William Penn Bancorporation (NASDAQ:WMPN) Will Pay A Dividend Of $0.03

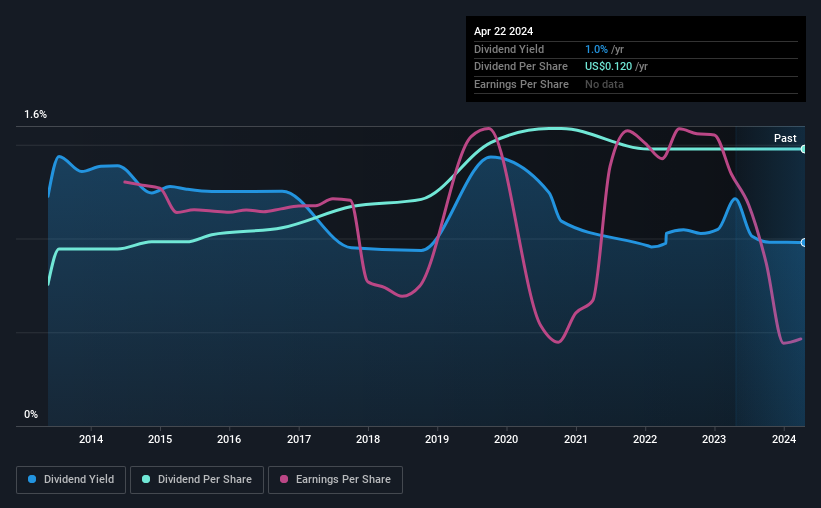

The board of William Penn Bancorporation (NASDAQ:WMPN) has announced that it will pay a dividend on the 9th of May, with investors receiving $0.03 per share. This payment means the dividend yield will be 1.0%, which is below the average for the industry.

See our latest analysis for William Penn Bancorporation

William Penn Bancorporation Will Pay Out More Than It Is Earning

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible.

William Penn Bancorporation has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. But while this history shows that the company was able to sustain its dividend for a decent period of time, its most recent earnings report shows that the company did not make enough earnings to cover its dividend payout. This is very worrying for shareholders, as this shows that William Penn Bancorporation will not be able to sustain its dividend at its current rate.

If the company can't turn things around, EPS could fall by 20.7% over the next year. If the dividend continues along recent trends, we estimate the future payout ratio could reach 154%, which could put the dividend in jeopardy if the company's earnings don't improve.

William Penn Bancorporation Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from $0.0614 total annually to $0.12. This implies that the company grew its distributions at a yearly rate of about 6.9% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though William Penn Bancorporation's EPS has declined at around 21% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, William Penn Bancorporation has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance