Why Investors Should Hold Copa Holdings (CPA) Stock for Now

Copa Holdings, S.A. (CPA) top line is benefiting from upbeat air-travel demand. Fleet-upgrade efforts also bode well for Copa Holdings. However, the company is grappling with low liquidity and higher expenses.

Factors Favoring CPA

Upbeat air-travel demand has been aiding Copa Holdings' revenues. As a reflection of this, first-quarter 2024 revenues of $893.5 million beat the Zacks Consensus Estimate of $846.2 million and rose 3% year over year on the back of upbeat passenger revenues. With more people taking to the skies, CPA's passenger revenues (which contributed 96.1% to the top line) increased 3% from first-quarter 2023, owing to capacity increase. Management expects the current-year load factor (percentage of seats filled by passengers) to be almost 87%, assuming the rosy traffic scenario continues. We expect the metric to be 86.8% in 2024.

Copa Holdings' fleet modernization efforts look encouraging. Apart from adding planes, this carrier is replacing the outdated models as part of its fleet modernization efforts. CPA exited 2022 with a consolidated fleet of 97 aircraft, which comprises 67 Boeing 737-800s, 22 Boeing 737 MAX 9s, nine Boeing 737-700s and one Boeing 737-800 freighter.

CPA exited 2023 and the first quarter of 2024 with a fleet of 106 planes – 67 Boeing 737-800s, 29 Boeing 737 MAX 9s, nine Boeing 737-700s and one Boeing 737-800 freighter. Copa Holdings expects to end 2024 with 115 aircraft.

CPA has an encouraging earnings surprise history. The company's earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average beat of 20.19%.

Key Risks

CPA's liquidity position is a concern. Cash and cash equivalent of $170.52 million at the end of first-quarter 2024 was much lower than the $1.7 billion of total debt (including lease liabilities). This implies that the company does not have enough cash to meet its debt burden.

Escalating operating expenses are likely to hurt Copa Holdings’ bottom line. In first-quarter 2024, total operating expenses increased 0.5% year over year to $677.5 million, owing to higher capacity, offset by lower fuel, maintenance, materials and repairs costs, and sales and distribution costs. Expenses on wages, salaries and other employee benefits rose 11.4%. Sales and distribution costs decreased 9.6%. Passenger servicing costs grew 45.6%. Flight operation costs increased 13.1%.

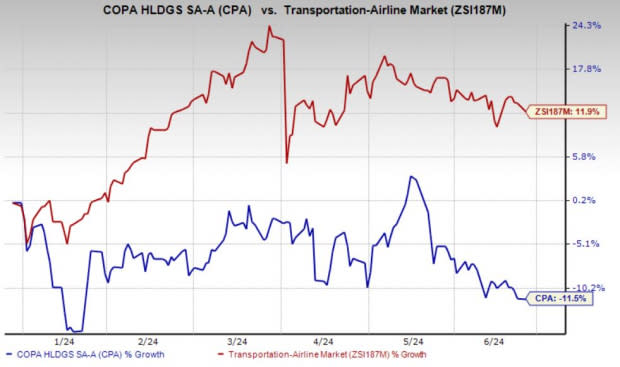

Partly due to these headwinds, shares of CPA have plunged 11.5% so far this year against the industry’s growth of 11.9%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

CPA currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have gained 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance