Why Investors Shouldn't Be Surprised By Converge Technology Solutions Corp.'s (TSE:CTS) 32% Share Price Surge

Converge Technology Solutions Corp. (TSE:CTS) shares have had a really impressive month, gaining 32% after a shaky period beforehand. But not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

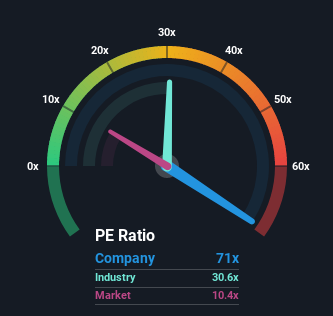

After such a large jump in price, given close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 10x, you may consider Converge Technology Solutions as a stock to avoid entirely with its 71x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Converge Technology Solutions as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Converge Technology Solutions

Want the full picture on analyst estimates for the company? Then our free report on Converge Technology Solutions will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Converge Technology Solutions' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 127%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 107% each year during the coming three years according to the twelve analysts following the company. With the market only predicted to deliver 8.1% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Converge Technology Solutions is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Converge Technology Solutions' P/E?

Shares in Converge Technology Solutions have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Converge Technology Solutions maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Converge Technology Solutions that you should be aware of.

If you're unsure about the strength of Converge Technology Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance