Why Is Archer Daniels (ADM) Down 2.8% Since its Last Earnings Report?

A month has gone by since the last earnings report for Archer Daniels Midland Company ADM. Shares have lost about 2.8% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is ADM due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Archer Daniels Beats on Q1 Earnings & Sales, Up Y/Y

Archer Daniels Midland Company began 2018 on a solid note with first-quarter results outpacing the estimates and increasing year over year. With this, the company breaks its more than three-year long trend of sales misses, besides second straight earnings beat.

Q1 Highlights

The company’s first-quarter adjusted earnings of 68 cents per share increased 13.3% year over year and substantially outpaced the Zacks Consensus Estimate of 47 cents.

On a reported basis, Archer Daniels’ earnings were 70 cents per share compared with 59 cents in the prior-year quarter.

Moreover, the company’s revenues of $15,526 million grew 3.6% year over year and surpassed the Zacks Consensus Estimate of $14,523 million. The upside was driven by solid sales across all segments except the Origination segment.

Going by segments, quarterly revenues at Oilseeds, Carbohydrate Solutions and Nutrition were up 7.8%, 4.5% and 11.1%, respectively, to $5,633 million, $2,622 million and $950 million. Also, revenues grew 12.8% to $106 million at the Other segment in the first quarter. However, revenues declined 1.4% to $6,215 million at the Origination segment.

Operational Discussion

Archer Daniels reported adjusted segment operating profit of $717 million in first-quarter 2018, up 5.7% from the year-ago quarter. On a GAAP basis, the company’s segment operating profit rose 4.1% year over year to $704 million.

On a segmental adjusted basis, adjusted operating profit for the Oilseeds segment climbed 11.8% year over year to $350 million. The uptick can be attributed to robust global market dynamics that lead to increased soybean crush margins. Notably, this segment witnessed crush volume records in North and South America. Further, sturdy origination volumes and higher margins were witnessed in South America. Additionally, robust results at Refining, Packaging, Biodiesel and Other operations aided segment’s growth. However, results were soft year over year at Crushing and Origination along with lower contributions from Wilmar.

Carbohydrate Solutions segment’s adjusted operating profit inched up 0.9% to $213 million. Results benefited from enhanced results from joint ventures in North America as well as robust Starches and Sweeteners results. Moreover, Wheat Milling results rose year over year on higher margins. However, Bioproducts results were hurt by soft ethanol margins.

Nutrition segment’s adjusted operating profit rose 24.7% to $96 million. The upside stemmed from double-digit profit growth at Wild Flavors and results at Animal Nutrition grew substantially on solid trade sales and favorable product mix. However, the improvement was somewhat compensated with soft results at Specialty Ingredients.

However, adjusted operating profit for the Origination segment’s declined 4.3% to $45 million. During the quarter, gains from solid Merchandising and Handling results as well as sturdy Global Trade owing to higher volumes and margins were more than offset by weak U.S. export volumes and nearly $40 million of mark-to-market impact on existing contracts. Additionally, transportation results declined year over year, leading to higher operating expenses.

Financials

Archer Daniels ended the quarter with cash and cash equivalents of $797 million, long-term debt including current maturities of $6,670 million and shareholders’ equity of $18,737 million.

In the first quarter of 2018, Archer Daniels generated negative cash of $3,574 million from operating activities. Further, the company’s trailing four-quarter average adjusted ROIC came in at 6.4%.

Additionally, the company paid dividends of $190 million to shareholders in the quarter.

Looking Ahead

Management remains impressed with its quarterly results, which gained from the company’s strategic initiatives and cost-saving efforts. Moving ahead, Archer Daniels remains focused on five major platforms, animal nutrition, bioactives, carbohydrates, human nutrition and taste along with geographic regions to drive growth.

Archer Daniels remains optimistic to deliver solid results in 2018 on the back of improving market conditions, gains from U.S. tax reform, product innovations and Project Readiness.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to three lower.

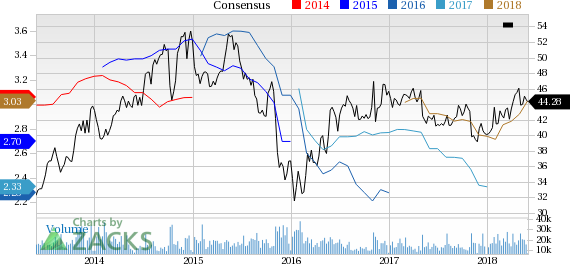

Archer Daniels Midland Company Price and Consensus

Archer Daniels Midland Company Price and Consensus | Archer Daniels Midland Company Quote

VGM Scores

At this time, ADM has a poor Growth Score of F, however its Momentum is doing a lot better with an A. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, ADM has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance