Why I’m Considering Canopy Growth Stock For My RRSP

Written by Karen Thomas, MSc, CFA at The Motley Fool Canada

From the moment we start working, we hear constant messaging about the importance of saving for retirement. While it’s easy to agree, finding the right investments for an RRSP is a much more complicated proposition. So I would like to share with you why I considered Canopy Growth Corp. (TSX:WEED)(NASDAQ:CGC) as a candidate for my RRSP.

Here are three reasons why I’m finally warming up to the infamous cannabis stock today.

Cannabis stocks have been outperforming in August as U.S. legalization legislation advances

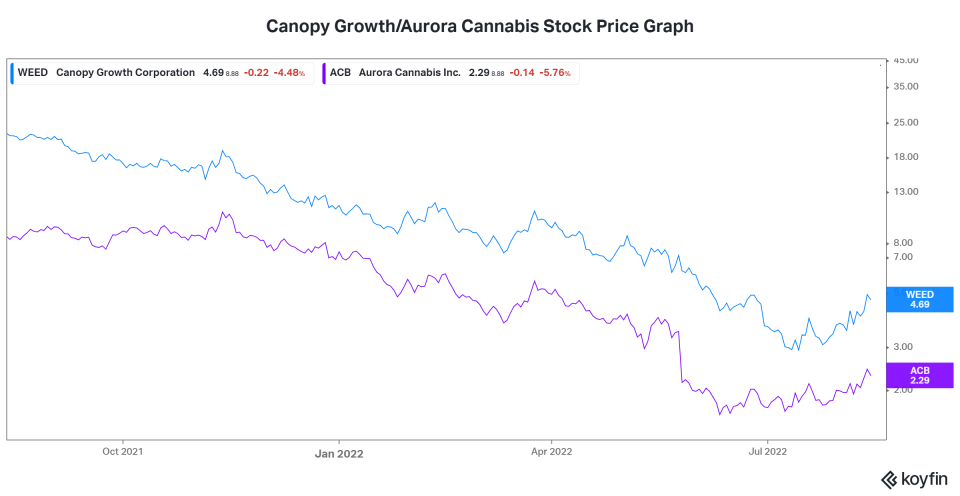

So maybe I’m not the only one whose warming up to these stocks. I mean, cannabis stocks have been on fire in August. For example, Canopy Growth stock is up 38%. Also, Aurora Cannabis Inc. (TSX:ACB)(NASDAQ:ACB) rose almost 30% in August.

Don’t get me wrong, I’m aware that these stocks have been disasters. The cannabis stock bubble burst a few years ago. This caused tremendous losses for many. So today, investors are no longer enamoured by these stocks. They’ve been burned.

The one good thing about this scenario is that cannabis stock valuations are no longer in bubble-territory. They’ve gone from trading at 100-plus times sales to now trading at levels that I can stomach. Canopy Growth stock, for example, is currently trading at four times sales. Aurora Cannabis stock is trading at two times sales. The more reasonable valuations mean I am comfortable considering them for my RRSP.

Canopy Growth shows long-term promise as a leader in the industry

In Canada, Canopy maintains the number one position in market share in premium products. Also, progress in being made in focusing and streamlining the business. In the latest quarter, Canopy demonstrated stabilized revenue and market share performance, and improved cash margins. This was largely attributed to the company’s focus on premium products as well as cost savings.

Total revenue for the quarter was $110 million. This was a 19% decline versus last year BUT an only 1% decline versus last quarter. Strong demand and record sales growth for Biosteel products helped. As a reminder, Biosteel sells sports hydration drink products. It has secured shelf space at Walmart. Also, additional retailers are showing strong interest. For now, the Walmart deal means that Biosteel will be available at 2,200 Walmart stores.

Canopy Growth has placed a big bet on the U.S. market. The company believes that it will be the largest cannabis market in the world. And while progress here has been slower than anticipated, two-thirds of Americans live in an area that has access to cannabis products. And legalization is moving forward, albeit at a snail’s pace.

Despite cash burn, Canopy Growth has built up a solid balance sheet

Cash burn is always concerning. But looking beyond that, I see many encouraging bits of information. Firstly, Canopy has $1.2 billion in cash. It also has US$500 million of available debt capacity. Lastly, proceeds from the company’s sale of different facilities have yet to be received.

So, the cannabis industry is still in its infancy. This means that investors must have patience. But remember, the cannabis industry still has great potential. It’s a product that meets the needs and desires of many, so analyst estimates of a global cannabis industry market size of $28 billion in 2021 makes sense. And that it’s expected to grow significantly in the next few years. Some estimates are calling for annual growth rates of 30% plus.

Thus, all market indications are that there will be room for many in this industry. But, it’s extremely difficult to predict which cannabis company will survive and thrive the most. One way to go about getting exposure to the cannabis industry in your RRSP is to buy a basket of cannabis stocks. Aurora Cannabis stock is another solid Canadian option. With a basket, we can weed out the company-specific risks while still having exposure to the overall industry trend.

The post Why I’m Considering Canopy Growth Stock For My RRSP appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Aurora Cannabis?

Before you consider Aurora Cannabis, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2022 ... and Aurora Cannabis wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 27 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/8/22

More reading

Fool contributor Karen Thomas has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

2022

Yahoo Finance

Yahoo Finance