Why Value Matters in Stock Investing

Written by Kay Ng at The Motley Fool Canada

Value matters a lot in stock investing. If you’re given the chance to pay $25 for a stock that’s worth $50 today, wouldn’t you do so in a heartbeat? Value stocks that pay dividends are even cooler, because when you pay a cheap price for these stocks, you get a higher dividend yield.

Some people believe the stock market is always efficient, and the stocks are priced fairly all the time. If that’s the case, then there wouldn’t be undervalued stocks, which is clearly not the case.

Let’s go through some examples of undervalued stocks.

Fortis stock

Fortis (TSX:FTS)(NYSE:FTS) stock has increased its dividend for 47 consecutive years. The dividend stock’s 10-year dividend-growth rate is 5.6%. Based on the regulated utility’s growth profile, management thinks a dividend-growth rate of 6% per year on average through 2025 is possible. This is a slightly higher growth rate than 5.6%.

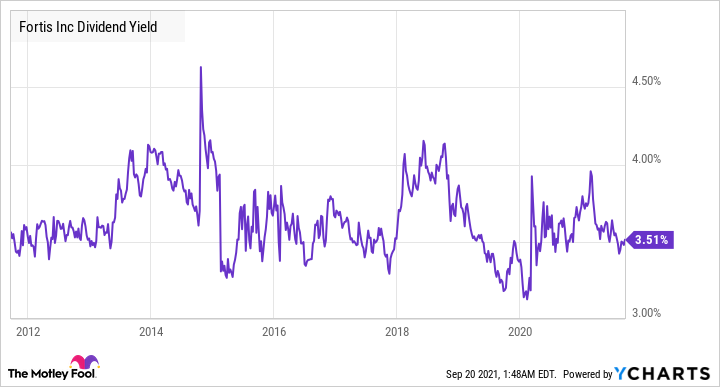

Fortis stock’s dividend yield history over the last decade could be an indicator of when the stock could be undervalued. The chart below displays its 10-year dividend yield history. It indicates that whenever the stock yields 4% or higher, it could be a good buy.

FTS Dividend Yield data by YCharts.

The stock yields 3.5% at writing. So, it’s not cheap. However, it will be increasing its dividend soon, leading to a forward yield of 3.7%. For a minimum target yield of 4% based on the higher dividend, we’re looking at a target buy price of at most $53.50. This suggests a dip of about 7% would be a nice pick up in the low-risk, high certainty dividend stock.

The act of buying stocks with valuation in mind could greatly increase returns. The last time Fortis stock yielded 4% was in February. Buyers then would pocket total returns of about 19.6% in about seven months if they sold now.

Bank of Montreal stock

Bank of Montreal (TSX:BMO)(NYSE:BMO) stock was obviously undervalued during the pandemic market crash last year. Back then, the bottom came in at about $55 per share, which was about 5.8 times normalized earnings.

Assuming fiscal 2019 as the normal, the diversified North American bank could earn adjusted earnings per share of at least $9.43 per share. Its normal long-term price-to-earnings ratio is about 11.4, which means at $55, it was trading at a whopping discount of 49%.

Actually, its 2021 adjusted EPS is estimated to rebound past its normalized fiscal 2019 earnings, which means the bank stock was even more undervalued during the crash based on a forward basis. That is, if investors believed that the bank should earn at least the amount it did in fiscal 2019 sometime soon in the future, they would have recognized the bank was extremely undervalued.

Those who had bought BMO stock at $55 would have more than doubled their investment from price appreciation only, as the stock climbed about 132% from that level! Additionally, they would have locked in an incredible yield on cost of 7.7%.

The Foolish investor takeaway

Admittedly, I chose the best recent buy points in the two dividend stock examples to illustrate how buying stocks when they’re undervalued can immensely boost your dividend income and total returns.

However, the point is not to try to buy at the lowest points in a correction, because, in reality, catching the bottom can only be by luck. I want to clarify that consistently buying when stocks are 40%, 30%, 20%, or even 10% undervalued will massively increase your returns in the long run. How big of a discount you want to wait for depends on factors, such as the quality of the stock.

The post Why Value Matters in Stock Investing appeared first on The Motley Fool Canada.

We’re Issuing a BUY Alert on this TSX Space Stock

Our team of diligent analysts at Motley Fool Stock Advisor Canada has identified one little-known public company founded right here in Canada that’s at the cutting-edge of the space industry and recently completed a transformational acquisition, all while making a handsome profit in the process!

The best part is that in a market where many stocks are selling at all-time-highs, this stock is trading at what looks like a VERY reasonable valuation… for now.

Click here to learn more about our #1 Canadian Stock for the New-Age Space Race

More reading

The Motley Fool recommends FORTIS INC. Fool contributor Kay Ng owns shares of Fortis.

2021

Yahoo Finance

Yahoo Finance