Trade tensions, oil, and housing keep the Bank of Canada on hold

The Bank of Canada is leaving its key benchmark interested rate unchanged.

“Global economic growth has slowed by more than the Bank forecast in its January Monetary Policy Report (MPR),” said the Bank of Canada.

“Ongoing uncertainty related to trade conflicts has undermined business sentiment and activity, contributing to a synchronous slowdown across many countries.”

The central bank says growth in Canada during the first half of 2019 is expected to be slower than previously anticipated. Part of the blame goes to lower oil prices and difficulty getting Canadian crude to market.

“Weaker-than-anticipated housing and consumption also contributed to slower growth,” said the Bank of Canada.

The Bank of Canada “projects real GDP growth of 1.2 per cent in 2019 and around 2 per cent in 2020 and 2021.”

In a report by Finder, nine out of 10 economists predicted the overnight rate would hold. They think the economy is on shaky ground and that household debt is still a concern for Bank of Canada Governor Stephen Poloz.

“Uncertainty remains elevated, and recent trends (January notwithstanding) have been quite weak – domestic demand contracted over the latter half of 2018. Retail sales remain soft, as do housing markets,” said Brian DePratto, Senior Economist at TD Economics, in the report.

“With little in the way of underlying inflationary pressures, the Bank can afford to take a 'wait and see' approach.”

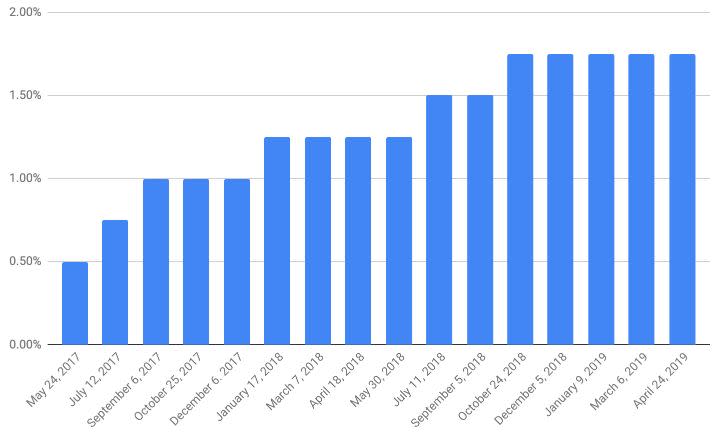

The overnight interest rate has been 1.75 per cent since October, after the central bank hiked it five times since the middle of 2017.

Sebastien Lavoie, Chief Economist at Laurentian Bank Securities, agreed with DePratto.

“All combined, the global slowdown and specific factors weighing down on Canadians households and the oil sector are justifying to keep the overnight rate at the current level,” Lavoie said in the report.

The outlier among the group — Atif Kubursi, emeritus professor of economics at McMaster University — expected a rate cut on Wednesday. Four out of 10 economists in the group expect a rate cut in July. In fact, they expect the rate to go as low as 1.15 per cent before it increases again.

Half of the economists see a recession on the horizon within the next 12 months.

Only 20 per cent said they felt positive about the federal budget. They say the CMCH first-time homebuyers incentive is expected to have next to no impact on home affordability. They also expect home prices to stabilize by the end of the year, with Montreal rising the most.

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance