDAQ:SWBI)

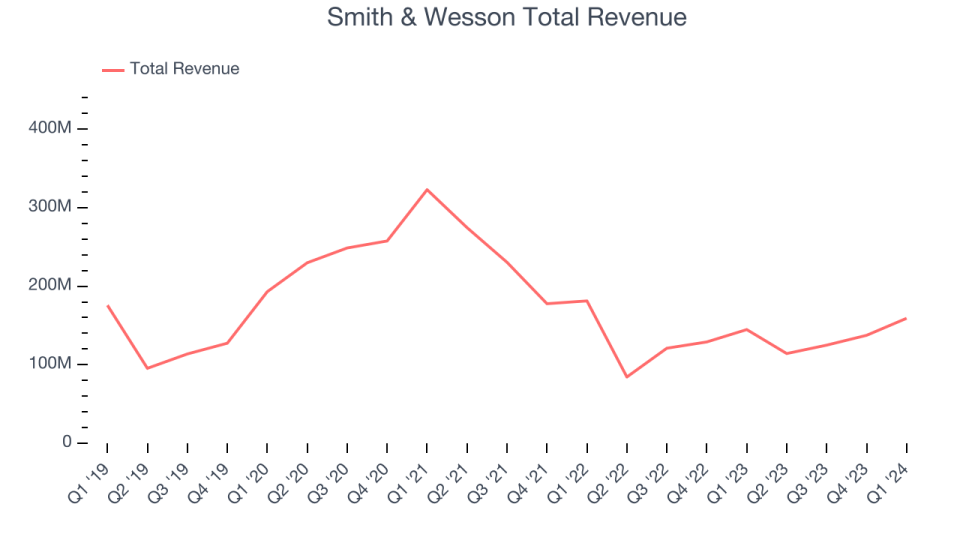

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $159.1 million, up 9.9% year on year, outperforming analysts' expectations by 1.5%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and a solid beat of analysts' operating margin estimates.

The stock is down 12.1% since the results and currently trades at $14.42.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Ruger (NYSE:RGR)

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $136.8 million, down 8.5% year on year, falling short of analysts' expectations by 10.8%. It was a weak quarter for the company: Its revenue, operating margin, and EPS fell short of Wall Street's estimates.

Ruger had the weakest performance against analyst estimates in the group. The stock is down 9.3% since the results and currently trades at $42.05.

Read our full analysis of Ruger's results here.

Polaris (NYSE:PII)

Founded in 1954, Polaris (NYSE:PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

Polaris reported revenues of $1.76 billion, down 19.9% year on year, in line with analysts' expectations. It was a mixed quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 11.2% since the results and currently trades at $78.31.

Read our full, actionable report on Polaris here, it's free.

Solo Brands (NYSE:DTC)

Started through a Kickstarter campaign, Solo Brands (NYSE:DTC) is a provider of outdoor and recreational products.

Solo Brands reported revenues of $85.32 million, down 3.3% year on year, surpassing analysts' expectations by 9.4%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and full-year revenue guidance beating analysts' expectations.

The stock is up 15.7% since the results and currently trades at $2.28.

Read our full, actionable report on Solo Brands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance