Changing Sales Strategies: Why Many Companies Face a Turning Point

In the first half of 2020, most car manufacturers are seeing decreased sales.

General Motors (NYSE:GM) recorded a 7% decrease in total vehicle sales in the U.S. during the first quarter of 2020 compared to the year-ago quarter, with sales falling 34% year over year in the second quarter. Ford (NYSE:F) saw a 21% decline in wholesales and a 15% decline in revenue year over year in the first quarter, with sales falling by a third in the second quarter compared to the prior-year quarter. Fiat Chrysler (NYSE:FCAU) reported a 15% decrease in revenue in the first quarter compared to the prior-year quarter. Even Tesla's (NASDAQ:TSLA) second-quarter deliveries fell 4.9% compared to the year-ago quarter, despite the much-awaited opening of its Shanghai Gigafactory.

One reason for the decreased sales is likely lower income from high unemployment numbers. However, another big contributor is the fact that most car sales are made after at least one face-to-face meeting between the buyer and a salesperson. Not everyone who buys a car is doing so because they "need" a new car - it's often because they simply "want" a new car. With the Covid-19 pandemic encouraging people to stay at home, far fewer potential buyers are coming into contact with sales representatives, instead shifting to buying online or delaying their purchase altogether.

This is just one of many examples of consumers increasingly moving online to shop safely. With the pandemic apparently here to stay, especially in the U.S., companies may find themselves needing to shift their sales strategies online as well, with their income and market share depending on how quickly and effectively they can make the change. While car sales will likely see more return to face-to-face sales, companies in other industries may see more of a permanent shift.

Relying on in-person sales

It can be difficult to tell how much face time a company's sales department has with its customers just by looking at its financial reports. For one, sales, general and administrative expenses, which is where the spending on sales usually falls under, is a wide umbrella that also includes things like legal costs and managements' salaries. Even for companies that separate out a sales and marketing category, it is rarely clear how much of the money is spent on direct face-to-face marketing and how much goes to advertisements and digital sales solutions.

However, we can get a good idea of how much companies rely on in-person conversations based on holistic reviews. For example, there's a reason that car salesmen are infamous - people typically go through more than one of them in order to buy a car. Retail stores that sell non-essential items also rely heavily on sales staff to assist customers, upsell and process transactions.

Retail and restaurants in particular could see more of their sales coming from online sources in the long term as consumers seek to limit their exposure to the Covid-19 virus. Doubtless more of the demand will shift back in the other direction in the long term due to delivery costs, but companies still need income in the meantime, and increased online sales have the potential to be more lucrative due to fewer expenses from running brick-and-mortar stores.

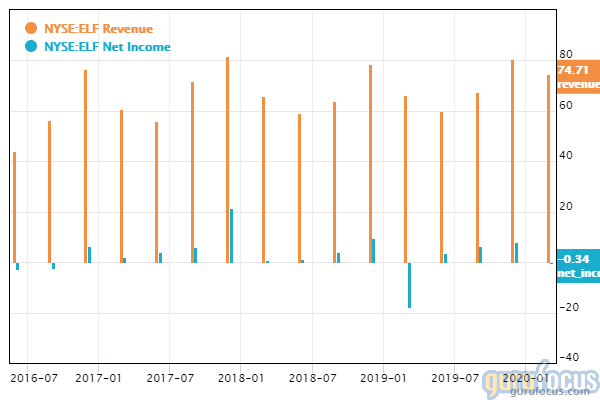

One example of a company quickly responding to the pandemic by putting more emphasis on online sales is e.l.f. Beauty Inc. (NYSE:ELF), which increased its spending on marketing, digital and consumer engagement in its recently reported fourth quarter of fiscal 2020 and was rewarded with 13% sales growth compared to the prior-year quarter.

Though many doctors spend more of their SG&A money on legal fees than on advertising, primary care clinics also rely a lot on their personal relationships with customers, so many are finding themselves needing to integrate telemedicine quickly in order to keep those customers from shifting to online-only health care services like Teladoc (NYSE:TDOC).

Cost-saving opportunities

In addition to companies that traditionally see many customers face-to-face every day, those with corporate clients or strong digital sales could also benefit from moving more of their sales budgets to a remote strategy. They could potentially save on SG&A expenses such as travel and entertainment by moving interactions online, as many in-person meetings with the executives of corporations mean first-class plane tickets, entertainment events and a much more significant chunk of time compared to meeting over a video chat.

Partially as a result of this, a study conducted by Gartner, a global research and advisory firm, found that nearly three out of every four chief financial officers and other finance leaders surveyed intend to shift at least 5% of on-site employees to permanent at-home positions even after the pandemic crisis is over.

Conclusion

An increasing amount of work has been moving online over the past few decades. The Covid-19 pandemic has sped this process up for many companies, and while some may be able to transition to a less digital environment once the crisis is over, the shift toward a greater preference for remote work and shopping is undeniable.

Thus, when evaluating potential investments, investors should keep an eye on a company's digital sales and marketing strategies. Can the company keep growing consistently with its existing face-to-face sales strategies? Is it prepared for success in an online environment, or will its income continue to be hurt by the inability to change with its market?

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance