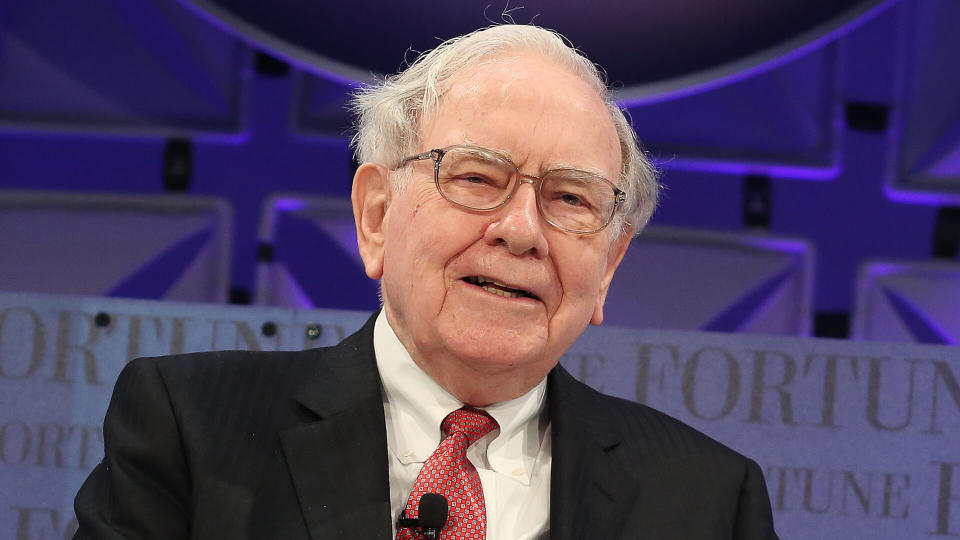

Why You Should Stay Calm and Carry On When the Market Crashes — Like Warren Buffett Does

One of the toughest things to do when the market crashes is to “keep calm and carry on,” as the British are fond of saying. Of course, it’s easy to plan on doing that when things are going well in the market. But when your portfolio is in the red and its value seems to be dropping every day, it’s a tougher pill to swallow.

Discover: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Learn: 3 Things You Must Do When Your Savings Reach $50,000

At times like that, it can help to read advice from successful investors like billionaire Warren Buffett. The famed CEO of Berkshire Hathaway, dubbed the “Oracle of Omaha” for his legendary investment success, has lots to say about how to manage falling markets. Here’s some of his advice, along with suggestions as to how you can implement it into your portfolio strategy.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

‘Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful’

This is probably one of Buffett’s most famous quotes, and many investors take it as an admonishment to stay the course when things get rough. But this is just a fragment of the original quote, which is actually a description of how Buffett and his team at Berkshire Hathaway have been successful over the long run. This brief quip is much richer when placed back in context with Buffett’s full message, which appeared in his 1986 letter to shareholders:

“Occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

As you can see, the “famous” part of Buffett’s quote wasn’t just a one-off telling investors to hang on to their investments. Rather, it was part of an explanation of how Buffett sees and reacts to markets. Even one of the most famous investors of all time is saying in black and white that he has no idea when the market is going to get frothy or sell off. All he does to succeed is observe what is happening and take advantage of the opportunities that the market presents.

Read: I’m a Financial Advisor: These 5 Index Funds Are All You Really Need

‘Don’t Watch the Market Closely’

In 2016, during a volatile time in the market, CNBC asked Buffett what he would suggest people do with their portfolios. Buffett’s response was, “I would tell [investors], don’t watch the market closely.”

Buffett’s reasoning was twofold. First, it can be emotionally difficult to see your investments going down every day. If you want to sleep at night, sometimes it can be best to not see all that carnage on a daily basis. But beyond that, Buffett knows that investors are emotional creatures. It’s only natural to want to sell out when you see your portfolio falling every day. But Buffett says this is the path to disaster.

According to Buffett, “…money is made in investing by owning good companies for long periods of time. That’s what people should do with stocks.”

Avoiding watching the market too closely when it is down can help protect you from jumping in and out.

In a 2018 CNBC interview, Buffett took this one step further, saying, “Some people should not own stocks at all because they just get too upset with price fluctuations. If you’re gonna do dumb things because your stock goes down, you shouldn’t own the stock at all.”

Rather than being taken as advice that you shouldn’t own stocks, instead read this quote as a reminder that you should understand that you might get emotional when your stocks go down and that you should stay the course, not “do dumb things.”

How Can You Implement Buffett’s Strategy Into Your Own Investment Planning?

There’s no denying that a billionaire investor with a full-time staff of investment professionals has some advantages that you might not have when it comes to making money in the market. However, the principles Buffett espouses make sense for even the smallest investor.

If Buffett, with all of his investment advantages, tells you that he doesn’t know if the market is going up or down, it means that you shouldn’t try to time the market either. But when he says that you should be buying when others are selling, it means that you should take heed of this as well. Rather than panicking when your portfolio starts going down — and doing “dumb things” — position yourself ahead of time so that you can actually take advantage of this. Continue to buy the quality companies and/or index funds that you own, whether through increased contributions or a shifting of some of your idle cash into your investment portfolio. Avoid letting your emotions take over or else you might jump in and out of the market, buying when things are high and selling when they are low.

Final Thought

In a 2008 op-ed for the New York Times, Buffett summed up his philosophy when it comes to recessions and major market selloffs:

“I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now,” Buffett wrote. “What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So, if you wait for the robins, spring will be over.”

More From GOBankingRates

Check Your Finances: You Might Be Making One of These Extremely Common Mistakes

6 Signs You're More Financially Savvy Than the Average American

This article originally appeared on GOBankingRates.com: Why You Should Stay Calm and Carry On When the Market Crashes — Like Warren Buffett Does

Yahoo Finance

Yahoo Finance