Winners And Losers Of Q1: Bumble (NASDAQ:BMBL) Vs The Rest Of The Consumer Subscription Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at consumer subscription stocks, starting with Bumble (NASDAQ:BMBL).

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 0.9%. while next quarter's revenue guidance was 2.8% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and consumer subscription stocks have had a rough stretch, with share prices down 16.6% on average since the previous earnings results.

Bumble (NASDAQ:BMBL)

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

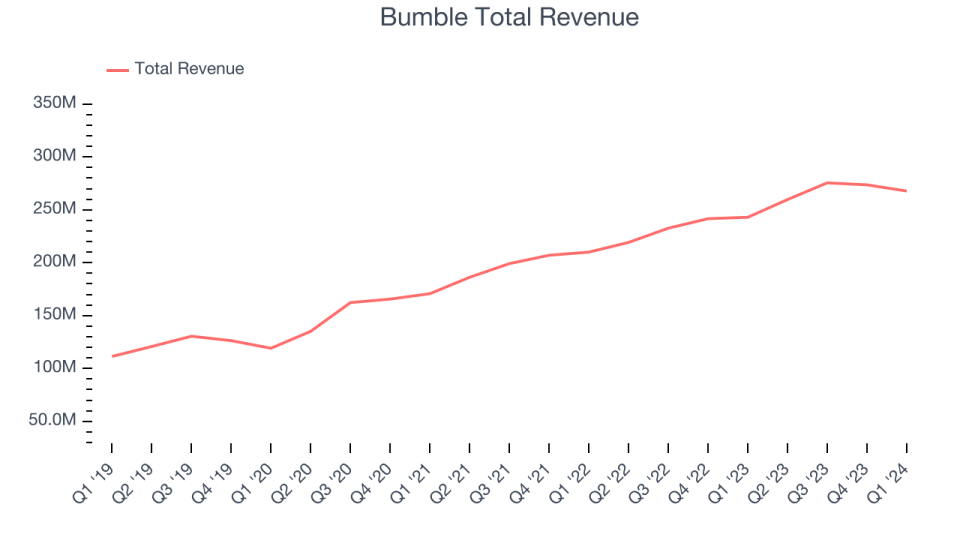

Bumble reported revenues of $267.8 million, up 10.2% year on year, in line with analysts' expectations. It was a weaker quarter for the company with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is down 6.1% since reporting and currently trades at $9.62.

Is now the time to buy Bumble? Access our full analysis of the earnings results here, it's free.

Best Q1: Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

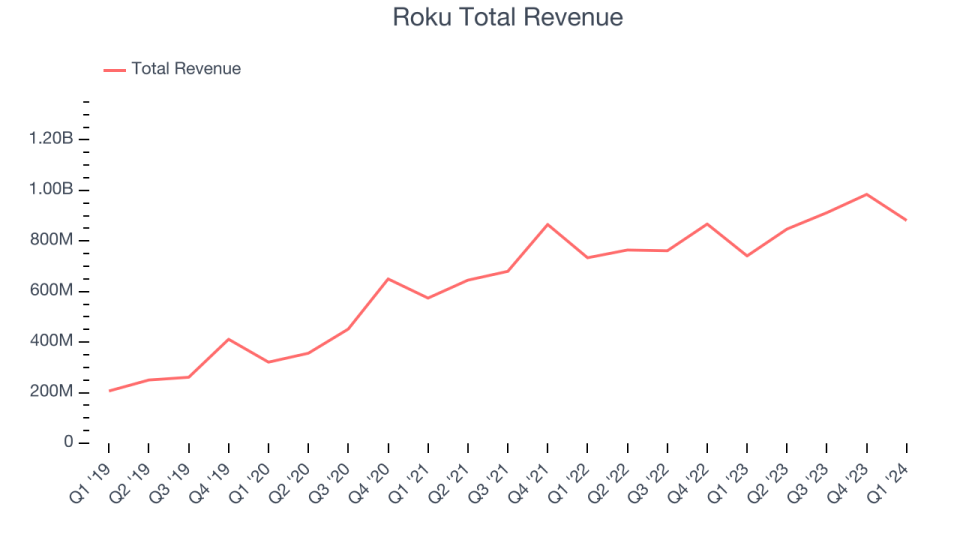

Roku reported revenues of $881.5 million, up 19% year on year, outperforming analysts' expectations by 3.7%. It was a decent quarter for the company with strong growth in its users but slow revenue growth.

Roku pulled off the biggest analyst estimates beat among its peers. The company reported 81.6 million monthly active users, up 14% year on year. The stock is flat since reporting and currently trades at $63.3.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Chegg (NYSE:CHGG)

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $174.4 million, down 7.1% year on year, in line with analysts' expectations. It was a weak quarter for the company with a decline in its users and slow revenue growth.

Chegg posted the slowest revenue growth in the group. The company reported 4.7 million users, down 7.8% year on year. As expected, the stock is down 61% since the results and currently trades at $2.8.

Read our full analysis of Chegg's results here.

Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $167.6 million, up 44.9% year on year, surpassing analysts' expectations by 1.1%. Looking more broadly, it was an ok quarter for the company with exceptional revenue growth.

Duolingo pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 23.7% since reporting and currently trades at $186.77.

Read our full, actionable report on Duolingo here, it's free.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $9.37 billion, up 14.8% year on year, in line with analysts' expectations. Looking more broadly, it was a mixed quarter for the company with strong growth in its users but underwhelming revenue guidance for the next quarter.

The company reported 269.6 million users, up 16% year on year. The stock is up 12.4% since reporting and currently trades at $686.3.

Read our full, actionable report on Netflix here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance