Why Qilu Expressway's Dividend Disappoints And One Stock That Excels

Dividend-paying stocks often draw investors looking for reliable income streams. However, stability in these payouts is crucial; companies like Qilu Expressway, with a history of dividend cuts, pose questions about the sustainability of their dividends. In this article, we will explore why such inconsistencies can be a red flag for investors and highlight another stock that demonstrates more dependable dividend performance.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

CITIC Telecom International Holdings (SEHK:1883) | 9.37% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.76% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.77% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.20% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 9.18% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.54% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.14% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.25% | ★★★★★☆ |

Tian An China Investments (SEHK:28) | 4.94% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

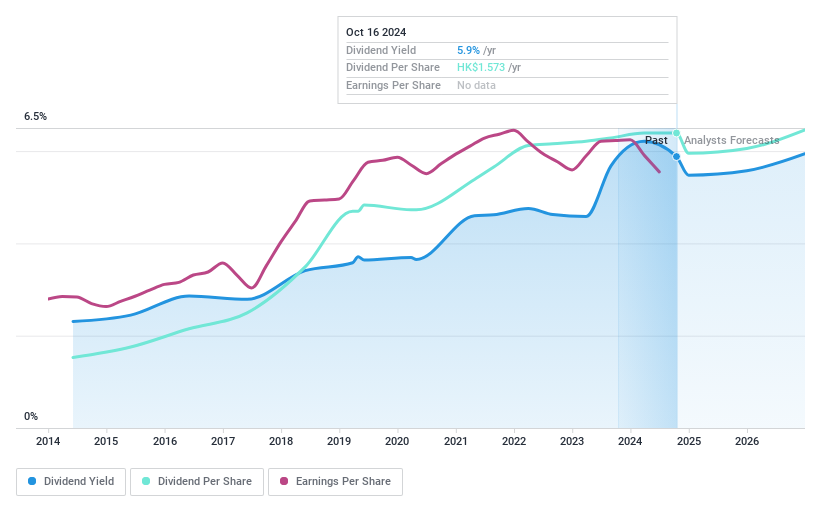

China Resources Land

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Resources Land Limited operates as an investment holding company focused on the investment, development, management, and sale of properties across the People's Republic of China, with a market capitalization of approximately HK$199.31 billion.

Operations: China Resources Land Limited generates revenue primarily from its development property business at CN¥212.34 billion, followed by its investment property business at CN¥23.07 billion, eco-system elementary business at CN¥17.11 billion, and asset-light management business at CN¥13.59 billion.

Dividend Yield: 5.5%

China Resources Land Limited demonstrates a strong dividend profile with a stable history of dividend payments over the past decade and a recent increase declared on June 7, 2024. Its dividends are well-covered by earnings, with a payout ratio of 32.8%, and cash flows, evidenced by a cash payout ratio of 22.3%. However, its dividend yield of 5.47% is below the top quartile in Hong Kong's market at 8.02%. Recent debt financing may raise concerns about leverage but reflects strategic capital management for short to medium-term obligations.

One To Reconsider

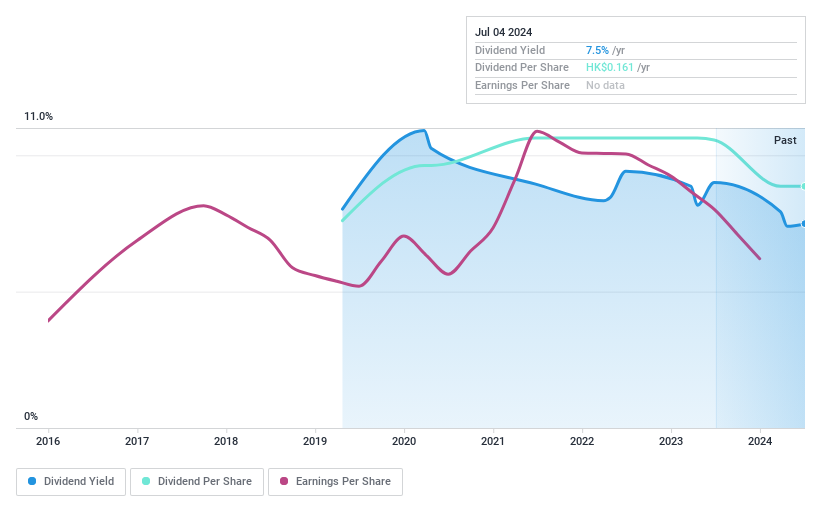

Qilu Expressway

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Qilu Expressway Company Limited, along with its subsidiaries, manages expressways across the People's Republic of China and has a market capitalization of HK$4.30 billion.

Operations: The company generates its revenue primarily from transportation infrastructure, totaling CN¥5.61 billion.

Dividend Yield: 7.5%

Qilu Expressway's recent dividend reduction to RMB 0.15 per share signals instability, reflecting broader financial challenges. The company's dividends are not adequately covered by its cash flows and earnings, with a significant drop in toll revenue due to construction disruptions impacting profitability. Despite a reasonable payout ratio of 57.1%, the lack of consistent free cash flow and a history of volatile payments make its dividend reliability questionable for long-term investors seeking stable returns.

Seize The Opportunity

Investigate our full lineup of 90 Top Dividend Stocks right here.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1109SEHK:1576 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance