Why Investors Shouldn't Be Surprised By The ONE Group Hospitality, Inc.'s (NASDAQ:STKS) Low P/E

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

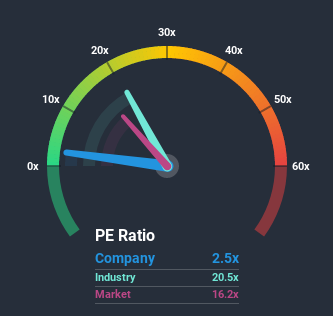

The ONE Group Hospitality, Inc.'s (NASDAQ:STKS) price-to-earnings (or "P/E") ratio of 2.5x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

ONE Group Hospitality certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for ONE Group Hospitality

How Does ONE Group Hospitality's P/E Ratio Compare To Its Industry Peers?

We'd like to see if P/E's within ONE Group Hospitality's industry might provide some colour around the company's particularly low P/E ratio. The image below shows that the Hospitality industry as a whole has a P/E ratio higher than the market. So we'd say there is practically no merit in the premise that the company's ratio being shaped by its industry at this time. Ordinarily, the majority of companies' P/E's would be lifted by the general conditions within the Hospitality industry. Ultimately though, it's going to be the fundamentals of the business like earnings and growth that count most.

Keen to find out how analysts think ONE Group Hospitality's future stacks up against the industry? In that case, our free report is a great place to start.

What Are Growth Metrics Telling Us About The Low P/E?

ONE Group Hospitality's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 287% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company are not good at all, suggesting earnings should decline by 156% over the next year. With the rest of the market predicted to shrink by 12%, it's a sub-optimal result.

With this information, it's not too hard to see why ONE Group Hospitality is trading at a lower P/E in comparison. However, when earnings shrink rapidly the P/E often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of ONE Group Hospitality's analyst forecasts revealed that its even shakier outlook against the market is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for ONE Group Hospitality (of which 2 don't sit too well with us!) you should know about.

If you're unsure about the strength of ONE Group Hospitality's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance