Why Royal Caribbean Cruises Stock Gained 45% in 2017

What happened

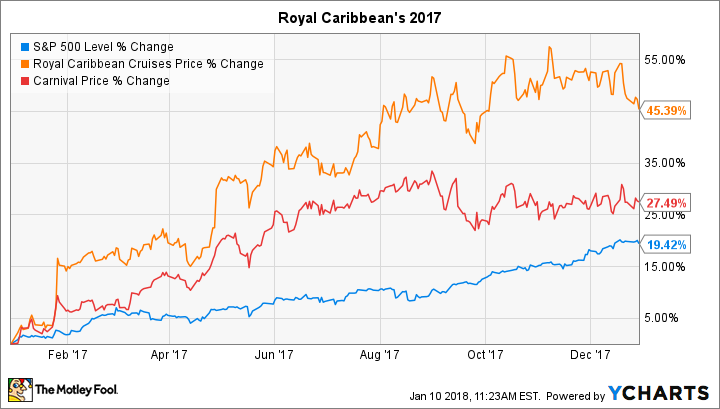

Shares of Royal Caribbean Cruises (NYSE: RCL) shot up 45% last year, compared to a 19% rise in the broader market, according to data provided by S&P Global Market Intelligence.

The rally reversed the prior year's underperformance while significantly outpacing the 27% jump in rival Carnival's stock.

So what

Like its larger competitor, Royal Caribbean benefited from broad growth in the global travel market in 2017. In fact, net yields (revenue per available room night) are on pace to rise by 6% and hit the top end of management's initial guidance thanks to strong booking and pricing trends across its Chinese, European, and North American itineraries.

That's a bit better than the 4.6% increase that Carnival managed over the past year, and it led to management's early achievement of its long-term goal of doubling 2014 annual earnings.

Image source: Getty Images.

Now what

The initial outlook for 2018 is healthy thanks to continued positive momentum on booking and pricing trends. Royal Caribbean wins that business -- and earns a chance to turn those guests into repeat cruisers -- by delivering consistently high customer satisfaction. If the company pairs those operating gains with the right pace of new ship launches, investors should see more market-beating sales and profit gains as the industry expands.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool recommends Carnival. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance