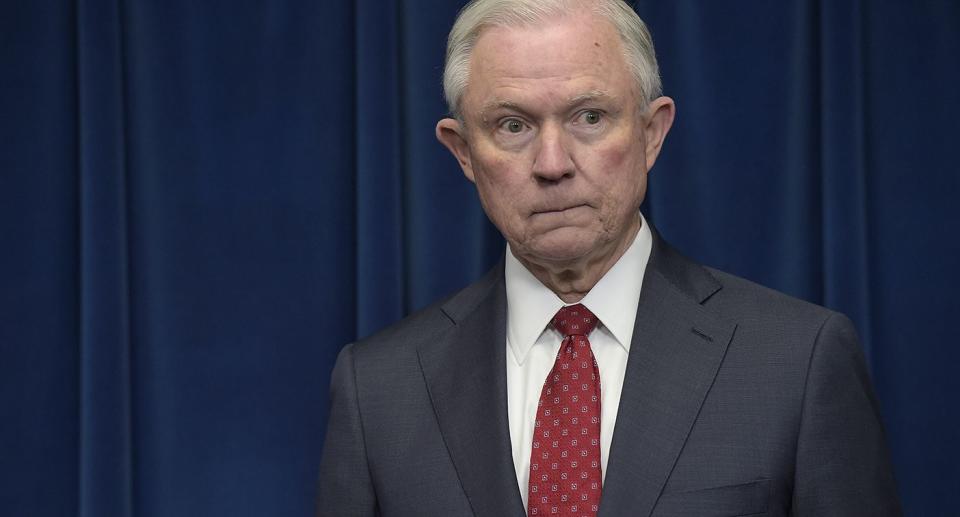

Why white-collar crooks may be cheering this Jeff Sessions memo

Late last week, President Donald Trump’s budget blueprint was released. Among many other headline-grabbing cuts—the EPA, Meals on Wheels, climate change funding, legal aid for low-income households, and on, and on, and on—it also included a less-noticed $1.1 billion, or 4%, cut to the Department of Justice. The DOJ, of course, includes two divisions of key interest to corporate America, namely, the antitrust division and the fraud section of the Criminal Division.

The budget blueprint doesn’t propose a funding level for the Securities and Exchange Commission, whose enforcement division conducts investigations into possible violations of securities laws and prosecutes civil cases. But internal sources say the SEC is also bracing for budget cuts.

At a recent conference in Washington, Michael Piwowar, a Republican economist who was first appointed to the Commission by President Barack Obama, and who was designated the Acting Chairman by President Trump, said, “Depending on which way the budget goes and stuff in the future, we’re going to have to make some tough choices in terms of using limited resources.” Some experienced lawyers there have already voted with their feet.

And there is cultural change afoot in that agency, too. President Trump’s pick for SEC chairman, Jay Clayton, is a longtime corporate lawyer whose firm, Sullivan & Cromwell, has represented many of the people he’ll now have to police. Clayton hasn’t yet been confirmed, but in the meantime, Piwowar is starting to impose more centralized control over the investigative process, says one person familiar with events. This person points out that this was the playbook in George W. Bush’s administration as well, where Republican commissioners had significant input on what investigations got done.

Sessions’ March 8 memo

In the context of the overall DOJ budget cut, a mostly unremarked-upon memo sent by new Attorney General Jeff Sessions on March 8 now seems more pointed to some observers. Entitled “Memorandum for all Federal Prosecutors” it directs prosecutors to focus not on corporate crime, but on violent crime.

“It is the policy of the Department of Justice to reduce crime in America, and addressing violent crime must be a special priority,” Sessions wrote. “This memorandum directs a focused effort by the Department’s dedicated public servants to investigate, prosecute and deter crime.”

While fighting violent crime is obviously critically important, in the past, the local cases have been the province of the state’s attorneys, not federal authorities.

To prosecutors, the Sessions memo is a big deal. It’s a direct command from the AG. And it’s axiomatic that if the DOJ’s budget is shrinking, and the amount of money and time devoted to one thing—violent crime—is going up, then the amount of money and time devoted to another thing—white collar crime—will go down. ‘It [addressing violent crime] is for sure going to push resources away from other things,” says a former prosecutor, who adds that there is also a hiring freeze in the Southern District of New York, which is widely regarded as the office that does the most on white collar crime. As he points out, the freeze doesn’t stop departures, and fewer bodies also mean less ability to bring cases. (The SEC also has a hiring freeze.)

Another former government prosecutor says that the ouster of Preet Bharara from the Southern District of New York, while part of the larger firing of all the US Attorneys, is reverberating through the legal community as well. “It does have symbolic meaning when you walk back your promise to keep in place the guy Time magazine called ‘The Sheriff of Wall Street,’” says this person, who says that morale is already low in the DOJ and the SEC, where people fear they are losing the ability to act aggressively on white collar matters.

The SEC declined to comment, and the Justice Department did not return a call.

Add to that last Friday’s news that the Trump administration is taking sides in a lawsuit—against the Consumer Financial Protection Bureau. Back in 2014, the CFPB instituted a case against a New Jersey based mortgage lender called PHH. PHH fought back on various fronts, and eventually, an appeals court ruled, among other things, that the CFPB’s structure was unconstitutional. The Obama administration threw its weight behind the CFPB. But last week, Trump’s Justice Department filed a friend-of-the-court brief agreeing the CFPB’s structure was indeed unconstitutional. Trump’s DOJ says that the president should be able to fire the CFPB director at will, not just for negligence or malfeasance, as is currently the case.

In sharp contrast to this, in corporate circles the most famous (or infamous) DOJ memo during the Obama Administration was the so-called Yates memo, which was written by then Deputy Attorney General Sally Yates in September 2015. (Yates, of course, was fired by Trump earlier this year after she declined to defend the travel ban.) Her missive, which was also sent to all the US Attorneys around the country, struck fear into the hearts of executives everywhere, because it was designed to have prosecutors hold individuals accountable for corporate misdeeds, not just collect fines and settlements from corporations. Or as then Acting Associate Attorney General Bill Baer explained, “When it comes to enforcing both criminal and civil statutes, it should not matter whether the offender commits white collar fraud or, as one judge termed it, ‘no collar’ fraud.” He added, “Civil wrongs can have damaging consequences, from the significant waste of taxpayer funds, to the loss of jobs, homes and financial security, to consumer overcharges, to fundamental market dislocations and economic crises…holding individuals account for corporate wrongdoing—even through civil enforcement actions—provides a powerful deterrent against future misconduct.”

The actual effect of the Yates memo has been debated, but as law firm McGuireWoods wrote in a legal alert, “What we know for certain is that it was intended to send a message both to the public and to the ‘C suite.'”

It’s impossible at this point to know how this all will shake out. And there certainly is a sense that the pendulum had swung too far. But one thing is for sure: The message has changed.

Bethany McLean is a contributing editor at Vanity Fair and bestselling author. Her recent book is “Shaky Ground: The Strange Saga of the U.S. Mortgage Giants,” published by Columbia Global Reports.

More from Bethany McLean:

Yahoo Finance

Yahoo Finance