Why You Should Buy Valero Energy (VLO) After Q1 Earnings Beat

ValeroEnergy Corporation VLO recently reported better-than-expected first-quarter 2024 earnings. The leading oil refiner’s earnings per share were $3.82, while revenues came in at $31.8 billion.

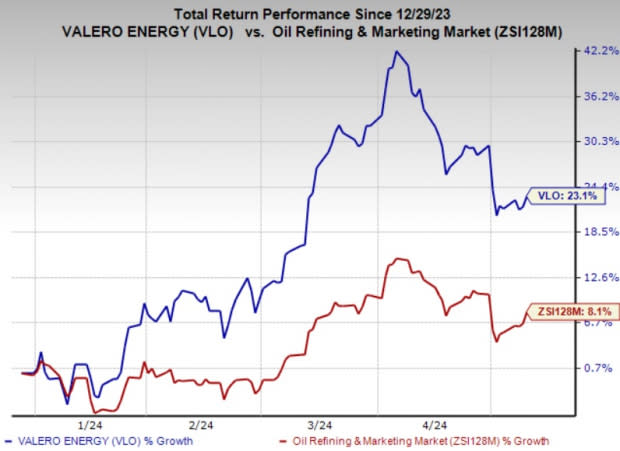

Price Performance Solid

Since the earnings announcement on Apr 25, the stock declined almost 5%, unrelated to the company’s fundamentals. However, Valero has proven to be incredibly rewarding since the beginning of 2024, gaining 23.1% year to date, surpassing the 8.1% rise of the composite stocks belonging to the Zacks Oil and Gas Refining & Marketing industry. Diverse refining assets and strong operational are among the key factors that are leading to the outperformance.

Image Source: Zacks Investment Research

The price chart may continue to show strength, given that Valero is a best-in-class oil refiner involved in the production of fuels and products that can meet the demands of modern life. Its refineries are located across the United States, Canada and the U.K. A total of 15 petroleum refineries, wherein Valero has ownership interests, have a combined throughput capacity of 3.2 million barrels per day.

Notably, the Renewable Diesel business segment of the firm comprises Diamond Green Diesel (“DGD”) — a joint venture between Darling Ingredients Inc. and Valero. DGD is a leading renewable fuel producer in North America. Low-carbon fuel policies across the globe primarily are aiding the demand for renewable diesel, therefore driving Valero’s Renewable Diesel business unit.

Valero boasts that its premium refining operations are resilient, even when the business operating environment is carbon-constrained. Its refining business has the capability to generate handsome cashflows that will allow it to return capital to shareholders and back growth projects.

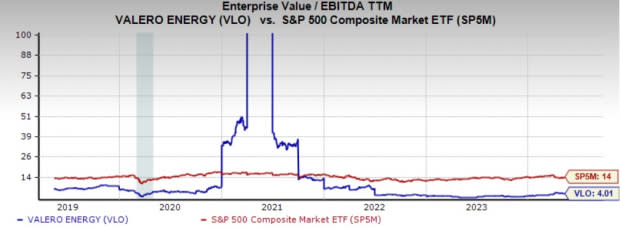

Solid Entry Point

Amid all these solid developments, the stock is cheap on a relative basis, and the current affordability of the stock is evident from its trailing 12-month enterprise value-to-EBITDA (EV/EBITDA) ratio, which stands at 4.01, notably lower than the Zacks S&P 500 composite average of 14.00.

Image Source: Zacks Investment Research

Hence, investors should consider purchasing VLO, which currently carries a Zacks Rank #2 (Buy), without hesitation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Energy Giants

Exxon Mobil Corporation XOM and Chevron Corporation CVX are the two integrated energy giants that have already reported first-quarter earnings. While ExxonMobil missed the Zacks Consensus Estimate of earnings for the first quarter, Chevron beat the consensus estimate for the same.

One of the largest integrated energy firms,Shell plc SHEL, has also reported earnings. The company said that it has once again achieved a quarter marked by robust financial and operational performance. Apart from reducing emissions, Shell is also showcasing its strong commitment to generating handsome value for shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance