Why You Should Like PPL Corporation’s (NYSE:PPL) ROCE

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we are going to look at PPL Corporation (NYSE:PPL) to see whether it might be an attractive investment prospect. To be precise, we’ll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First up, we’ll look at what ROCE is and how we calculate it. Then we’ll compare its ROCE to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

Understanding Return On Capital Employed (ROCE)

ROCE is a measure of a company’s yearly pre-tax profit (its return), relative to the capital employed in the business. All else being equal, a better business will have a higher ROCE. Overall, it is a valuable metric that has its flaws. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since ‘No two businesses are exactly alike.’

How Do You Calculate Return On Capital Employed?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for PPL:

0.082 = US$3.1b ÷ (US$43b – US$4.4b) (Based on the trailing twelve months to September 2018.)

So, PPL has an ROCE of 8.2%.

See our latest analysis for PPL

Does PPL Have A Good ROCE?

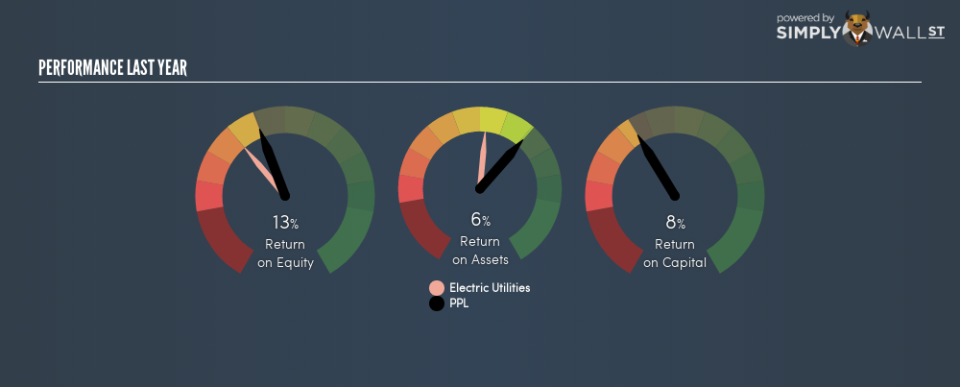

ROCE is commonly used for comparing the performance of similar businesses. In our analysis, PPL’s ROCE is meaningfully higher than the 5.0% average in the Electric Utilities industry. We would consider this a positive, as it suggests it is using capital more effectively than other similar companies. Aside from the industry comparison, PPL’s ROCE is mediocre in absolute terms, considering the risk of investing in stocks versus the safety of a bank account. It is possible that there are more rewarding investments out there.

It is important to remember that ROCE shows past performance, and is not necessarily predictive. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. ROCE is, after all, simply a snap shot of a single year. Since the future is so important for investors, you should check out our free report on analyst forecasts for PPL.

Do PPL’s Current Liabilities Skew Its ROCE?

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

PPL has total assets of US$43b and current liabilities of US$4.4b. As a result, its current liabilities are equal to approximately 10% of its total assets. It is good to see a restrained amount of current liabilities, as this limits the effect on ROCE.

The Bottom Line On PPL’s ROCE

If PPL continues to earn an uninspiring ROCE, there may be better places to invest. You might be able to find a better buy than PPL. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance